- United States

- /

- Consumer Durables

- /

- NYSE:WHR

Whirlpool (WHR): Five-Year Losses Deepen as Slow Revenue Growth Sets Background for Earnings Season

Reviewed by Simply Wall St

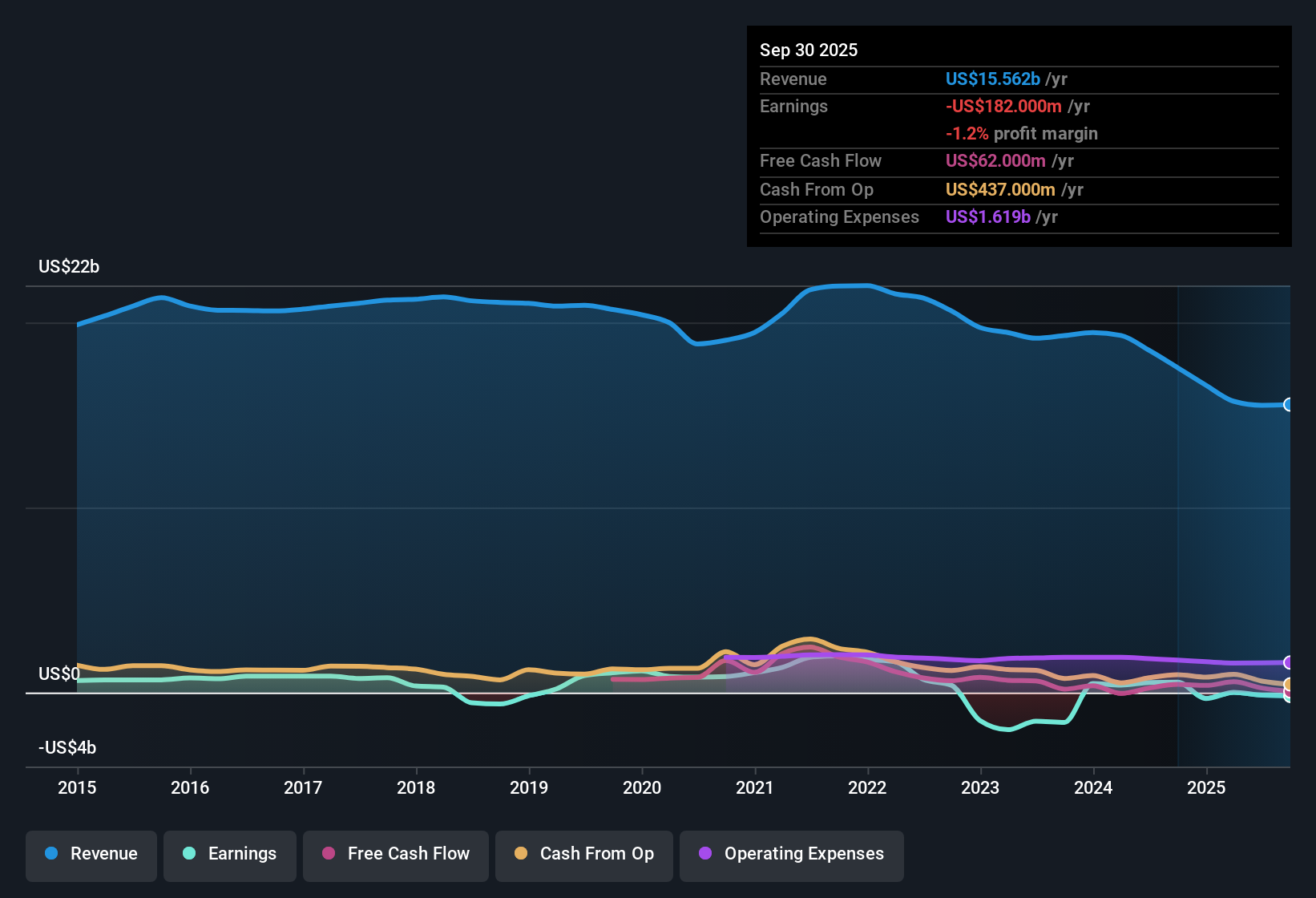

Whirlpool (WHR) remains unprofitable, with net losses accelerating at a 37.5% annual pace over the past five years. Looking ahead, analysts expect revenue to grow at just 1.2% per year, lagging the broader US market’s 10.1% annual growth rate. Still, earnings are forecast to flip positive within the next three years, with projected annual EPS growth of 80.19% during that period. Investor optimism will likely hinge on the company’s valuation support and the prospect of significant profit growth, even as risks remain elevated.

See our full analysis for Whirlpool.Next, we will see how these numbers compare to the narratives that drive expectations in the market, highlighting where assumptions could be confirmed or upended.

See what the community is saying about Whirlpool

Profit Margins Poised for a Turnaround

- Analysts expect profit margins to rise sharply from -0.9% today to 4.7% in three years, signaling a dramatic shift from recurring losses to meaningful profitability over a short period.

- According to the analysts' consensus view, Whirlpool's heavy investment in new premium appliances and smart tech, coupled with a strong push in global markets, is set to increase operating margins as consumer preferences evolve and supply chains improve.

- Consensus highlights that restructuring and cost controls are designed to deliver a more resilient margin structure as volume stabilizes. This should support these higher margin forecasts.

- However, the consensus also tempers expectations as weak sales in mature markets and competitive pricing could prevent full margin recovery if growth initiatives do not drive sustained demand.

- Check how analyst expectations for turnaround align with market realities in the full consensus narrative. 📊 Read the full Whirlpool Consensus Narrative.

Dividend Cuts Reflect Lingering Financial Strain

- Whirlpool’s reduction of its annual dividend to pre-COVID levels is the strongest signal yet that management expects it will take several years before enough cash flow returns to support more generous payouts.

- Analysts' consensus view draws attention to the twin risks: ongoing stagnation in mature markets and macro headwinds, such as high rates and slower home sales, which force Whirlpool to divert cash from dividends toward operational stability instead.

- Bears argue that persistent low consumer demand and currency risk in Latin America could further squeeze margins, leaving less flexibility to restore dividends even as profits recover on paper.

- The consensus underscores that, while restructuring may eventually boost free cash flow, the short-term sacrifice in shareholder returns will not be quickly reversed.

Valuation Remains a Key Bright Spot

- Whirlpool’s shares trade at a Price-To-Sales Ratio of 0.3x, much lower than the US Consumer Durables industry average of 0.6x and peer average of 1.1x. The shares also sit well below the DCF fair value of $115.69 at a current share price of $77.58.

- Analysts' consensus narrative suggests that this discount is seen as justified given recent earnings losses and muted sales guidance, but also highlights that if profit margins rebound and cash flow improves as forecast, the upside to fair value could be significant.

- A gap of over $38 per share between the DCF fair value and current price signals strong valuation support, provided that management delivers on growth and efficiency goals.

- Still, consensus cautions that without a sustained lift in revenue and profitability, Whirlpool risks being a value trap trading at perpetual discounts despite appearing cheap on paper.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Whirlpool on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers that others might miss? Put your perspective to work and build your own narrative in just a few minutes. Do it your way.

A great starting point for your Whirlpool research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Whirlpool’s recent dividend cuts, subdued growth, and lingering profitability challenges highlight concerns about sustained cash flow and financial resilience.

If dependable income matters in your portfolio, seek out reliable yield and lower payout risk by screening for these 2018 dividend stocks with yields > 3% now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHR

Whirlpool

Manufactures and markets home appliances and related products and services in the North America, Latin America, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives