- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

Instacart (CART) Valuation Check After FTC AI Pricing Probe and $60 Million Settlement

Reviewed by Simply Wall St

The latest move from US regulators has put Maplebear (CART) under a brighter spotlight, with an FTC probe into its AI driven pricing tools landing just as the company agrees to a $60 million settlement.

See our latest analysis for Maplebear.

Despite the regulatory noise, investors have largely kept faith, with a roughly 14% 1 month share price return lifting Maplebear to about $45.94 and leaving 1 year total shareholder return in positive territory. However, recent gains suggest momentum could be fragile if trust concerns deepen.

If scrutiny of Instacart has you rethinking where growth and risk are better balanced, this could be a smart moment to explore fast growing stocks with high insider ownership.

With regulatory clouds gathering just as revenue and profits keep growing, Maplebear trades at a modest discount to analyst targets and a steep implied intrinsic value gap. Is this a buyable mispricing, or has the market already banked future growth?

Most Popular Narrative Narrative: 9.2% Undervalued

With Maplebear last closing at $45.94 against a narrative fair value near $50.62, the story leans toward upside potential if the assumptions hold.

The company's rapid deployment of AI and automation across fulfillment, inventory prediction, batching, and customer experience continues to deliver operational efficiencies, improve order accuracy, and reduce delivery times by 25% over four years. These technology driven savings are reinvested (e.g., lower basket sizes, free pickup), aiding customer frequency and retention while structurally supporting higher contribution margins and net margins.

Curious how this efficiency playbook, paired with rising margins and a premium future earnings multiple, adds up to that valuation gap? The full narrative breaks down the math and the expectations powering that price.

Result: Fair Value of $50.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory uncertainty around gig worker rules and rising competition from retailer-led delivery platforms could quickly compress margins and challenge that upside case.

Find out about the key risks to this Maplebear narrative.

Another View: Market Multiples Send A Different Signal

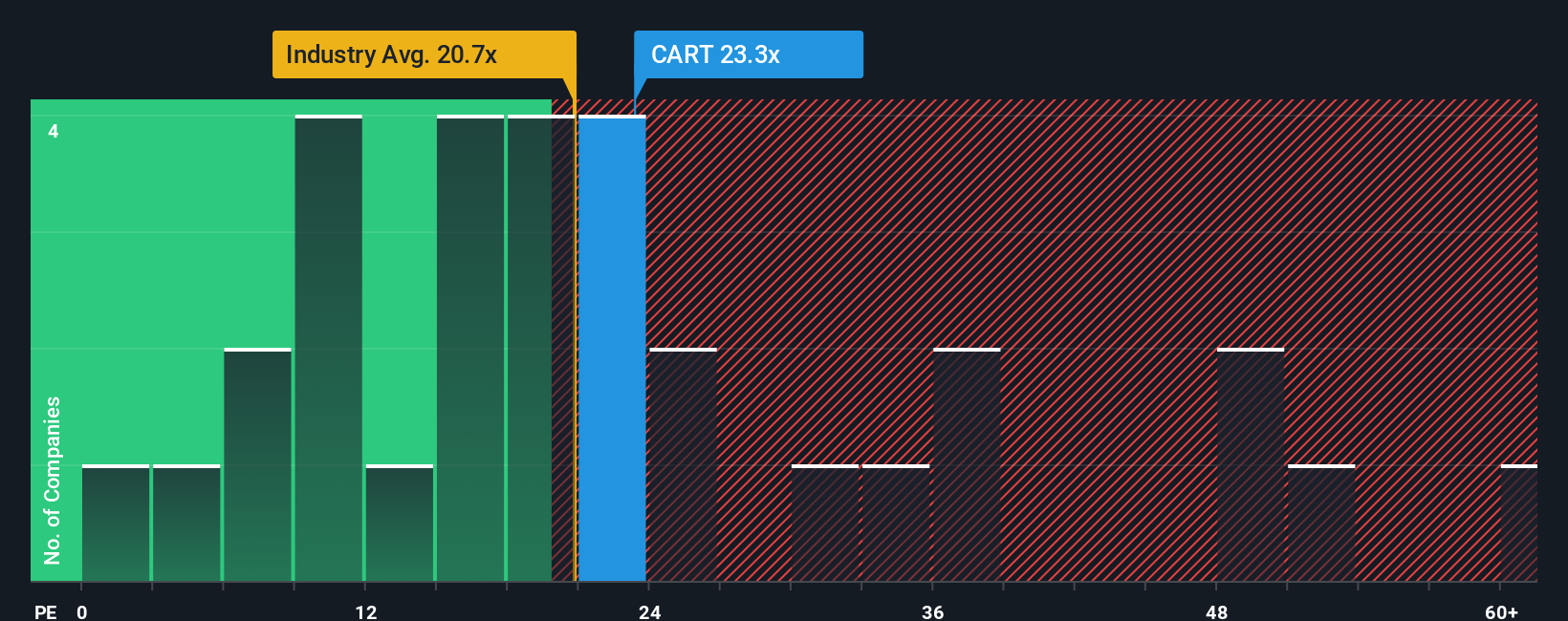

While the narrative fair value points to upside, the market is pricing Maplebear at 23.9 times earnings versus an industry average of 21.5 times and a fair ratio of 18.3 times. That richer multiple implies less margin for error, so is the discount really as generous as it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Maplebear Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a fresh narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Maplebear.

Ready for more investment ideas?

Turn today’s research into action and scan fresh opportunities before the crowd using screeners built to surface clear, data backed ideas in seconds.

- Capture potential bargains early by targeting companies trading below their cash flow value through these 912 undervalued stocks based on cash flows.

- Position yourself for the next wave of innovation by focusing on real businesses riding the AI tailwind using these 24 AI penny stocks.

- Strengthen your income strategy by zeroing in on established companies offering yields above 3 percent with these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion