- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Is Costco Stock Still a Bargain After Ongoing Store Expansions and Market Gains?

Reviewed by Bailey Pemberton

- Wondering if Costco Wholesale is still a great buy or if the growth has already been priced in? You’re in the right place for a clear view on whether shares offer value right now.

- Costco stock has shown steady momentum lately, rising 2.5% over the last week and 4.5% in the past year. This is a sign the market is paying attention, but not overheating.

- Recent headlines shine a light on Costco’s ongoing store expansions and efforts to evolve its product offerings. Markets often interpret these as steps toward bolstering long-term resilience. Investors have also been closely watching management’s updates on membership trends, as continued growth there can translate into lasting revenue strength.

- On our valuation checks, Costco scores 0 out of 6 for being undervalued. See the valuation score here. This cues up a deeper look at why, how, and what that means. Ahead, we’ll compare valuation approaches; stick around for a fresh perspective on what really matters for long-term value.

Costco Wholesale scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Costco Wholesale Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and discounting them back to today’s value. In essence, it tries to capture what all those future dollars are worth in today's terms. This approach can offer perspective on whether a stock is overvalued or undervalued at current prices.

For Costco Wholesale, the DCF model starts with the company’s latest Free Cash Flow of $8.16 billion. Analysts provide detailed projections for the next five years. From year six onward, estimates are extrapolated to map out a full decade’s trajectory. According to Simply Wall St, Costco’s Free Cash Flow could reach $12.25 billion by 2030, reflecting consistent growth powered by operational strength. All cash flows are presented in US dollars, which matches the company’s reporting currency.

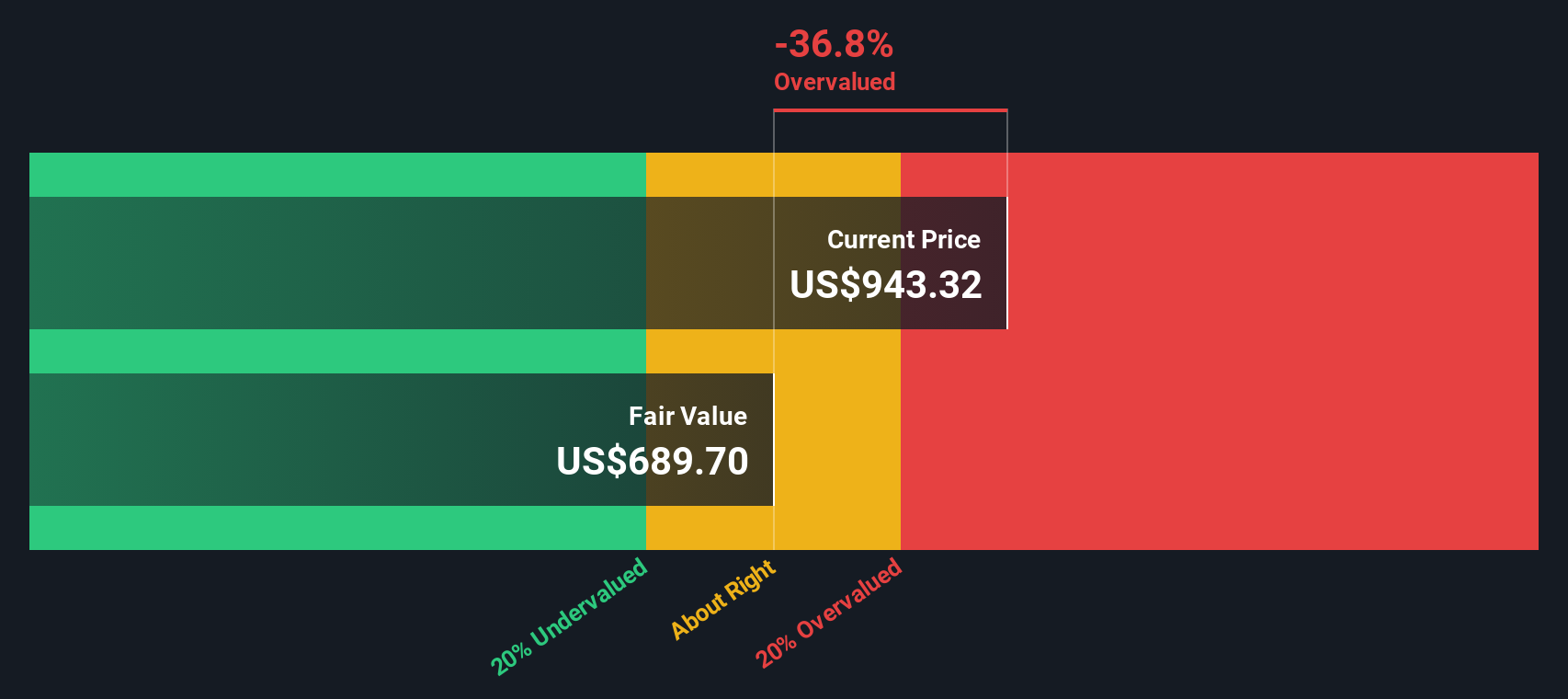

Based on this two-stage forecast, the DCF model produces an estimated intrinsic value of $690.25 per share. Compared to Costco’s current share price, this suggests the stock is approximately 35.5% overvalued using this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Costco Wholesale may be overvalued by 35.5%. Discover 849 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Costco Wholesale Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a widely used metric for valuing profitable companies because it tells investors how much they are paying for each dollar of earnings. For well-established businesses like Costco, which consistently generate solid profits, the P/E ratio offers meaningful insight into market expectations and perceived quality.

It is important to note that what qualifies as a "normal" or "fair" P/E ratio can shift depending on growth prospects, profitability, and business risk. Companies with faster earnings growth and lower risk often trade at higher multiples, while slower growers or riskier names typically command lower ratios.

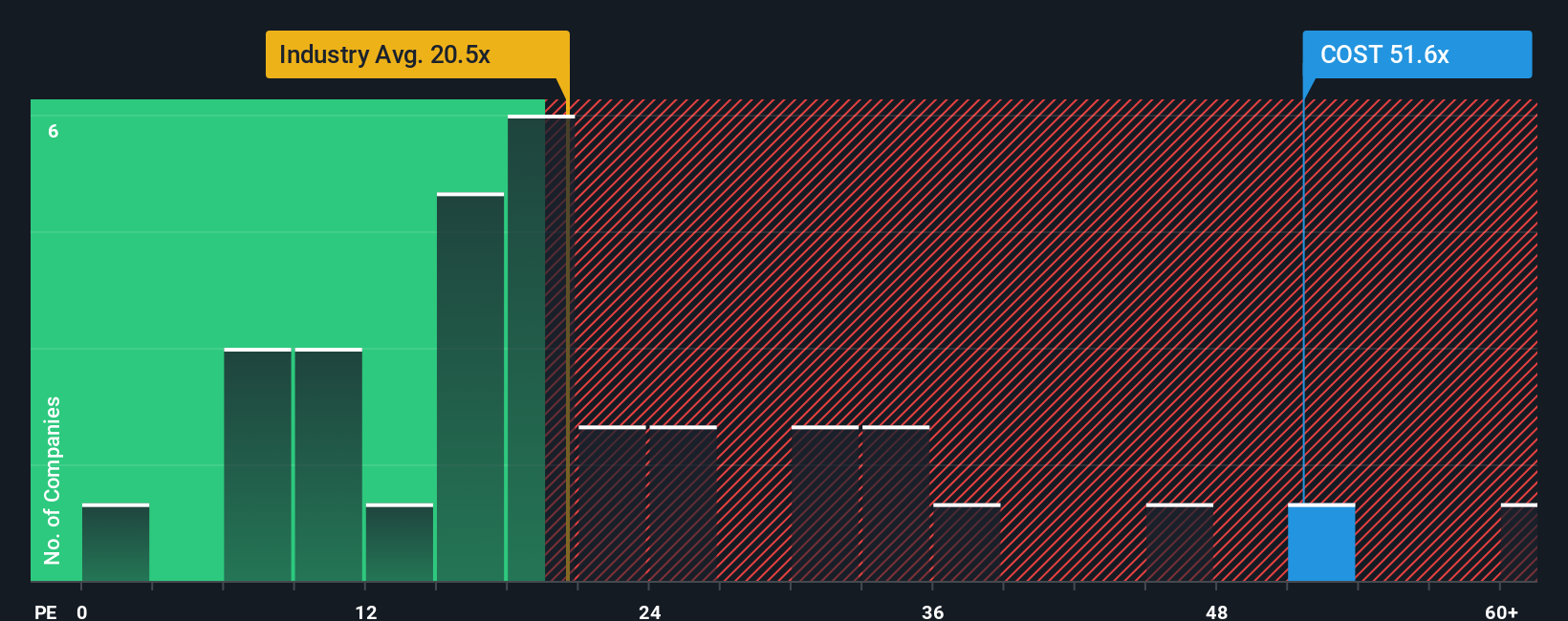

Currently, Costco trades at a P/E of 51.2x. That is significantly above the Consumer Retailing industry average of 19.7x and the peer group average of 22.0x. However, using Simply Wall St's proprietary Fair Ratio, which blends expected earnings growth, profit margin, industry trends, company size, and risks, Costco's fair P/E is calculated at 33.3x.

The Fair Ratio provides a more precise benchmark than simply comparing with peers or the industry because it captures the broader context behind Costco's premium, such as its growth consistency, scale advantages, and strong profitability profile.

Comparing the actual P/E of 51.2x to the Fair Ratio of 33.3x suggests that Costco's shares are richly valued relative to underlying fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Costco Wholesale Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just crunching numbers or comparing financial ratios. It is your story about the company, where you see its future, the trends you believe in, the risks you weigh, and the targets you think it can achieve. Narratives help connect the dots by tying together your perspective on Costco’s future revenues, earnings, and margins with a financial forecast and a personal estimate of fair value.

Narratives are made easy and accessible on the Simply Wall St Community page, where millions of investors share and refine their investment stories. With Narratives, you can compare your estimated fair value to the current price, helping you decide whether to buy, hold, or sell. Even better, these Narratives update automatically as new information such as earnings results or industry news arrives, so your decision-making always stays relevant.

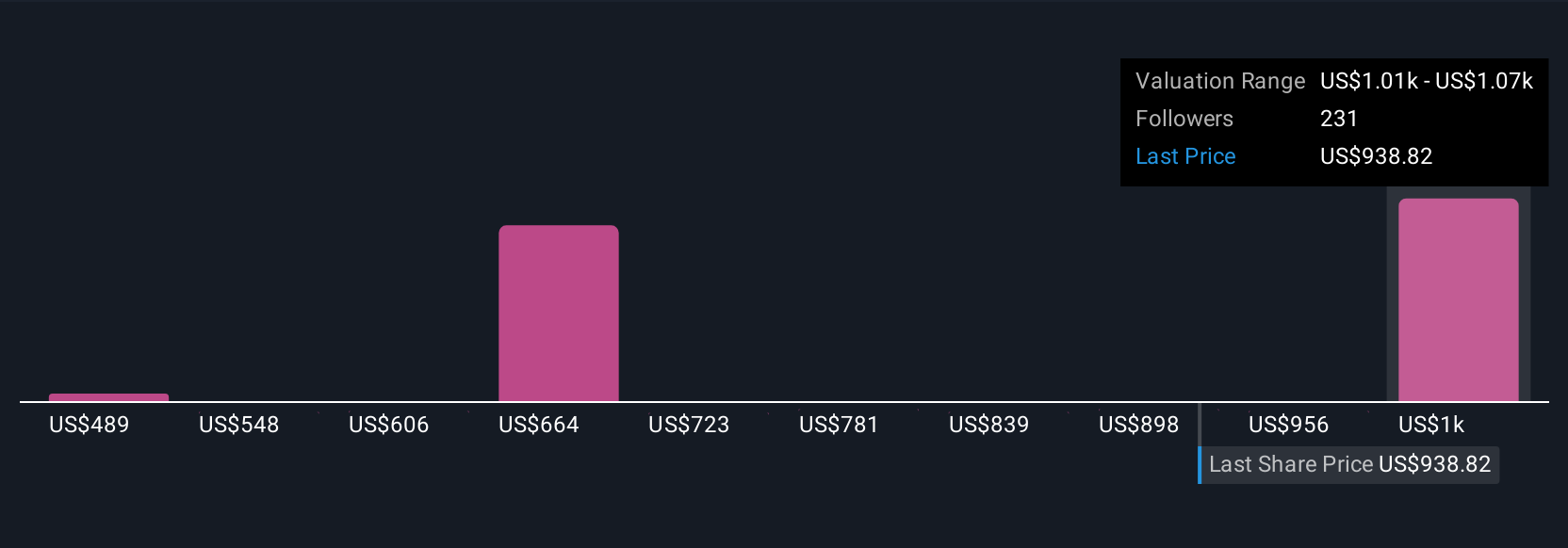

For example, some investors believe Costco’s revenue growth and international expansion will drive a fair value as high as $1,225, while others focus on rising costs and assign a much lower fair value of $620. Narratives let you transparently see and learn from these differing viewpoints whenever you need perspective.

Do you think there's more to the story for Costco Wholesale? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives