- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Does COST's Tiered Perks Strategy Hint at a New Membership Model for Long-Term Value?

Reviewed by Sasha Jovanovic

- In recent weeks, Costco Wholesale reintroduced early shopping hours exclusively for its Executive members and opened its seventh Business Centre in Canada, expanding its presence in Ontario.

- These moves highlight Costco's dual focus on enhancing membership value and accelerating international expansion, sparking both customer debate and signals of long-term growth ambitions.

- We'll explore how the early shopping perk for Executive members could impact Costco's membership business model and overall investment outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Costco Wholesale Investment Narrative Recap

To own Costco Wholesale stock, you need confidence in its membership-driven business model, disciplined store expansion, and ability to sustain consistent returns despite retail competition and margin pressures. The reintroduction of early Executive Member shopping hours appears unlikely to materially alter the most important near-term catalyst, continued store expansion, nor the biggest current risk: rising labor costs impacting margins, given ongoing plans for wage increases.

Among recent developments, the launch of Costco’s seventh Business Centre in Canada is most relevant, as it directly supports the company’s growth catalysts by deepening its international footprint and potentially boosting membership revenue. Expansion into new markets aligns with Costco’s ongoing strategy to drive sales growth and diversify earnings streams, reinforcing its focus on scaling operations even as localized initiatives, such as member benefits, attract mixed reactions.

Yet in contrast, investors should be aware that as Costco commits to higher labor costs across regions, the pressure on operating margins could intensify if…

Read the full narrative on Costco Wholesale (it's free!)

Costco Wholesale's outlook anticipates $329.0 billion in revenue and $10.4 billion in earnings by 2028. This implies a 7.0% annual revenue growth rate and an increase in earnings of $2.6 billion from the current $7.8 billion level.

Uncover how Costco Wholesale's forecasts yield a $1060 fair value, a 16% upside to its current price.

Exploring Other Perspectives

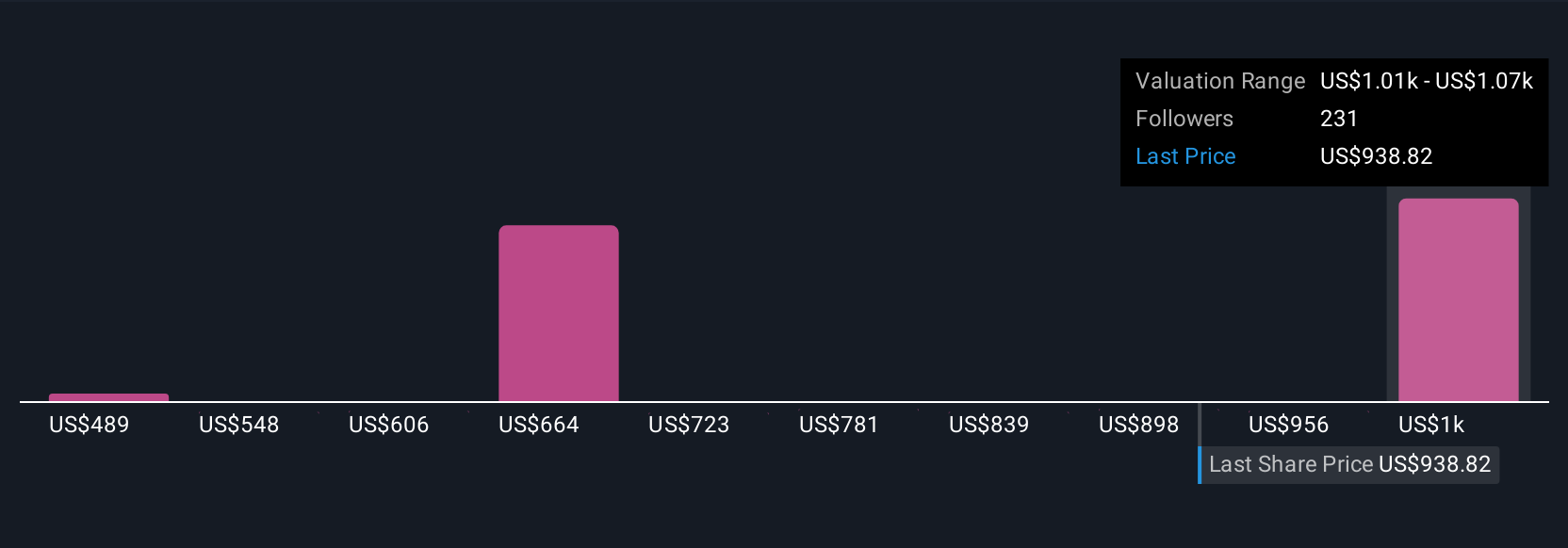

The Simply Wall St Community submitted 21 independent fair value estimates for Costco, ranging between US$686.67 and US$1,059.55 per share. With this wide spectrum of opinions, remember that ongoing labor cost increases remain a pivotal profit risk and could shape your view on future performance.

Explore 21 other fair value estimates on Costco Wholesale - why the stock might be worth 25% less than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives