- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

The Bull Case for Instacart (CART) Could Change Following Major Health and Retail Media Partnerships Expansion

Reviewed by Simply Wall St

- Earlier this week, Instacart announced nationwide partnerships with Vroom Delivery and Pear Suite, enabling its advertising technology to reach 3,500 additional convenience stores and integrating Instacart Health's food access tools into healthcare outreach across the US.

- These collaborations further extend Instacart’s retail media network and underscore the company's move to blend commerce, advertising, and healthcare solutions across a broader customer base.

- We'll explore how Instacart’s expansion into health-focused retail media with Vroom Delivery impacts its long-term earnings outlook and business model.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Maplebear Investment Narrative Recap

To invest in Maplebear, you need to believe that Instacart can successfully widen its digital ecosystem by integrating commerce, advertising, and health while navigating industry pressures on margins and growth. The new partnerships with Vroom Delivery and Pear Suite support acceleration of high-margin advertising revenue and food access initiatives, providing incremental reach but not changing the main short-term catalyst: deeper adoption of its omnichannel retail media solutions; the biggest risk remains consumer ad-spend volatility and platform competition, which could limit near-term topline acceleration if the macro backdrop sours.

Among recent news, the Vroom Delivery partnership is most relevant, as it brings 3,500 convenience stores into the Instacart Carrot Ads network. This substantially increases advertising inventory and merchant touchpoints, directly advancing one of Instacart's critical growth catalysts, expansion of its retail media network and advertiser base, which strengthens revenue diversification and platform stickiness.

By contrast, investors should also be mindful of the competitive pressures from retailer-led and third-party platforms that could influence Instacart’s future order volumes and revenue trajectories...

Read the full narrative on Maplebear (it's free!)

Maplebear's narrative projects $4.6 billion in revenue and $779.9 million in earnings by 2028. This requires 9.3% yearly revenue growth and a $300.9 million earnings increase from $479.0 million today.

Uncover how Maplebear's forecasts yield a $59.88 fair value, a 29% upside to its current price.

Exploring Other Perspectives

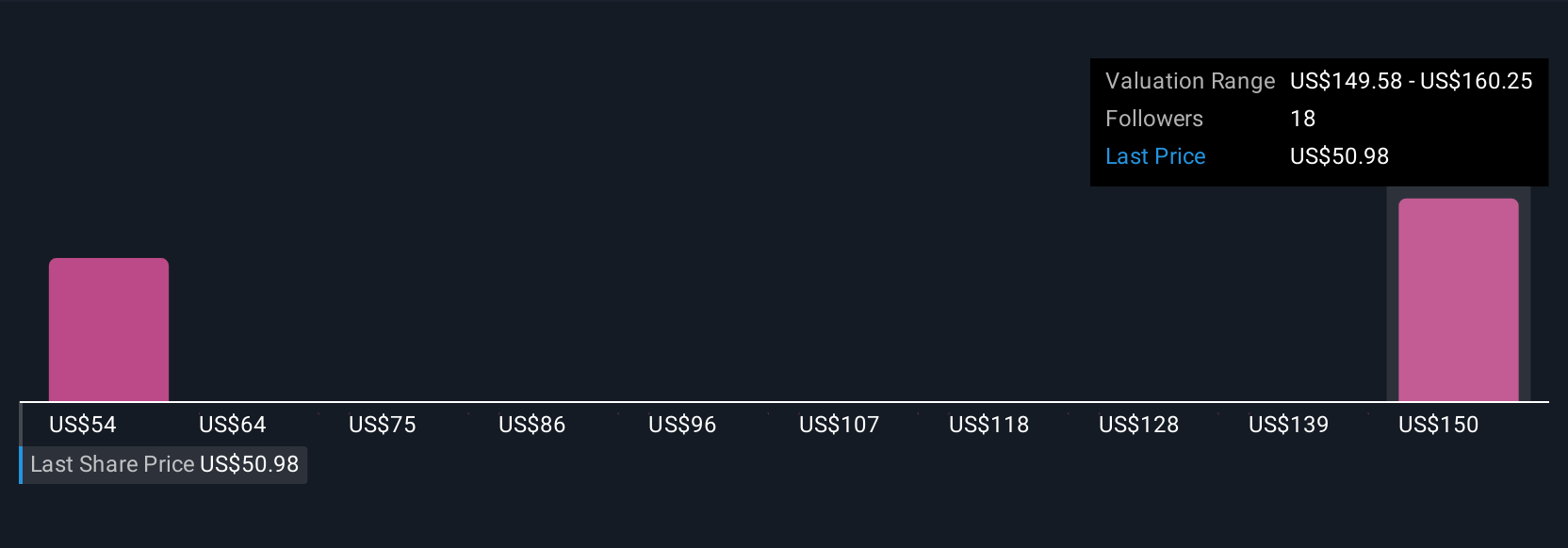

The Simply Wall St Community’s fair value estimates for Maplebear range from US$59.88 to US$160.41 across two analyses. While some see major upside, many are weighing how intensifying competition could affect Instacart’s revenue and market share, review these viewpoints to see how your perspectives compare.

Explore 2 other fair value estimates on Maplebear - why the stock might be worth just $59.88!

Build Your Own Maplebear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maplebear research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Maplebear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maplebear's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives