- United States

- /

- Luxury

- /

- NYSE:WWW

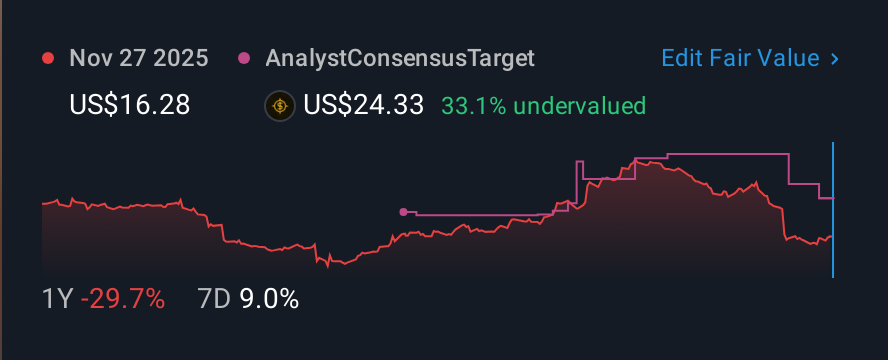

Subdued Growth No Barrier To Wolverine World Wide, Inc. (NYSE:WWW) With Shares Advancing 38%

Wolverine World Wide, Inc. (NYSE:WWW) shares have continued their recent momentum with a 38% gain in the last month alone. The annual gain comes to 112% following the latest surge, making investors sit up and take notice.

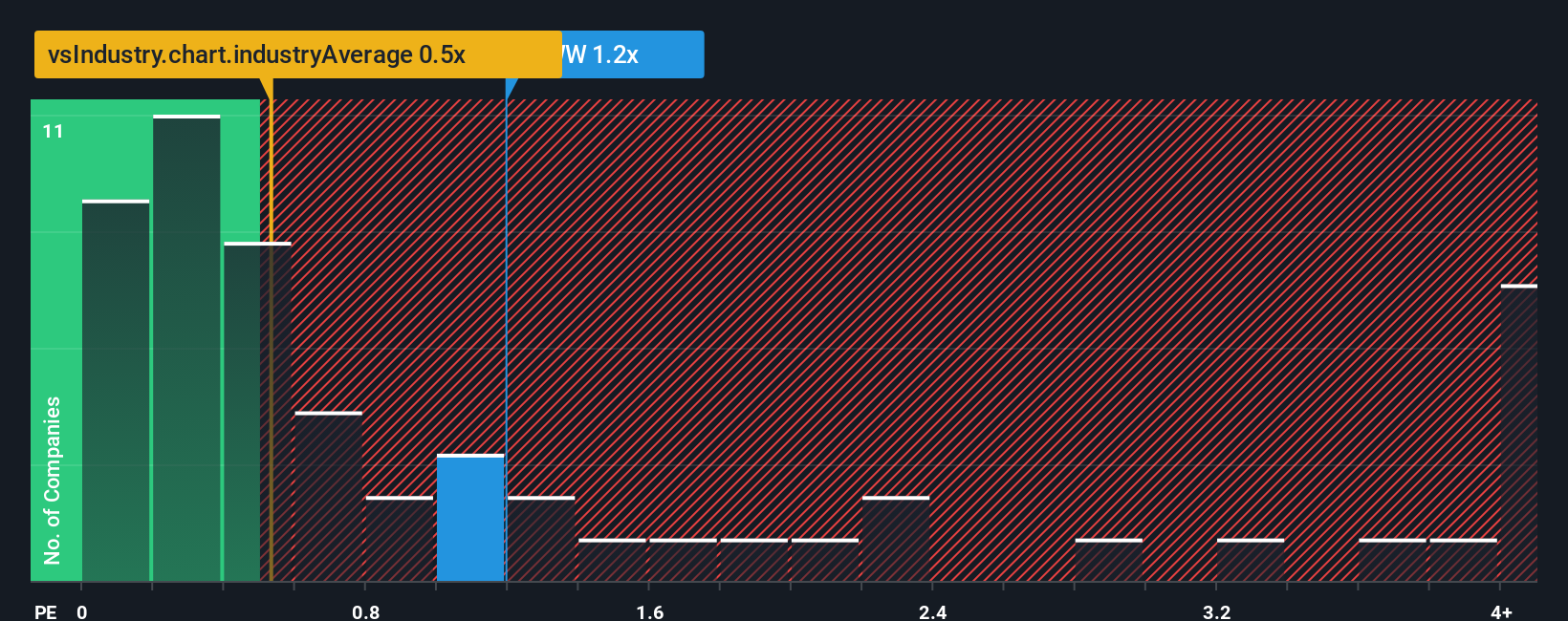

Following the firm bounce in price, you could be forgiven for thinking Wolverine World Wide is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in the United States' Luxury industry have P/S ratios below 0.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Wolverine World Wide

How Has Wolverine World Wide Performed Recently?

Wolverine World Wide could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wolverine World Wide will help you uncover what's on the horizon.How Is Wolverine World Wide's Revenue Growth Trending?

In order to justify its P/S ratio, Wolverine World Wide would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 2.9% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 30% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 5.7% as estimated by the eight analysts watching the company. With the industry predicted to deliver 4.5% growth , the company is positioned for a comparable revenue result.

In light of this, it's curious that Wolverine World Wide's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Wolverine World Wide's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Wolverine World Wide's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Wolverine World Wide has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Wolverine World Wide, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success