- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Is Costco Still Worth Its Price After Five-Year 155% Surge and Global Expansion?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Costco Wholesale’s sky-high share price still offers value, you are not alone and you are asking the right question.

- After a steady 2.0% rise in the last week and nearly flat returns year-to-date, many investors are weighing up fresh growth potential against shifting market risks, especially following a 155.3% gain over five years.

- Recently, headlines have highlighted Costco’s in-store traffic trends and expansion into new international markets, both factors influencing recent price activity. Attention also lingers on their membership fee model, which has attracted analyst debate on future customer loyalty and profitability shifts.

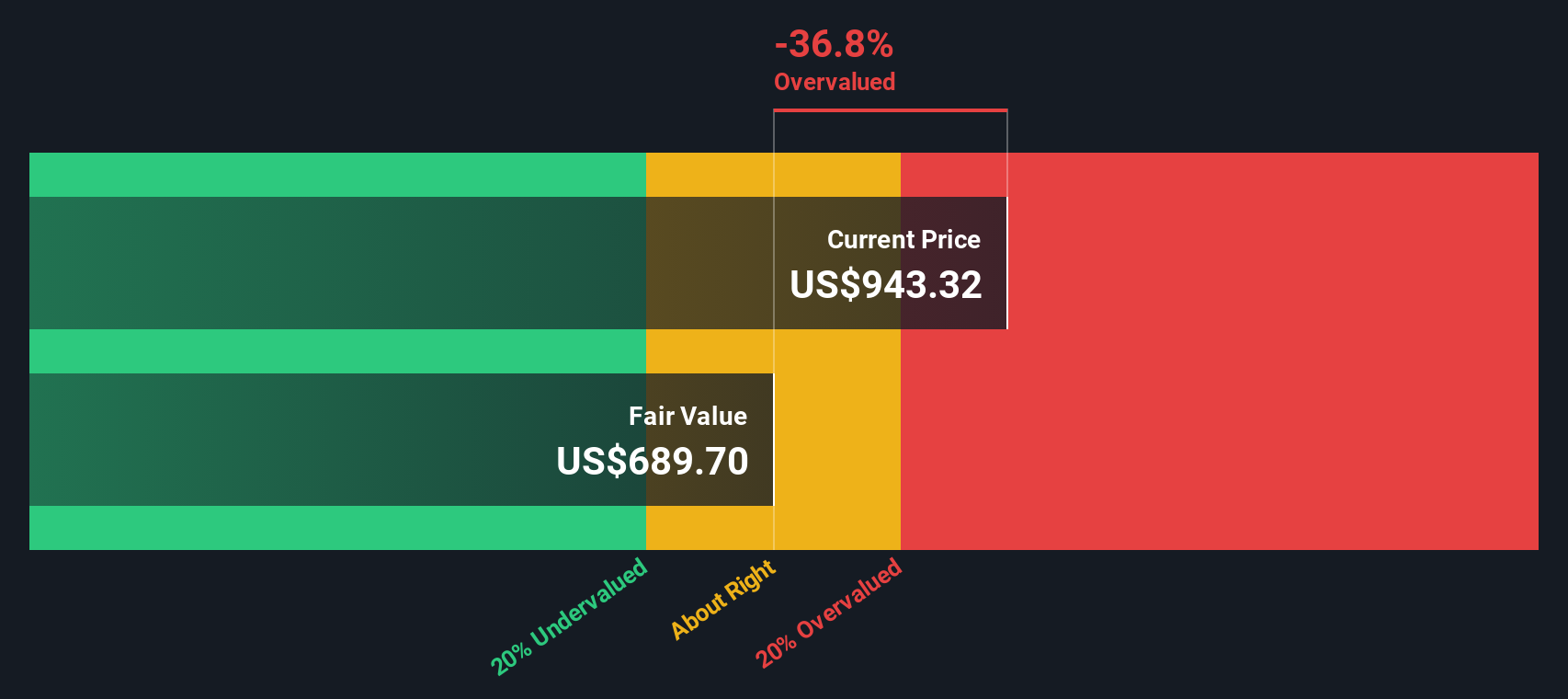

- With a current valuation score of 0 out of 6 on our undervaluation checks, Costco is notable for its premium. We will break down what that score really means by examining different approaches to valuation. Then, stick around for an even better way to understand whether Costco is worth its price tag.

Costco Wholesale scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Costco Wholesale Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. This approach helps investors see the value of a business based on its ability to generate cash over time.

For Costco Wholesale, the most recent Free Cash Flow stands at $8.16 billion. Analysts have projected Costco’s annual Free Cash Flow to grow steadily, reaching $10.71 billion by 2028. Looking out over a ten-year horizon, Simply Wall St extends these estimates and suggests continued growth with forecasted Free Cash Flow up to $15.66 billion by 2035.

Based on these projections and using a 2 Stage Free Cash Flow to Equity model, the DCF model calculates an intrinsic value of $691.44 per share. However, when compared to Costco’s current share price, this DCF valuation indicates the stock is trading at a 31.9% premium. This means it is considered significantly overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Costco Wholesale may be overvalued by 31.9%. Discover 930 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Costco Wholesale Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic valuation multiple and is especially relevant when analyzing profitable companies like Costco Wholesale. It measures how much investors are willing to pay for each dollar of the company’s earnings, making it a straightforward way to assess market expectations about profitability and growth.

Growth prospects and perceived risks play a big role in determining what a “normal” PE ratio should be for any given business. Companies with strong earnings growth and lower risk profiles often trade at higher multiples. Those with slower growth or greater uncertainty typically have lower PE ratios.

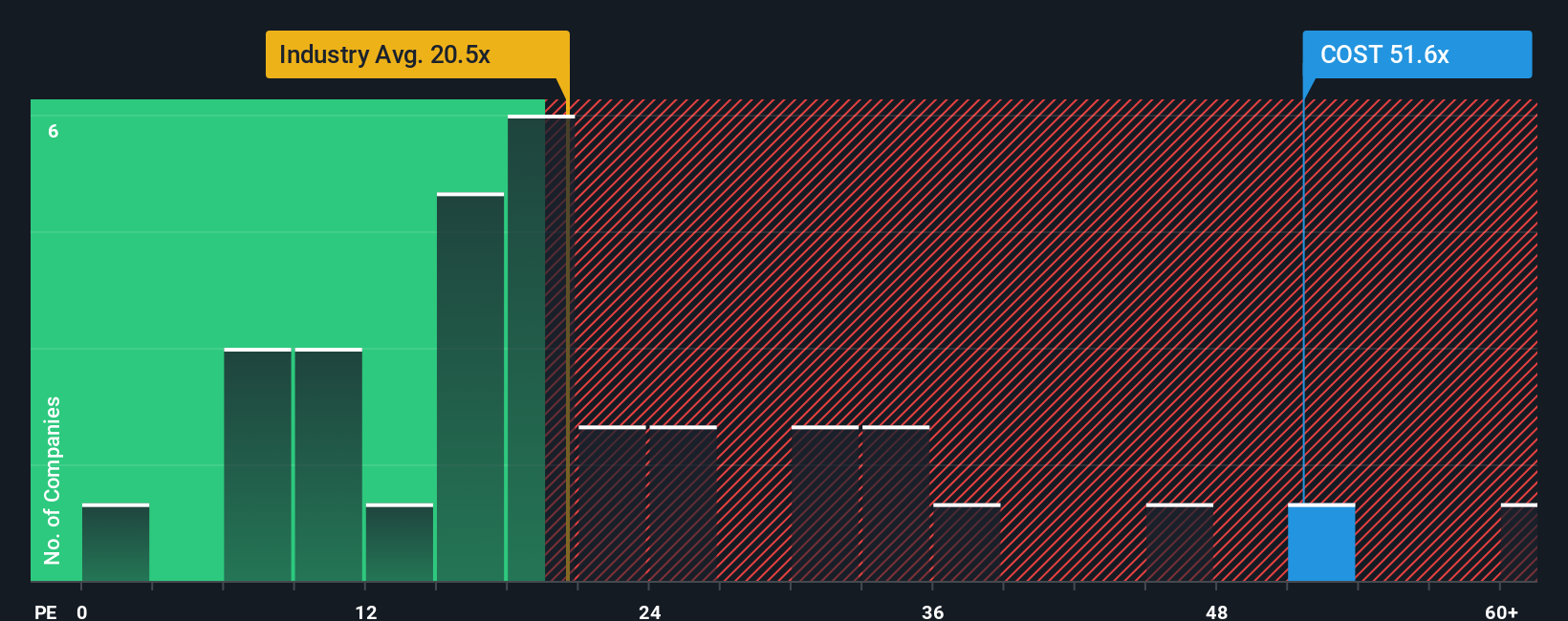

Currently, Costco trades at a PE multiple of 49.9x. This is much higher than both the industry average of 20.1x and the average for its peers at 22.5x. This indicates that the market places a significant premium on Costco’s future performance. While this might raise eyebrows, it is important to dig deeper before drawing any conclusions about overvaluation.

Simply Wall St’s proprietary “Fair Ratio” offers another perspective. Unlike broad benchmarks, the Fair Ratio estimates a company-specific multiple by evaluating earnings growth, industry norms, profit margins, company size, and unique business risks. This tailored approach helps make a more accurate judgment about whether the stock is expensive, considering all relevant factors rather than just a one-size-fits-all reference point.

For Costco, the Fair Ratio stands at 34.8x, noticeably lower than its current PE ratio. Since the difference between these two is significant, it suggests that, even after factoring in Costco’s growth and strengths, the shares appear to be richly valued at today’s price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your Costco Wholesale Narrative

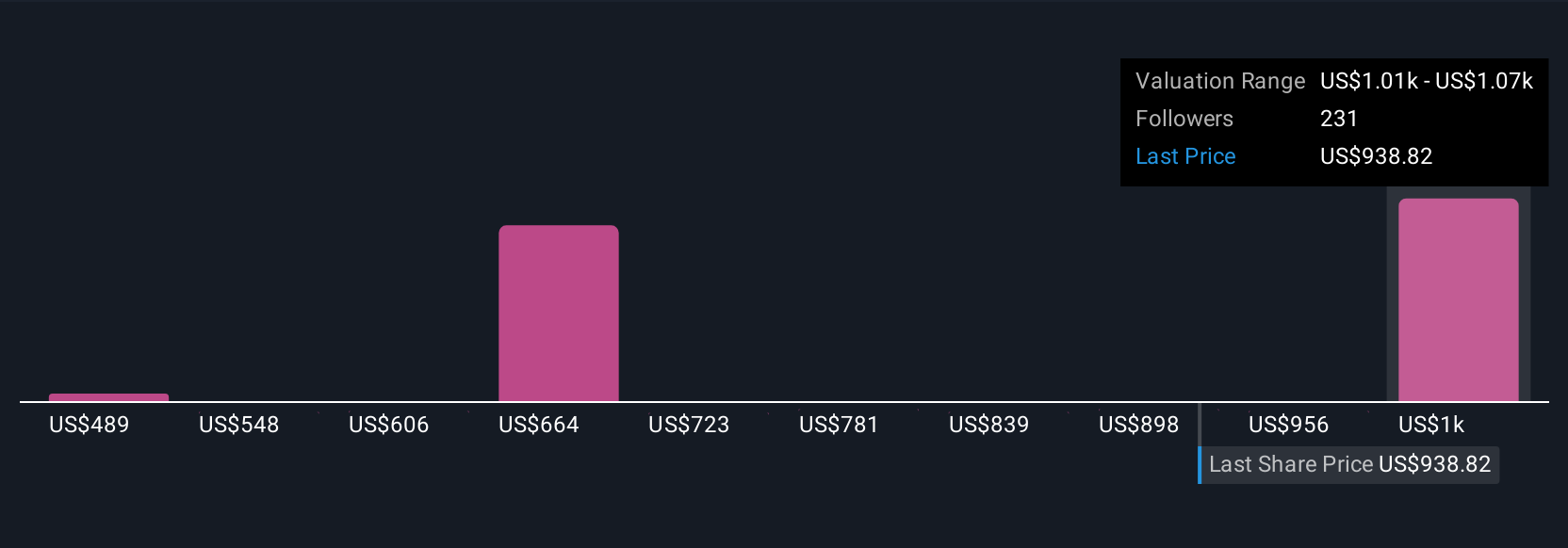

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company—what you believe about its business, its future revenue and earnings growth, its risks, and ultimately, what you think it is worth.

Unlike traditional valuation models, Narratives connect the company’s business story and outlook with a financial forecast and a fair value estimate. This approach allows you to incorporate your own assumptions and perspectives, making investing more personal and relevant. It can also help you see how your scenario lines up with the current share price.

Millions of investors already use Narratives on Simply Wall St’s Community page, where it is easy to create, edit, and compare your own forecast with others. Narratives are especially useful because they update automatically as new information is released, from company news to quarterly earnings reports. This ensures your investment thesis stays current.

For example, based on current analyst Narratives, some investors believe Costco’s fair value is as high as $1,225 per share due to strong membership retention and aggressive expansion. Others see it as low as $620 based on concerns about margin pressure and rising costs. Narratives help you decide whether Costco is a buy, hold, or sell for you by showing exactly how your view stacks up next to the market price.

Do you think there's more to the story for Costco Wholesale? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026