- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco (COST): A Deep Dive Into Valuation After Strong Earnings and Recent Share Price Pullback

Reviewed by Simply Wall St

Costco Wholesale (COST) just wrapped its fiscal quarter with solid gains in net sales and growing membership income, powered by its trademark low-margin, high-volume approach. Still, the stock is under pressure after recent declines, which draws fresh questions about its elevated valuation compared to future growth prospects.

See our latest analysis for Costco Wholesale.

Costco’s latest retail wins and solid membership growth are promising, yet the share price has fallen over 15% since February and momentum is still soft, with a 1-year total shareholder return of -6.3%. While the company’s business model is delivering sturdy results, the lofty valuation means investor enthusiasm is tempered, at least for now.

If you’re interested in what’s driving outperformance elsewhere, this is a great opportunity to discover fast growing stocks with high insider ownership.

With its financial resilience considered alongside an unusually high valuation and recent share price weakness, the central question is now clear: Is the recent decline in Costco’s stock a genuine buying opportunity, or has the market already priced in every bit of expected future growth?

Most Popular Narrative: 14.9% Undervalued

The most closely followed narrative values Costco Wholesale at a fair value above its latest closing price. This highlights a potential misalignment between recent price action and future prospects and sets the stage for the core catalysts underpinning the narrative’s bullish case.

Costco plans to continue expanding its warehouse locations, with 28 new openings planned for fiscal year 2025. This expansion is likely to increase membership and sales volume, driving revenue growth.

Want to know why analysts think Costco deserves its rich valuation? The most important drivers behind this price include ambitious revenue growth, robust membership trends, and bold profit margin assumptions. Ready to discover which expectations could push Costco higher? Click above for the full story and find out the forecasts fueling this valuation.

Result: Fair Value of $1,055.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, foreign exchange fluctuations and rising labor costs could pressure Costco’s profit margins. These factors may challenge the bullish outlook if such trends persist.

Find out about the key risks to this Costco Wholesale narrative.

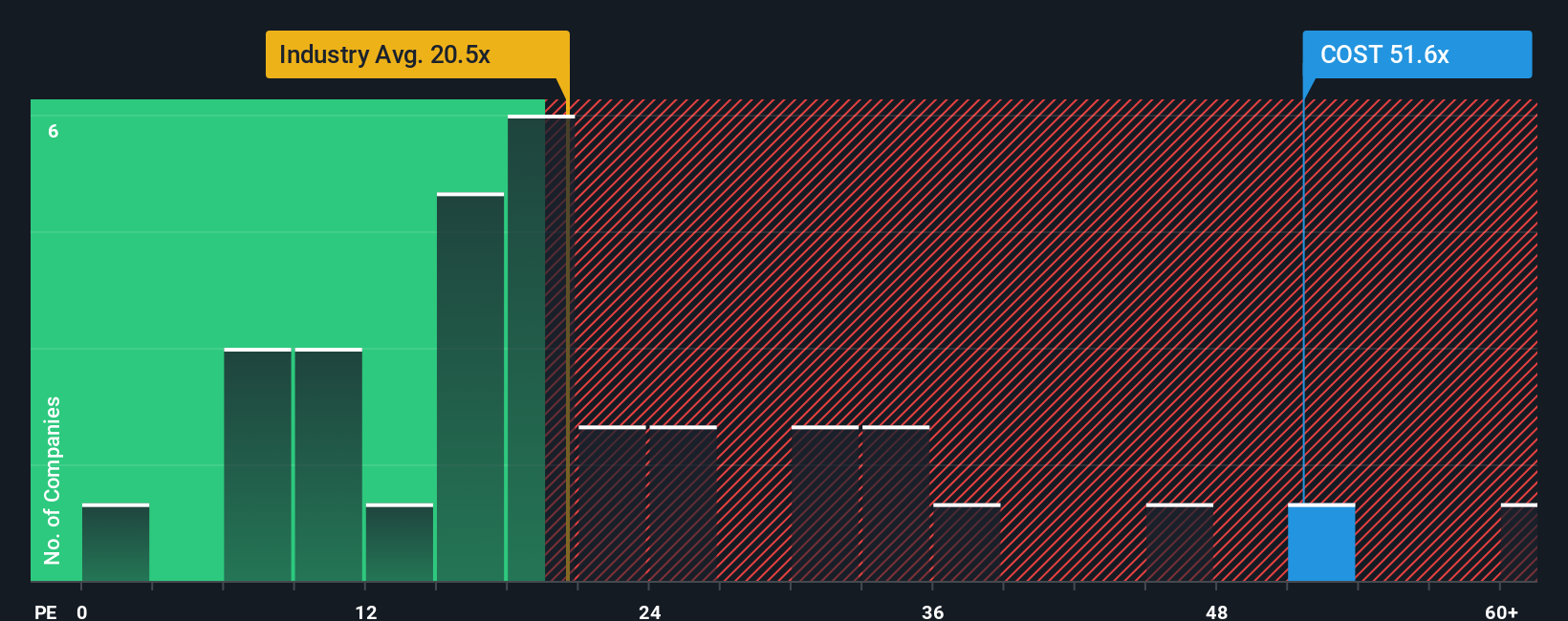

Another View: Market Ratios Tell a Different Story

While our first look highlights Costco as undervalued based on analyst targets, its price-to-earnings ratio sits at 49.2x. This is a stark contrast to the US Consumer Retailing average of 20.9x and a fair ratio of 33.2x. This premium pricing signals that much optimism is already built into the stock. Are investors paying too much for proven resilience?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

Feel that the story could be interpreted differently, or want to dive deeper on your own terms? You can craft your own narrative and conclusions in just a few minutes. Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let new opportunities pass you by. Take the next step and supercharge your watchlist with fresh stocks you might have missed.

- Uncover reliable income by checking out these 16 dividend stocks with yields > 3%, which consistently delivers yields above 3% for long-term growth potential.

- Tap into the AI wave with these 26 AI penny stocks, reshaping entire industries and creating tomorrow’s market leaders today.

- Capitalize on strong cash flow potential with these 927 undervalued stocks based on cash flows, trading at attractive valuations based on their fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives