- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Will Bobbie’s Organic Formula Launch Reveal a New Wellness Strategy for Costco (COST)?

Reviewed by Sasha Jovanovic

- Bobbie announced the nationwide launch of its USDA Organic infant formula in select Costco warehouses, following strong digital sales and rapid in-store rollout driven by consumer demand for premium, accessible baby nutrition.

- This marks the first time a USDA Organic infant formula is available on Costco shelves, expanding access to high-quality, transparently sourced infant products for millions of families and reinforcing the warehouse giant’s commitment to value and wellness.

- We’ll explore how the addition of Bobbie’s high-quality organic formula fits into Costco’s broader investment narrative and membership-driven growth model.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Costco Wholesale Investment Narrative Recap

To be a shareholder in Costco, you must believe in the long-term resilience of its membership-driven business model and its ability to maintain value leadership despite slowing growth. The addition of Bobbie’s USDA Organic infant formula, while expanding Costco’s wellness and family value profile, is not expected to have a material impact on immediate sales growth or alter the most pressing risk: moderating revenue growth versus premium valuations.

Among recent company updates, the Q4 2025 earnings report stands out, confirming steady year-on-year increases in both revenue and net income. This context shows that new product offerings like Bobbie complement ongoing sales momentum, but do not shift the core near-term catalysts fueling investor attention.

However, amid this performance, investors should be aware that slowing sales growth, especially as competition intensifies, could...

Read the full narrative on Costco Wholesale (it's free!)

Costco Wholesale's outlook anticipates $329.0 billion in revenue and $10.4 billion in earnings by 2028. This reflects a 7.0% annual revenue growth rate and a $2.6 billion increase in earnings from the current $7.8 billion.

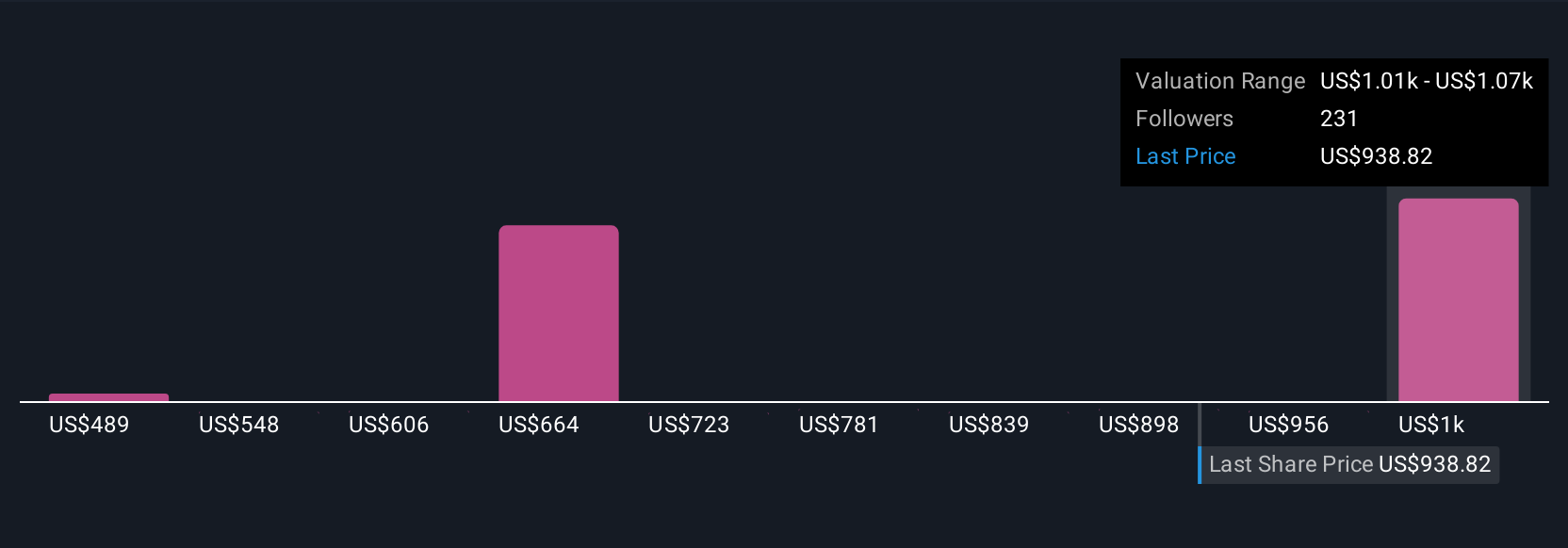

Uncover how Costco Wholesale's forecasts yield a $1056 fair value, a 18% upside to its current price.

Exploring Other Perspectives

You’ll find fair value estimates for Costco from the Simply Wall St Community ranging from US$691 to US$1,225, based on 25 independent views. As many anticipate sales growth moderation, these varied assessments point to a range of alternative scenarios for Costco’s future.

Explore 25 other fair value estimates on Costco Wholesale - why the stock might be worth 23% less than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives