- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:CHSN

What You Can Learn From Chanson International Holding's (NASDAQ:CHSN) P/S After Its 33% Share Price Crash

Chanson International Holding (NASDAQ:CHSN) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 251% in the last twelve months.

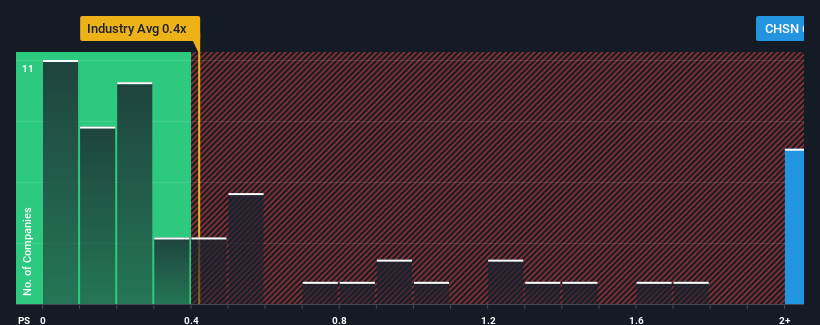

In spite of the heavy fall in price, you could still be forgiven for thinking Chanson International Holding is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.7x, considering almost half the companies in the United States' Consumer Retailing industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Chanson International Holding

How Has Chanson International Holding Performed Recently?

Revenue has risen firmly for Chanson International Holding recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Chanson International Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Chanson International Holding?

Chanson International Holding's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The strong recent performance means it was also able to grow revenue by 33% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 4.8% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Chanson International Holding is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Chanson International Holding's P/S

A significant share price dive has done very little to deflate Chanson International Holding's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Chanson International Holding maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Chanson International Holding has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CHSN

Chanson International Holding

Manufactures and sells a range of bakery products, seasonal products, and beverage products for individual and corporate customers in the People’s Republic of China, Cayman Islands, and the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives