- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:ANDE

What Andersons (ANDE)'s New Leadership and Dividend Declaration Means For Shareholders

Reviewed by Simply Wall St

- The Andersons, Inc. declared a fourth quarter 2025 cash dividend of US$0.195 per share, payable on October 22, 2025, and recently announced the appointments of Steven Oakland to its board and Emmanuel Ayuk as executive vice president, general counsel, and corporate secretary.

- These leadership additions bring significant food and agriculture industry expertise and governance experience to Andersons, potentially impacting its future strategic direction and operational oversight.

- We'll explore how adding experienced executives like Steven Oakland to the board may influence Andersons's ongoing transformation and future growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Andersons Investment Narrative Recap

To be a shareholder in Andersons, you need to believe in its ability to grow through investments in renewables, processing efficiency, and gaining new international customers, despite current pressure from volatility in the core agribusiness segment. The latest board and executive appointments are unlikely to materially change the near-term catalyst of ethanol cash flow from recent plant acquisitions, nor do they diminish the near-term risk of margin pressure from commodity cycles or fluctuating grain demand.

Of the recent announcements, the appointment of Steven Oakland to the board stands out given his extensive food and beverage experience. While this move provides fresh industry expertise at the highest level, it does not significantly alter Andersons’s exposure to macroeconomic risks such as grain oversupplies and weak demand in key regions, both of which remain top-of-mind for investors as the industry faces ongoing revenue and earnings pressure.

By contrast, a persistent factor that could catch investors off-guard is just how quickly margin pressure from commodity cycles can affect earnings sustainability if...

Read the full narrative on Andersons (it's free!)

Andersons' outlook points to $13.3 billion in revenue and $186.7 million in earnings by 2028. This assumes 4.8% annual revenue growth and an increase in earnings of $106.1 million from the current $80.6 million.

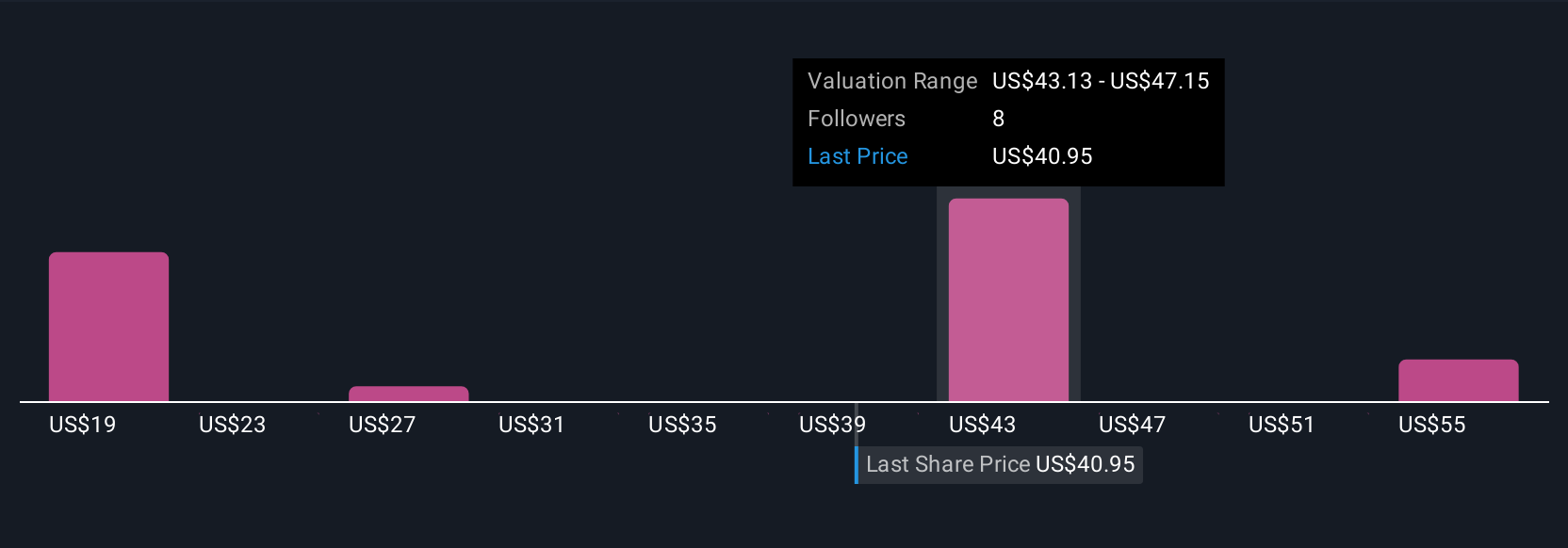

Uncover how Andersons' forecasts yield a $46.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Five independent fair value estimates from the Simply Wall St Community range widely, from US$18.78 to US$59.24 per share. With board-level changes unfolding, many participants are considering Andersons's ability to capture margin upside from regulatory moves in renewables, inviting you to compare multiple viewpoints before forming your own outlook.

Explore 5 other fair value estimates on Andersons - why the stock might be worth as much as 54% more than the current price!

Build Your Own Andersons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Andersons research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Andersons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Andersons' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANDE

Andersons

Operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives