- United States

- /

- Leisure

- /

- NYSE:YETI

YETI (YETI): Assessing Valuation as Recent Momentum Draws New Investor Attention

Reviewed by Simply Wall St

YETI Holdings (YETI) has been drawing some renewed attention lately as its stock showed steady gains across the past month. Investors are watching to see if this momentum reflects improving fundamentals or if it is related to something more cyclical.

See our latest analysis for YETI Holdings.

In the past year, YETI Holdings’ share price has trended upward, picking up speed in recent weeks. A strong 14.3% share price return over the past month has contributed to its steady 2024 gains. However, its total shareholder return for the past year is still modest at just over 2%, showing that while momentum may be building now, longer-term holders have experienced a bumpier ride.

If the recent rebound in YETI is sparking your curiosity, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors with a critical question: Is YETI’s recent strength a sign of undervaluation, creating a buying window, or is the market already factoring in all the company’s expected growth ahead?

Most Popular Narrative: Fairly Valued

YETI Holdings’ narrative price target of $40.47 is marginally above its recent close at $41.23. This suggests analysts see the market value as near fair. Investors following the most popular narrative are watching whether growth catalysts can decisively shift this balance in the months ahead.

The company's accelerated international expansion, particularly robust growth and brand engagement in Europe and the rapid ramp-up in Japan and Asia, is unlocking a large revenue opportunity in underpenetrated markets. This is expected to drive sustained double-digit growth internationally and diversify global revenue streams.

What projections are really fueling that price target? Analysts are betting on a narrative of expansion into new markets and innovative products. Get the full story on how these underlying forecasts add up to the “just right” fair value call.

Result: Fair Value of $40.47 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. drinkware challenges and rising competition could still dampen growth and test YETI’s ability to maintain pricing power in the future.

Find out about the key risks to this YETI Holdings narrative.

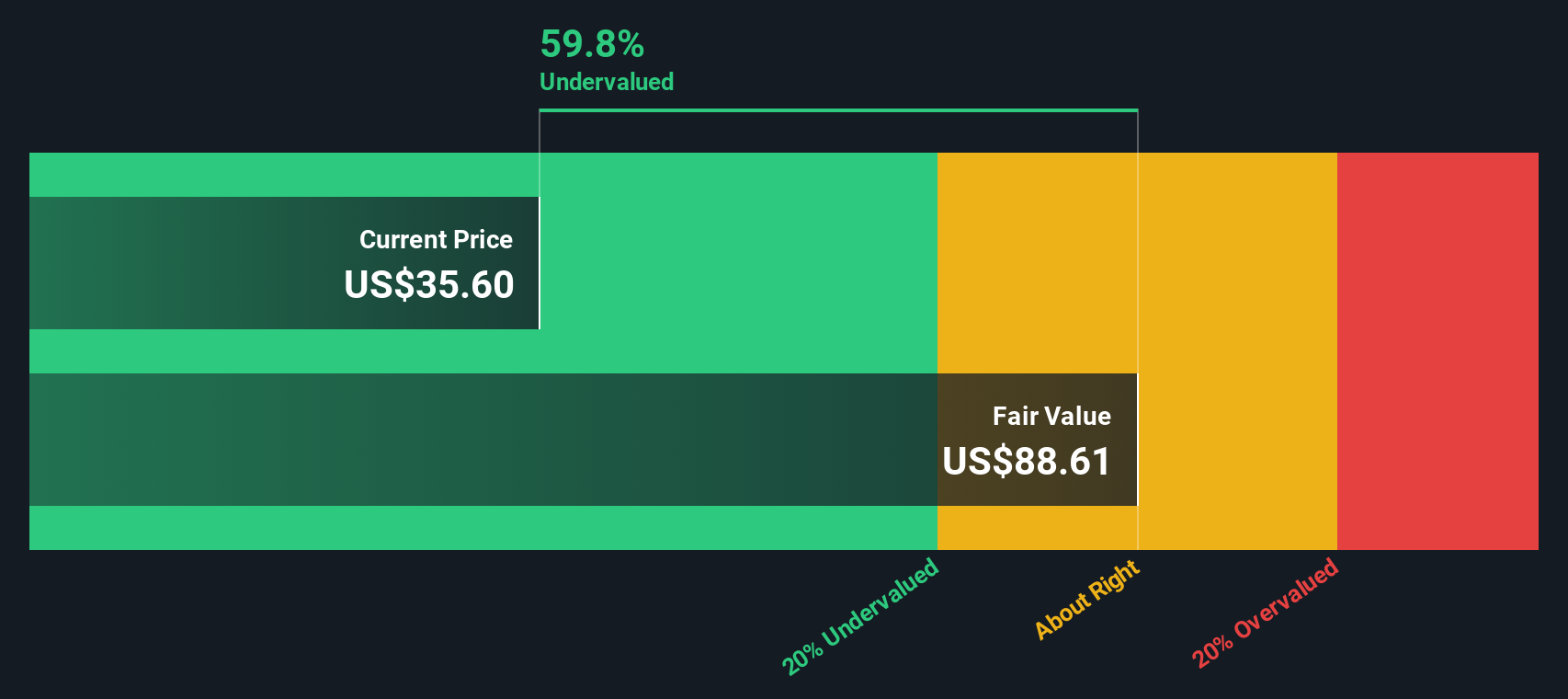

Another View: Looking Through the DCF Lens

While traditional valuation metrics suggest YETI Holdings is priced about right, the SWS DCF model paints a much more optimistic picture. Our DCF estimate pegs fair value at $105.98, which is well above today’s price. If the DCF is correct, is the market overlooking YETI’s long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own YETI Holdings Narrative

If you see the numbers differently or want to dig deeper on your own, assembling a personalized take is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding YETI Holdings.

Looking for More Investment Ideas?

Don’t miss out on stocks that are capturing attention right now. These tailored ideas will help you spot the next opportunity before everyone else does.

- Tap into companies rewarding investors with strong payouts by checking out these 14 dividend stocks with yields > 3% yielding over 3% and see who is making income count.

- Accelerate your search with these 931 undervalued stocks based on cash flows to pinpoint stocks trading below their fair value based on potential cash flow upside.

- Be early in the next tech wave by uncovering these 26 quantum computing stocks at the forefront of quantum computing innovation right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YETI

YETI Holdings

Designs, retails, and distributes outdoor products under the YETI brand name.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success