- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:PSMT

Does PriceSmart’s Wellness Collaboration With Edible Garden Signal Shifting Brand Strategy for PSMT?

Reviewed by Sasha Jovanovic

- Edible Garden AG Incorporated recently announced the international launch of its award-winning Pre & Post Workout Kick. Sports Nutrition bundle at PriceSmart warehouse clubs, expanding the product’s reach to health-focused customers and planning further availability on Amazon.

- This move highlights PriceSmart's ability to attract innovative consumer brands while reinforcing its position as a partner of choice for emerging wellness trends.

- We'll examine how the addition of a recognized nutrition product through a new collaboration could influence PriceSmart's evolving investment story.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PriceSmart Investment Narrative Recap

If you’re considering PriceSmart as an investment, the core thesis rests on continued club expansion in Central and South America, private label growth, and the company’s ability to select on-trend brands that resonate with evolving member preferences. While the introduction of Edible Garden’s wellness bundle showcases PriceSmart’s responsiveness to consumer demand, its immediate impact on earnings or margin outlooks appears limited; the most pressing short-term catalyst remains new club openings, while exposure to FX headwinds and liquidity constraints in certain markets like Trinidad is still the biggest risk.

Among PriceSmart's recent milestones, the opening of its seventh warehouse club in Guatemala stands out. This addition extends the company’s reach in a high-growth market, reinforcing the significance of its club rollout strategy as a key driver of both revenue expansion and membership growth, especially as established markets gradually mature.

Yet, despite these positives, investors should not lose sight of persistent risks from foreign currency volatility in core markets like Trinidad, which...

Read the full narrative on PriceSmart (it's free!)

PriceSmart's narrative projects $6.9 billion revenue and $209.1 million earnings by 2028. This requires 10.1% yearly revenue growth and a $66.5 million earnings increase from $142.6 million.

Uncover how PriceSmart's forecasts yield a $116.67 fair value, a 4% downside to its current price.

Exploring Other Perspectives

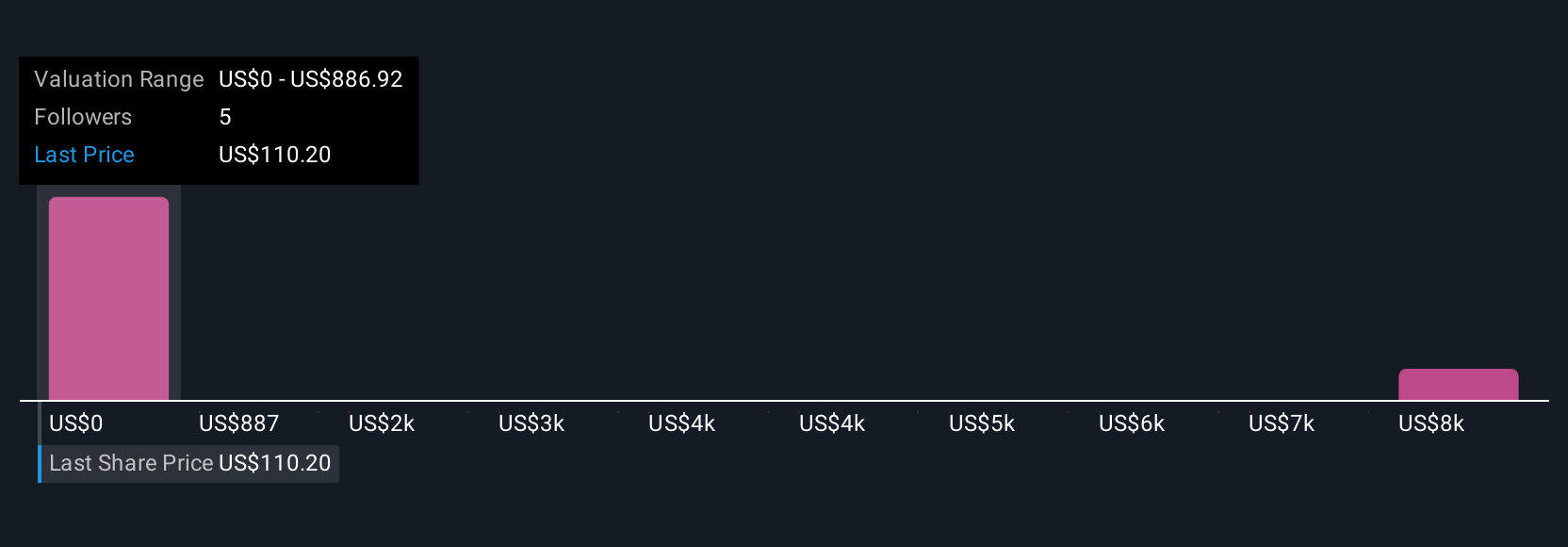

Fair value estimates for PriceSmart from five Simply Wall St Community members range from US$886.92 to US$8,869.22, highlighting the vastly different takes individual investors bring. As you weigh these viewpoints, keep in mind expanding club locations is still seen as the main lever for near-term growth, setting the stage for debate about how far PriceSmart’s momentum can realistically carry earnings.

Explore 5 other fair value estimates on PriceSmart - why the stock might be a potential multi-bagger!

Build Your Own PriceSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PriceSmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PriceSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PriceSmart's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PSMT

PriceSmart

Owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives