- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

Is Dollar Tree’s Recent 38% Rally Supported by Its Fundamentals in 2025?

Reviewed by Bailey Pemberton

- Thinking Dollar Tree stock might be undervalued or due for a breakout? You’re not alone in wondering if now is the moment to dig deeper into its price tag.

- The stock has jumped 4.0% over the past week, gained 6.7% this month, and is up an impressive 38.2% year-to-date. These moves have sparked fresh conversations about its long-term growth potential and risk profile.

- In the headlines, Dollar Tree has drawn attention for its ongoing multi-year turnaround efforts and bold pricing moves targeting changing consumer budgets. Both factors are fueling market speculation and recent rallies.

- When we run Dollar Tree through our valuation checks, it reaches a modest 1 out of 6. This indicates there is plenty of debate about its real worth. Here is a breakdown of those numbers and, later, we will highlight an approach that could make sense of it all.

Dollar Tree scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dollar Tree Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future free cash flows and discounts them back to today’s value, aiming to estimate the underlying worth of the business.

For Dollar Tree, the current trailing twelve month Free Cash Flow stands at $1.89 billion. Analyst projections extend five years out and forecast a gradual decline in annual Free Cash Flow, with estimates dropping to $914 million by 2029. Beyond that, further decreases are extrapolated by Simply Wall St, with Free Cash Flow settling in the $500 million range in later years.

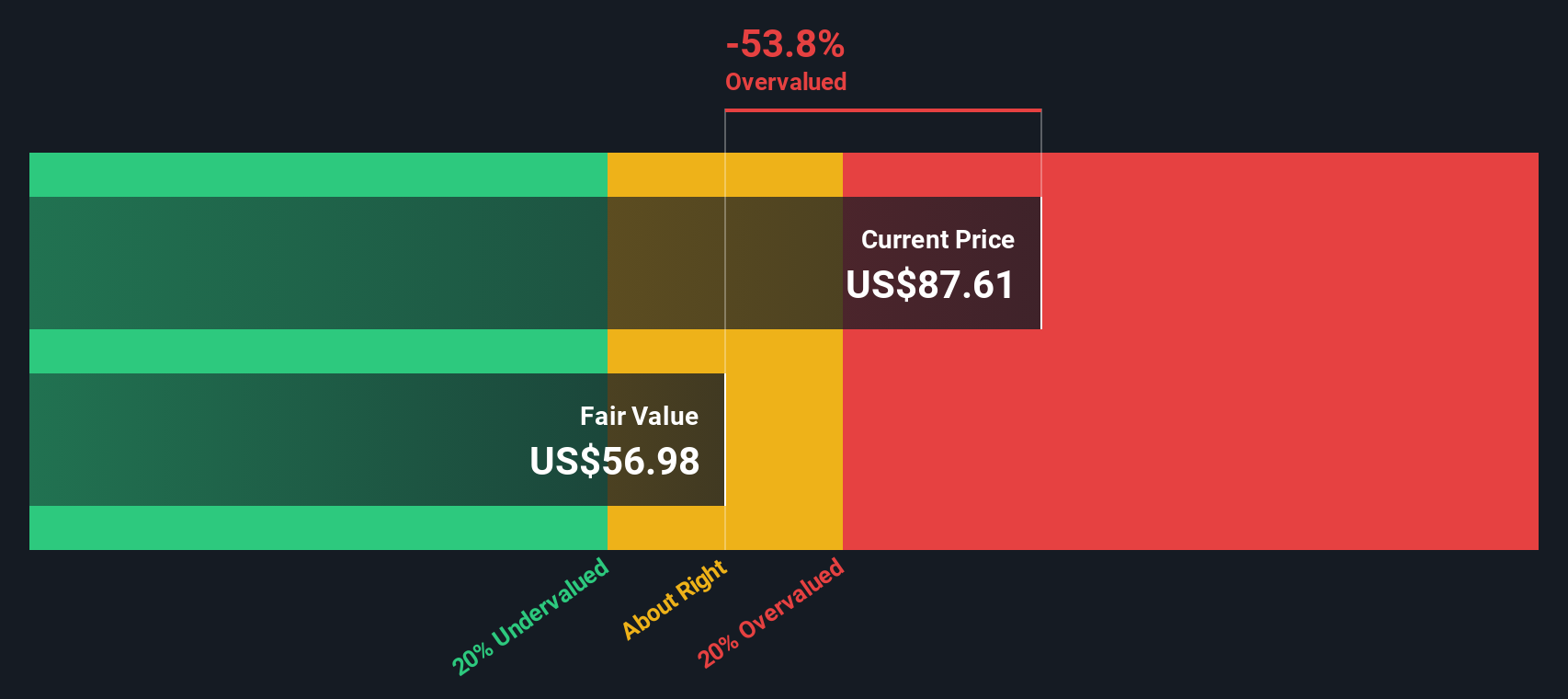

All projections are in US dollars, and the calculations follow the 2 Stage Free Cash Flow to Equity approach. Based on these input assumptions, the DCF model arrives at an estimated fair value of $57.91 per share.

With Dollar Tree’s current share price sitting much higher, the DCF result implies the stock is approximately 82.5% overvalued by this metric. This suggests the market’s optimism for Dollar Tree is not matched by its forecasted future cash flows, at least according to standard DCF methods.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dollar Tree may be overvalued by 82.5%. Discover 924 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Dollar Tree Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly links a company’s share price to its earnings power. For retail investors, a sensible PE ratio can offer useful context on whether a stock is priced high or low relative to its ability to generate profits each year.

However, growth expectations and risk levels play a crucial role in shaping what counts as a “normal” or “fair” PE ratio. Companies with faster growth, reliable earnings, and lower risk often justify higher PE ratios, while riskier or slower-growing businesses typically trade for less.

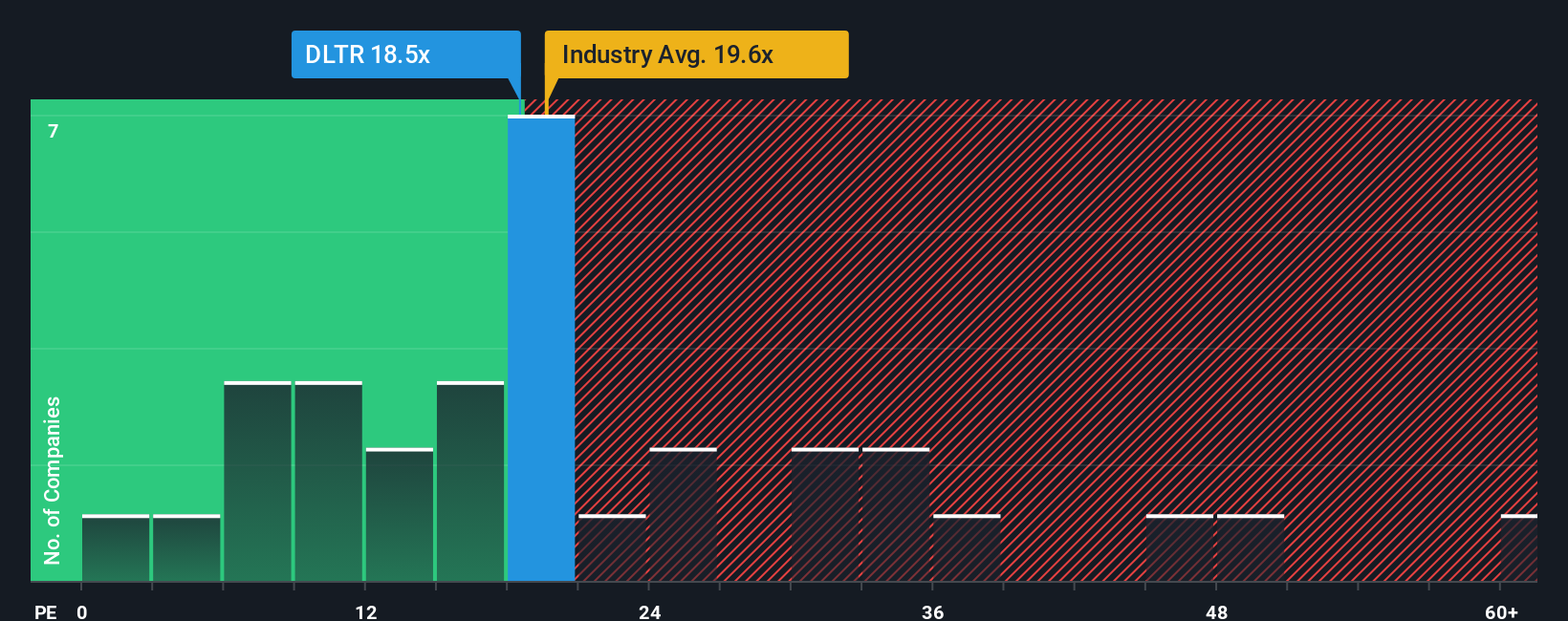

Dollar Tree is currently trading at a PE ratio of 19.4x. For comparison, the Consumer Retailing industry average stands at 20.0x, and its peers are at 19.0x, indicating Dollar Tree sits right in line with the broader market and peer group. But numbers alone do not tell the full story.

This is where Simply Wall St’s “Fair Ratio” comes in. For Dollar Tree, the Fair PE Ratio is calculated at 18.3x. This proprietary metric takes into account factors that simple peer or industry comparisons miss, such as the company’s earnings growth outlook, its profit margins, market capitalization, and specific business risks. The Fair Ratio aims to tailor what “fair value” really means for Dollar Tree, rather than assuming industry or peer averages are always relevant.

When comparing Dollar Tree’s current PE of 19.4x to its Fair Ratio of 18.3x, the difference is just over 1 point. This suggests the shares are trading at a slight premium to their tailored fair value. While not egregiously overvalued, there is a modest disconnect between the market price and underlying fundamentals at this time.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1435 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dollar Tree Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

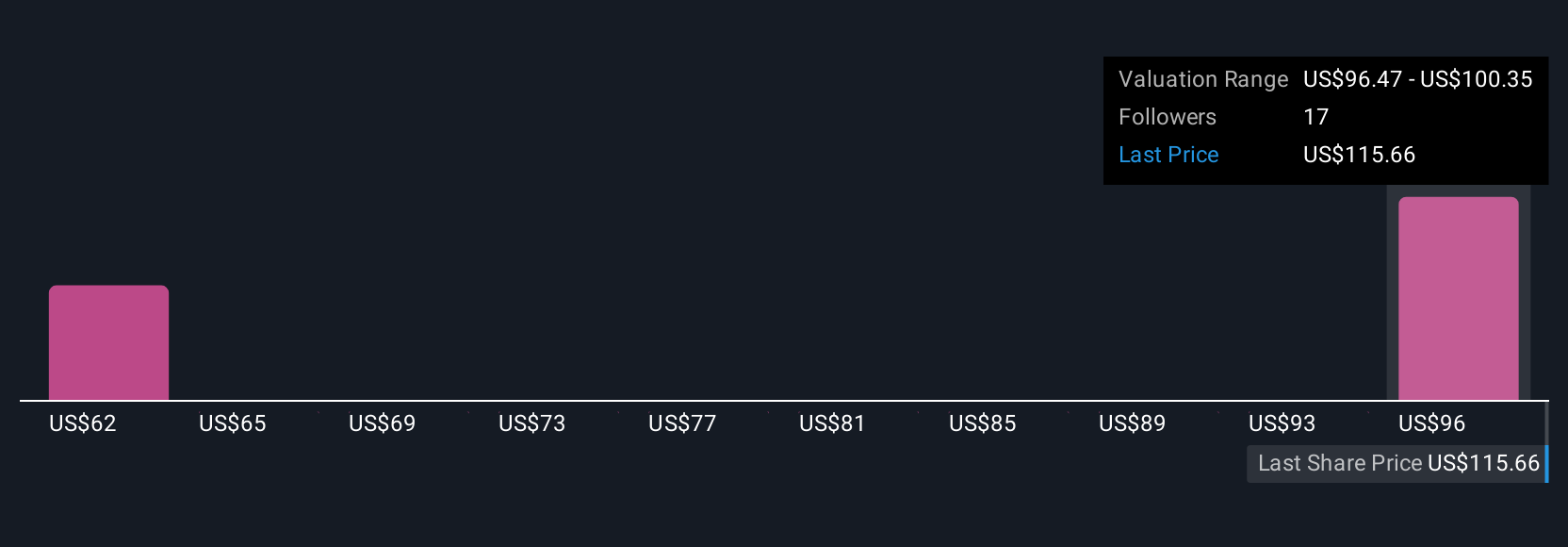

A Narrative is simply your own story or perspective on a company, bringing together what you believe about its future revenue, earnings, and profit margins and how those beliefs shape your estimate of fair value.

This approach makes investing more personal and powerful. Instead of being limited to what analysts or formulas say a company is worth, you can connect your view of Dollar Tree’s business outlook to a tailored financial forecast and your own calculated fair value.

On Simply Wall St’s Community page, Narratives are easy to create and track, used by millions of investors as a dynamic decision-making tool.

With Narratives, you can quickly compare your current fair value estimate to the share price, helping you decide if Dollar Tree is a buy, hold, or sell based on your convictions.

Most importantly, Narratives update automatically as new earnings or news emerge, so your analysis stays relevant and actionable without manual work.

For example, one investor building their Narrative might highlight aggressive store expansion and margin gains, supporting a $140 fair value. Another might focus on cost headwinds and operational risks, limiting their estimate to $75.

Do you think there's more to the story for Dollar Tree? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success