- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

How Investors Are Reacting To Casey's General Stores (CASY) Outpacing Retail Sector and Receiving Upgraded Outlook

Reviewed by Sasha Jovanovic

- Earlier this year, Casey's General Stores outperformed the Retail-Wholesale sector with a year-to-date return of about 38.4%, while its full-year earnings outlook was revised upwards by analysts and it received a favorable Zacks Rank of #2 (Buy).

- This performance notably exceeded both the sector average gain and the industry’s average, reflecting increasing investor confidence in the company’s operational trajectory and earnings potential.

- We’ll now explore how Casey’s strong sector and industry outperformance, driven by raised earnings estimates, impacts its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Casey's General Stores Investment Narrative Recap

To be a Casey’s General Stores shareholder, you likely believe in its ability to drive long-term value through consistent store expansion, resilient earnings, and a focus on prepared foods margins, despite regional exposure and execution risk in integrating new acquisitions. While recent news of strong stock outperformance and upward earnings revisions has reinforced positive sentiment, it doesn’t meaningfully change the near-term focus on successfully capturing synergy from acquired stores, where results may take time to reach expectations, presenting a potential drag on margins. Among recent announcements, Casey’s reaffirmation of its FY 2026 earnings guidance on September 8 stands out. This move, emphasizing stable same-store sales growth and inside margin expectations, directly addresses investor attention on short-term earnings catalysts and demonstrates confidence even as integration and market headwinds remain focal points. Yet even as positive returns capture attention, investors should keep in mind the ongoing risk if margin improvements from acquired stores are delayed…

Read the full narrative on Casey's General Stores (it's free!)

Casey's General Stores' narrative projects $19.5 billion revenue and $760.7 million earnings by 2028. This requires 6.0% yearly revenue growth and a $179 million earnings increase from $581.7 million today.

Uncover how Casey's General Stores' forecasts yield a $585.85 fair value, a 6% upside to its current price.

Exploring Other Perspectives

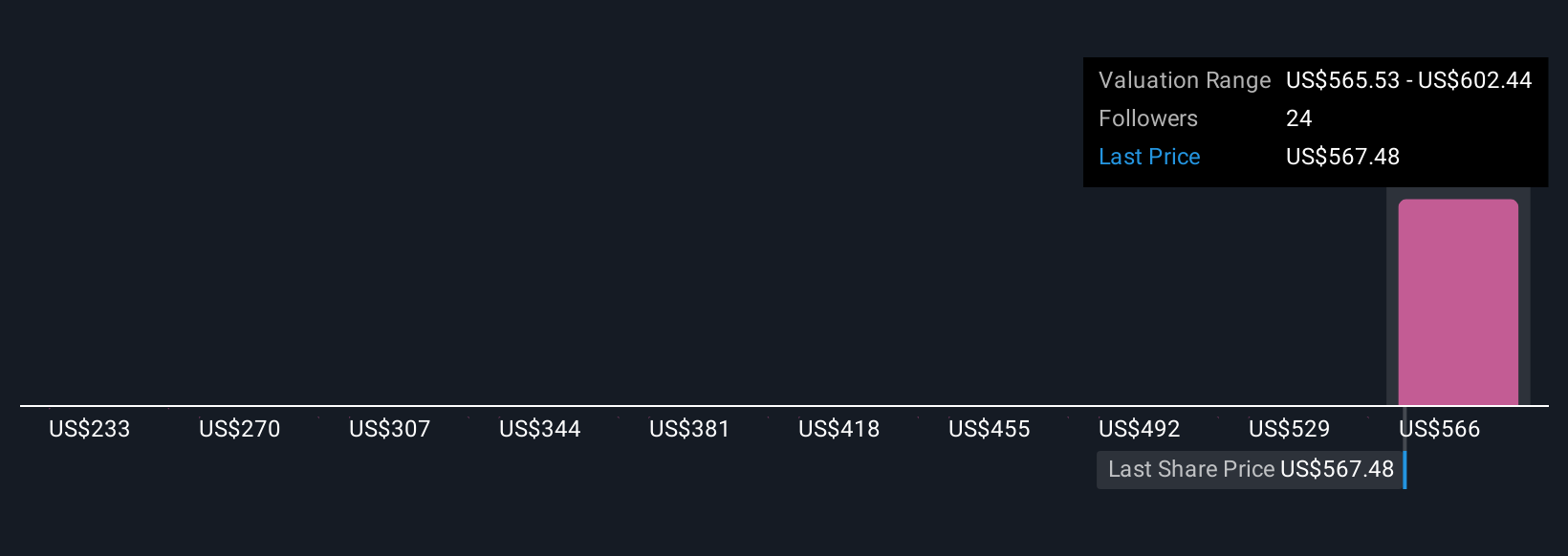

Four recent fair value estimates from the Simply Wall St Community span a wide range from US$233 to US$608 per share. With so many perspectives, consider how store integration and operational synergy timing remain a central issue for future performance and valuation discussions.

Explore 4 other fair value estimates on Casey's General Stores - why the stock might be worth less than half the current price!

Build Your Own Casey's General Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Casey's General Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casey's General Stores' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives