- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

Is Casey's (CASY) Still Undervalued? A Fresh Look at Its Valuation After Recent Momentum

Reviewed by Simply Wall St

Casey's General Stores (CASY) has stayed on investors' radars following its 7% gain over the past three months. Many are now closely watching how recent performance could shape the stock’s next steps.

See our latest analysis for Casey's General Stores.

Momentum has clearly been building for Casey’s General Stores, with a 38.94% year-to-date share price return and a strong 33.79% total shareholder return over the last 12 months. Recent moves show that its performance has outpaced many peers and fueled optimism about future growth.

If you’re wondering where else momentum is picking up, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with the share price sitting near its all-time highs, investors are left wondering whether Casey’s is still trading below its true value, or if the market has already baked in much of the company’s future growth potential. Is there still a buying opportunity here, or has the stock run ahead of itself?

Most Popular Narrative: 6% Undervalued

With Casey’s General Stores’ last close at $548.32, the most widely followed narrative sets a fair value estimate at $585.85, putting the stock modestly below that target. This gap focuses attention on whether the market’s confidence in growth and execution merits a premium.

Investments in digital strategy, supply chain efficiency, and store remodels enhance operating leverage and set the stage for sustained earnings growth. Heavy reliance on acquisitions, regional and labor risks, weak digital presence, and declining fuel demand pose challenges to future revenue growth and margin expansion.

Curious about the high stakes behind this valuation? One bold growth ingredient and a controversial industry outlook fuel a premium profit forecast. Can management deliver? Unlock the narrative to reveal the critical numbers shaping that price target.

Result: Fair Value of $585.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including slower than expected synergy gains from acquisitions or a decline in fuel demand, either of which could temper momentum.

Find out about the key risks to this Casey's General Stores narrative.

Another View: The Multiple Tells a Different Story

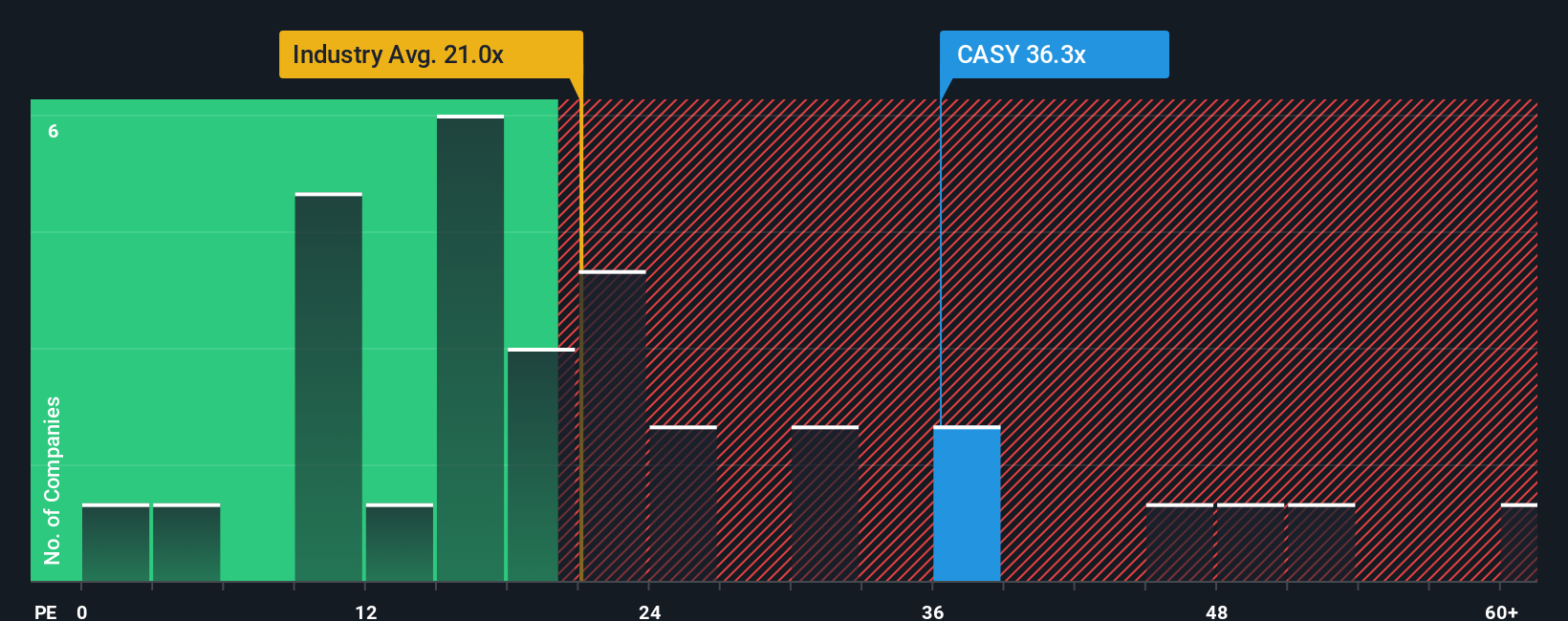

Stepping back from fair value estimates, Casey’s trades on a price-to-earnings ratio of 35x, well above the industry average of 21.1x and the fair ratio of 21.4x. This premium signals high confidence, but also highlights significant valuation risk if future growth does not materialize. Is the market’s optimism setting the bar too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casey's General Stores Narrative

If you’d rather take a different view or dig through the numbers firsthand, you can craft a fresh perspective for Casey’s in just a few minutes yourself: Do it your way.

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Expand your strategy by searching for companies that match your goals and explore ideas you may not have considered. The next big opportunity could be closer than you think.

- Unlock high yields and consistent returns by checking out these 18 dividend stocks with yields > 3%, which offers yields above 3% for steady income potential.

- Equip your portfolio with innovators by targeting these 27 AI penny stocks leading breakthroughs in artificial intelligence and automation.

- Tap into potential undervaluation and market mispricing by browsing these 906 undervalued stocks based on cash flows, based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives