- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CHEF

Does Chefs’ Warehouse’s Q3 Beat and Raised 2025 Outlook Reinforce the Growth Story for CHEF?

Reviewed by Sasha Jovanovic

- The Chefs’ Warehouse, Inc. recently reported better-than-expected third quarter results, with net sales for the quarter rising to US$1.02 billion and earnings per share exceeding analyst expectations, and the company raised its full-year 2025 revenue and profit guidance to reflect ongoing demand trends.

- A distinguishing highlight is the company's expanded presence in the specialty food distribution market after acquiring Italco Food Products, which contributed to revenue growth despite some pressures in commodity categories.

- We'll explore how Chefs’ Warehouse’s improved margin outlook and guidance increase reshape the company’s investment narrative and future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Chefs' Warehouse Investment Narrative Recap

To be a Chefs’ Warehouse shareholder today, an investor needs to believe the company can drive continued growth by deepening its specialty focus and executing on margin improvements, even as cost pressures and integration risks linger. The recent earnings and raised guidance reinforce the company’s ability to outpace expectations, but the most important short-term catalyst remains successful integration and performance of acquired businesses versus ongoing wage and cost headwinds, a balance this quarter's results don't materially disrupt.

Among the latest developments, the company’s decision to raise its full-year 2025 sales and earnings guidance following its strong third quarter directly ties to investor expectations for continued revenue and margin momentum. This announcement is especially relevant as it speaks to near-term confidence in profitability, a key underpinning of current market optimism around the stock.

By contrast, it's worth highlighting for investors that integration risks after major acquisitions remain front and center, especially if operational disruptions...

Read the full narrative on Chefs' Warehouse (it's free!)

Chefs' Warehouse's narrative projects $4.9 billion revenue and $121.9 million earnings by 2028. This requires 7.6% yearly revenue growth and a $52.3 million earnings increase from $69.6 million currently.

Uncover how Chefs' Warehouse's forecasts yield a $76.62 fair value, a 30% upside to its current price.

Exploring Other Perspectives

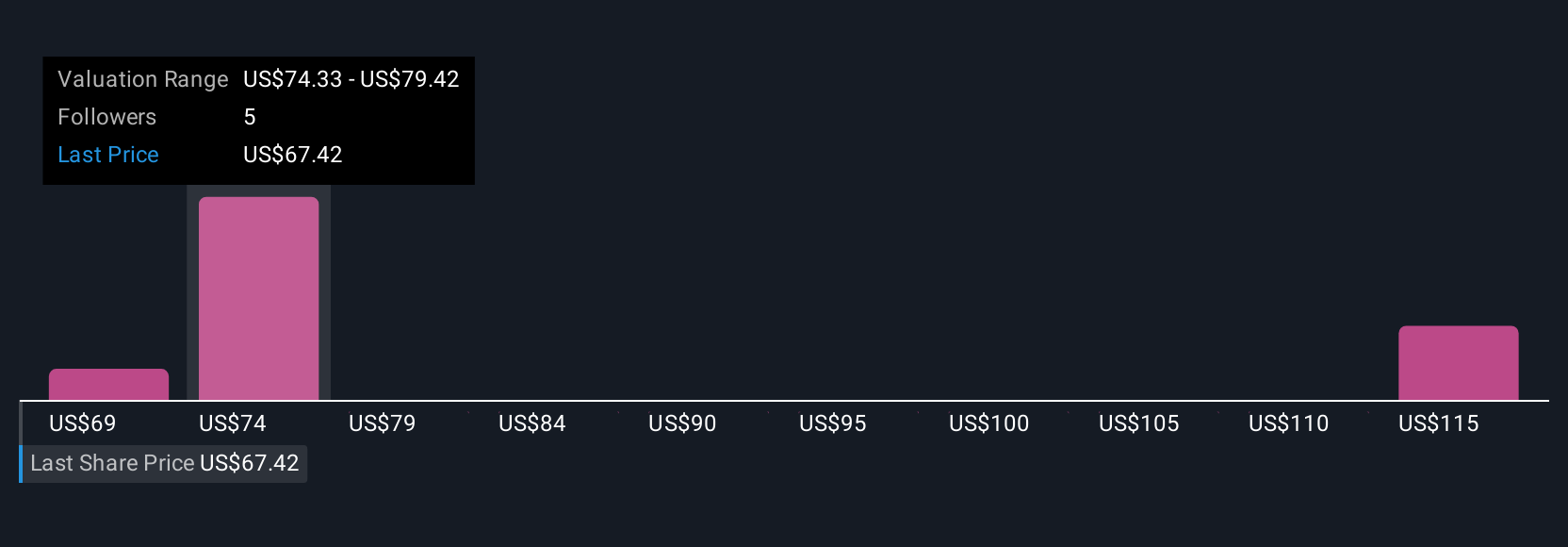

Five members of the Simply Wall St Community valued Chefs’ Warehouse between US$38.55 and US$89.11 per share, revealing wide differences in outlook. With recently raised earnings guidance, your views on ongoing margin and integration execution could shift the debate even further, see how your opinion compares with others.

Explore 5 other fair value estimates on Chefs' Warehouse - why the stock might be worth 35% less than the current price!

Build Your Own Chefs' Warehouse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chefs' Warehouse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chefs' Warehouse's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHEF

Chefs' Warehouse

Distributes specialty food and center-of-the-plate products in the United States, the Middle East, and Canada.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives