- United States

- /

- Luxury

- /

- NYSE:ZGN

How Accelerating Direct-to-Consumer Growth at Ermenegildo Zegna (ZGN) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Ermenegildo Zegna N.V. recently announced unaudited results for the third quarter and nine months ended September 30, 2025, reporting Q3 total revenues of €398.23 million, slightly higher than the previous year's comparable period, and nine-month revenues of €1.33 billion, down modestly year-over-year.

- A key highlight from the results was a 9.1% organic growth in the direct-to-consumer channel, especially driven by strength in the Americas and EMEA, as well as double-digit growth in the DTC segments of Tom Ford Fashion and Thom Browne.

- We'll examine how the acceleration in direct-to-consumer sales might influence Zegna's long-term revenue and margin outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ermenegildo Zegna Investment Narrative Recap

To be a shareholder in Ermenegildo Zegna, you need to believe in the company’s ability to shift more of its growth into direct-to-consumer channels as wholesale slows, all while managing cost pressures. While the improved Q3 direct-to-consumer growth is encouraging for the brand’s most important short-term catalyst, it does not materially offset the ongoing risk of weaker wholesale performance, especially at Thom Browne, that could weigh on margins. Of recent announcements, the upcoming leadership transition at Thom Browne is especially relevant. The new CEO steps in as the wholesale segment faces headwinds, heightening execution risk during a crucial period when direct-to-consumer gains are needed to counterbalance softness elsewhere and preserve overall profit margins. However, investors should also be aware that cost discipline remains critical, especially as investments in talent and new stores elevate SG&A expenses…

Read the full narrative on Ermenegildo Zegna (it's free!)

Ermenegildo Zegna is projected to reach €2.2 billion in revenue and €127.2 million in earnings by 2028. This outlook assumes annual revenue growth of 3.4% and a €50.1 million increase in earnings from the current €77.1 million.

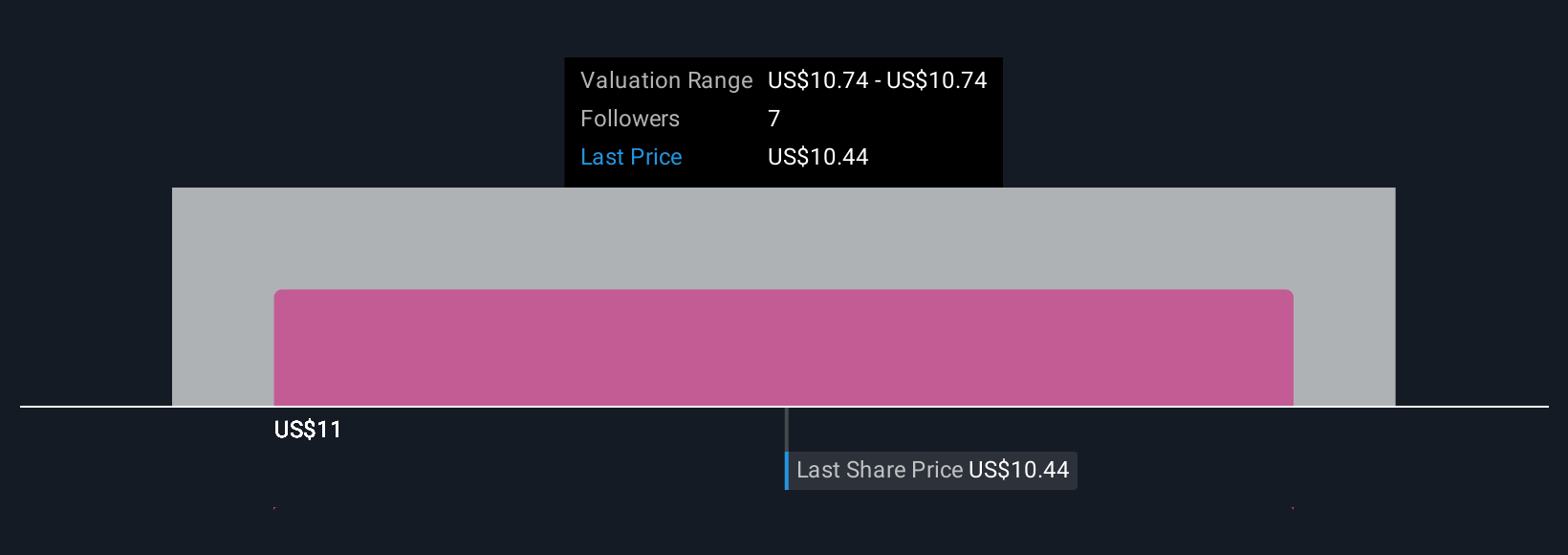

Uncover how Ermenegildo Zegna's forecasts yield a $10.74 fair value, a 3% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community sits at €10.74 per share. Direct-to-consumer momentum stands out, but broader risks like wholesale weakness mean your outlook could look quite different.

Explore another fair value estimate on Ermenegildo Zegna - why the stock might be worth just $10.74!

Build Your Own Ermenegildo Zegna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ermenegildo Zegna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ermenegildo Zegna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ermenegildo Zegna's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ermenegildo Zegna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZGN

Ermenegildo Zegna

Designs, manufactures, markets, and distributes luxury menswear and womenwear, children’s clothing, footwear, leather goods, and other accessories worldwide.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives