- United States

- /

- Consumer Durables

- /

- NYSE:WHR

Will Leadership Changes and CFO Appointment Alter Whirlpool's (WHR) Path to Margin Improvement?

Reviewed by Sasha Jovanovic

- Whirlpool Corporation recently announced significant executive leadership changes, including the appointment of Roxanne Warner as Chief Financial Officer and new roles for key executives, with transitions effective January 1, 2026.

- This reshaping of the senior leadership team signals a realignment of Whirlpool's management and operational structure at a time of ongoing business transformation and portfolio adjustments.

- We'll now examine how recent leadership transitions may influence Whirlpool's investment narrative and outlook for structural margin improvement.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Whirlpool Investment Narrative Recap

To be a Whirlpool shareholder today, you need to believe in the company’s ability to reposition its mature business through ongoing restructuring and operational improvements, while navigating challenges like slow growth in core markets and margin pressure from global competition. The recent M&A discussions regarding a potential sale of Whirlpool’s stake in its Indian subsidiary appear unlikely to materially impact the most significant near-term catalysts, namely margin recovery initiatives, or the biggest risks tied to muted demand in North America and Europe.

Among the latest corporate updates, the advanced negotiations to sell a substantial stake in Whirlpool of India Limited stand out, as this could impact future international contributions and provide incremental capital flexibility. While meaningful for Whirlpool's broader portfolio strategy, this announcement does not directly mitigate the immediate risks of competitive pressure and persistent headwinds in the company’s largest, most mature geographic segments.

But rather than reducing exposure, investors should be aware of the ongoing risk from Whirlpool’s heavy dependence on slow-growth North American and European markets, especially as ...

Read the full narrative on Whirlpool (it's free!)

Whirlpool's outlook suggests $15.8 billion in revenue and $741.4 million in earnings by 2028. This scenario assumes a -0.6% annual revenue decline and a $887.4 million increase in earnings from the current -$146.0 million.

Uncover how Whirlpool's forecasts yield a $86.78 fair value, a 23% upside to its current price.

Exploring Other Perspectives

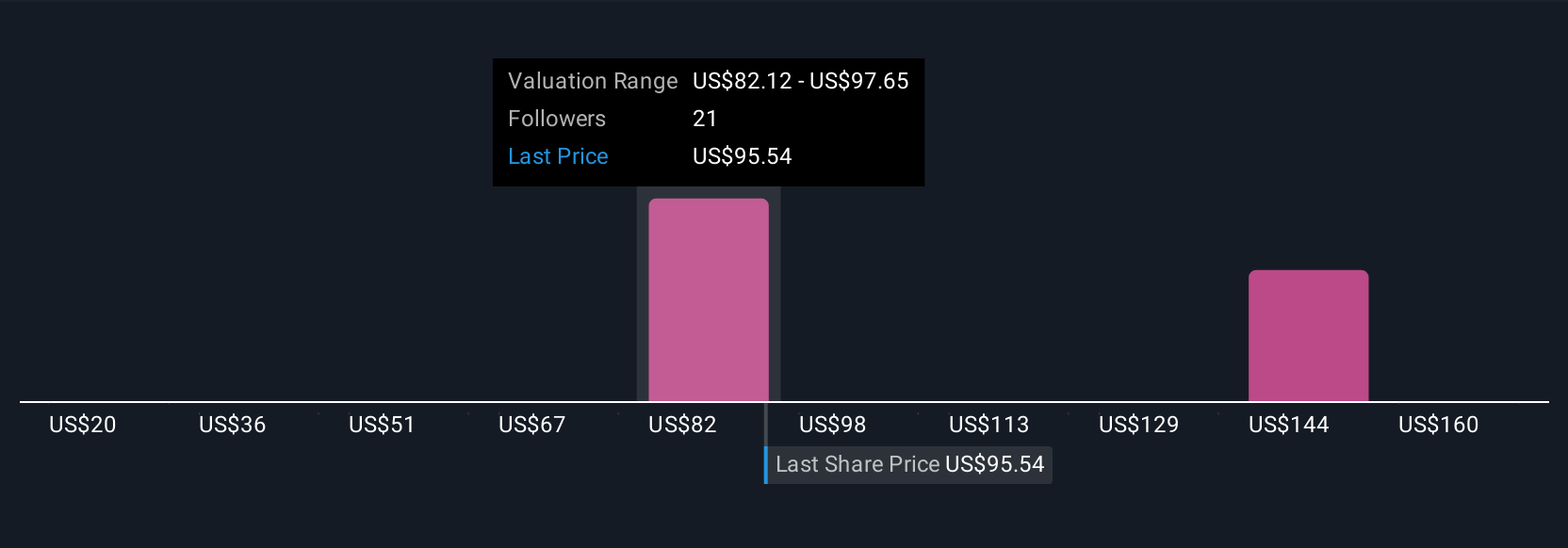

Five individual fair value estimates from the Simply Wall St Community span from US$86.78 to US$175.29 per share. Yet, ongoing margin challenges in saturated Western markets weigh heavily on near-term performance, underscoring why viewpoints on Whirlpool’s potential can vary so widely.

Explore 5 other fair value estimates on Whirlpool - why the stock might be worth over 2x more than the current price!

Build Your Own Whirlpool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Whirlpool research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Whirlpool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Whirlpool's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHR

Whirlpool

Manufactures and markets home appliances and related products and services in the North America, Latin America, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives