- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

Did Instacart's Bottlecapps Partnership Just Shift Maplebear's (CART) Retail Media Narrative?

Reviewed by Simply Wall St

- Instacart recently announced a partnership with Bottlecapps to bring its Carrot Ads technology to Bottlecapps' platform, enabling retailers across the US and Canada to access advanced retail media capabilities for alcohol brands and e-commerce advertising.

- This collaboration not only expands Instacart's advertising reach but also aims to give Bottlecapps retailers and advertisers new ways to engage high-intent consumers and enhance digital product discovery.

- We'll examine how expanding Carrot Ads to Bottlecapps retailers can shape Instacart's future earnings and advertising revenue prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Maplebear Investment Narrative Recap

To be a Maplebear (Instacart) shareholder, you need to believe in the company’s ability to expand beyond food and beverage by growing enterprise partnerships and strengthening its retail media offerings. The new Bottlecapps alliance highlights Instacart’s focus on advertising growth, but the main short-term catalyst still appears to be scaling newer ad services, a key area to offset the ongoing risk of reliance on food and beverage as its core vertical. This partnership does marginally support the strategy but may not immediately alter the primary risks or catalysts facing the business.

Among recent developments, Instacart’s expanded collaboration with The Trade Desk to enhance programmatic advertising stands out, as it aligns with the same catalyst: driving digital ad revenue through broader brand and retailer access to its platform. Both The Trade Desk and Bottlecapps partnerships illustrate Instacart's ongoing efforts to increase high-margin advertising income.

On the other hand, investors should also be aware of Instacart’s exposure to pressures if average order values...

Read the full narrative on Maplebear (it's free!)

Maplebear's narrative projects $4.4 billion in revenue and $680.5 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $256.5 million earnings increase from the current $424.0 million.

Uncover how Maplebear's forecasts yield a $53.54 fair value, a 8% upside to its current price.

Exploring Other Perspectives

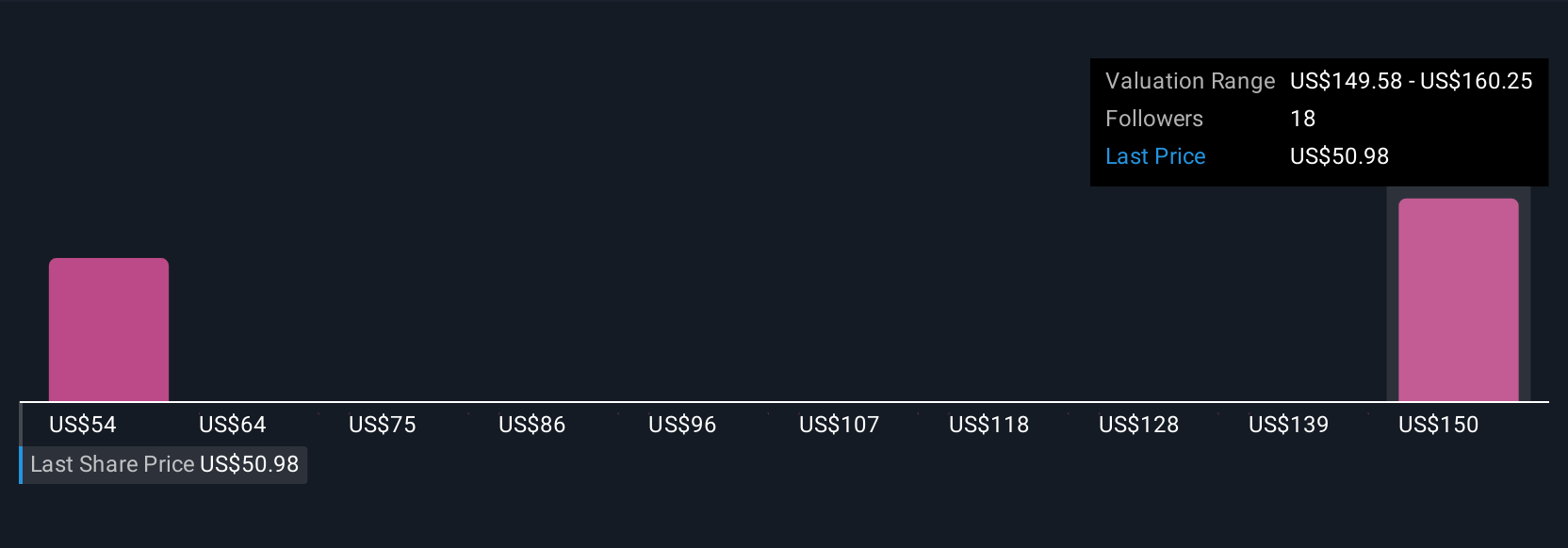

The Simply Wall St Community’s fair value estimates for Maplebear (Instacart) range from US$53.54 to US$65.17, across two analyses. While buyers see upside in diversified ad growth, continuing reliance on food and beverage verticals can weigh on future returns. Explore several perspectives to understand what could influence your outlook.

Explore 2 other fair value estimates on Maplebear - why the stock might be worth just $53.54!

Build Your Own Maplebear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maplebear research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Maplebear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maplebear's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives