- United States

- /

- Consumer Durables

- /

- NYSE:WHR

Is There Opportunity in Whirlpool After Recent Stock Declines and Recovery Signs?

Reviewed by Bailey Pemberton

Thinking about adding Whirlpool to your portfolio or holding tight to your shares? You’re not alone. Many investors are reexamining their moves after Whirlpool’s latest price shifts, and it’s smart to look at what the numbers and news are telling us. With a current price of $73.66 and a one-week return of 1.4%, there’s evidence of a little recovery, even though the stock is still down nearly 5% over the past month. Year to date, Whirlpool’s story is similar to many consumer goods giants, with a steep decline of 36%. The long-term view also shows a sustained challenge, with shares down over 50% in the last five years.

What is behind these moves? Recent headlines point to shifting consumer demand and ongoing supply chain adjustments across the appliance industry. While the big swings may seem dramatic, they also raise questions about whether investors are now pricing Whirlpool with more caution, or if an opportunity may be developing as the company adapts to a new environment. These trends matter when you are deciding if Whirlpool fits your strategy, especially as signs point to evolving risks, but also to possible upside potential as industry cycles shift.

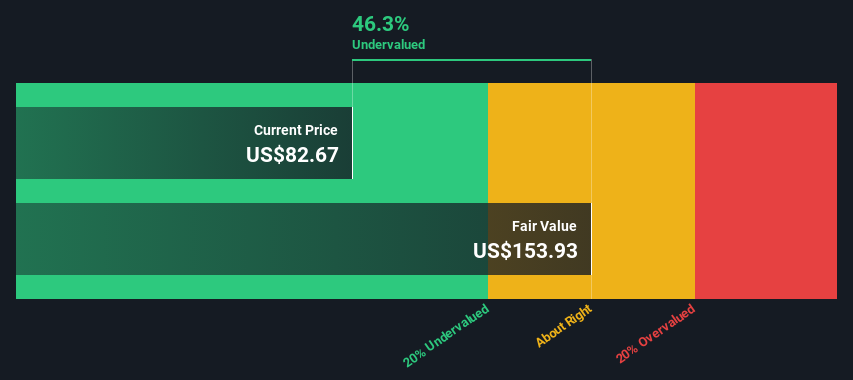

With all this in mind, Whirlpool’s valuation deserves a closer look. The company currently scores a 5 out of 6 on our undervaluation checks, signaling it is overlooked in several key areas. But how should you decide what the stock is worth, and is the market missing something significant? Up next, we will examine the usual valuation measures. Then, we will explore an even deeper way to look at what is truly driving value for Whirlpool investors.

Why Whirlpool is lagging behind its peers

Approach 1: Whirlpool Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future free cash flows and then discounting those values back to today using a required rate of return. This approach helps investors see what the future dollars generated by Whirlpool are worth right now in $.

According to the latest numbers, Whirlpool’s most recent Free Cash Flow sits at about $178 million. Analysts have provided projections out to 2027, estimating that future FCF could climb as high as $469 million by then. For further years, projections are extrapolated using historical growth trends, showing steady increases through 2035. However, the farther out the estimates, the more assumptions are involved.

After discounting all those estimated future cash flows, the intrinsic value calculated for Whirlpool lands at $113 per share. With the current price at $73.66, the DCF analysis implies the stock trades at a sizable 34.8% discount to fair value. This suggests the market is pricing in a lot of caution or possibly missing a hidden value driver in Whirlpool’s future cash potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Whirlpool is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

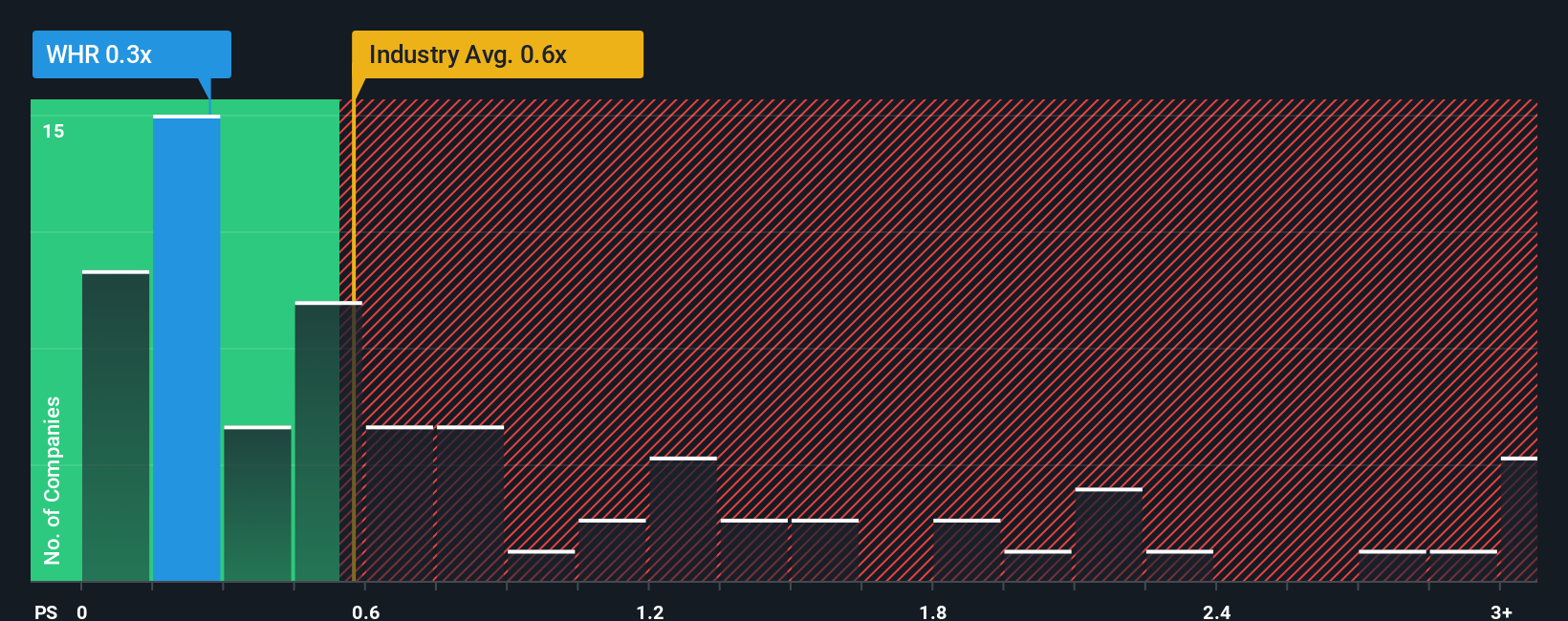

Approach 2: Whirlpool Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation tool for companies like Whirlpool, especially when profits are under pressure or earnings are volatile. It provides a clear picture of how much investors are willing to pay for each dollar of a company’s sales, giving a grounded sense of value even when traditional earnings metrics are less reliable.

Whirlpool’s current P/S ratio sits at 0.27x, meaning investors are paying just 27 cents for every dollar of Whirlpool’s sales. For context, the average P/S ratio across the Consumer Durables industry is 0.62x and the company's direct peers average 1.11x. This positions Whirlpool’s sales valuation well below both its closest rivals and typical sector norms. However, simply comparing ratios can be misleading without factoring in Whirlpool’s unique strengths, risks, growth potential, and profit margins.

This is where Simply Wall St’s Fair Ratio comes in. Unlike basic industry or peer comparisons, the Fair Ratio incorporates elements such as expected growth, company size, profitability, and overall business risk. This offers a more complete benchmark for what Whirlpool’s P/S multiple should reasonably be. The Fair Ratio for Whirlpool is 0.60x. Comparing this to Whirlpool’s present P/S ratio of 0.27x shows the market is pricing the stock below what would be fair based on its fundamentals, which points to undervaluation at current levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

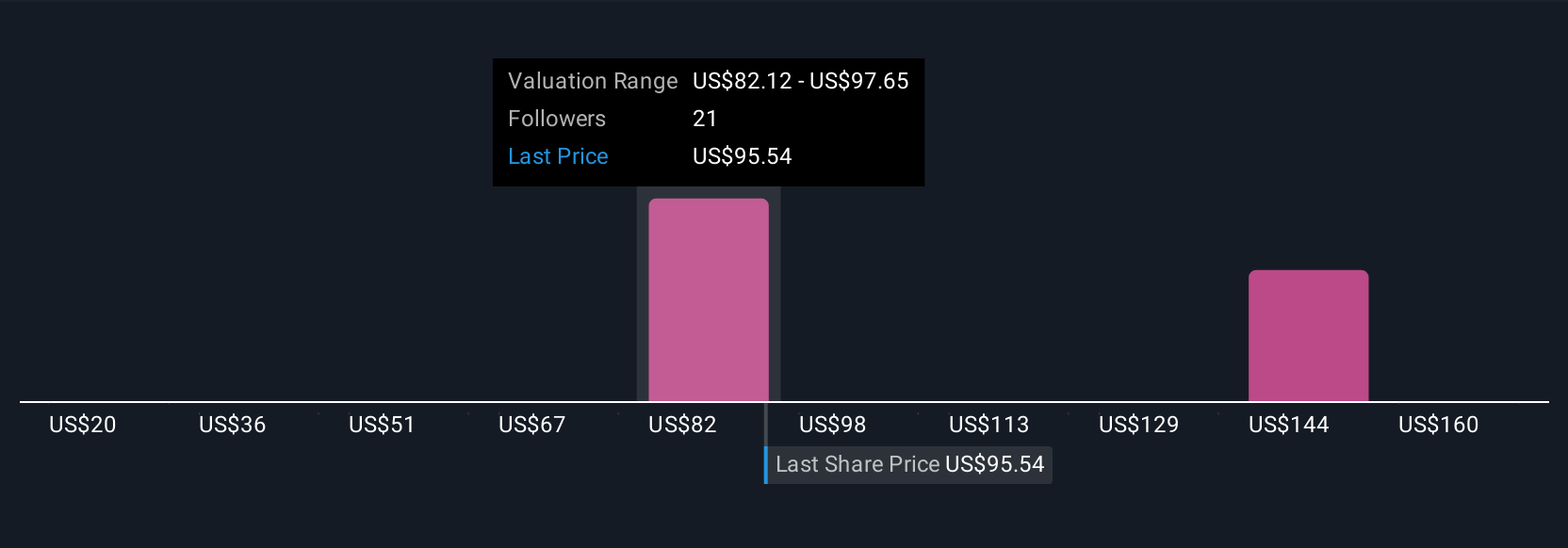

Upgrade Your Decision Making: Choose your Whirlpool Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story and perspective about a company, connecting the numbers you expect, such as future revenue, earnings, and profit margins, to a forecast and, ultimately, to what you believe is a fair value for the stock. Narratives make it easier to link Whirlpool’s business story, the catalysts and risks you see, and your personal expectations together so your investment decision is driven by more than just a spreadsheet or a single metric.

Narratives on Simply Wall St’s Community page are accessible tools used by millions of investors, empowering you to write or follow forecasts that match your own outlook. This approach helps you decide when to buy or sell by comparing your fair value estimate to Whirlpool’s live market price. Even better, Narratives update dynamically when fresh news, earnings, or outlooks are announced so your perspective can adapt as the facts change.

For example, one Narrative for Whirlpool sees product innovation, premium appliances, and international expansion leading to stronger earnings and a fair value as high as $145 per share. Another Narrative, focused on risks like competition and slow U.S. demand, sets fair value closer to $63 per share. Which outlook fits your belief? Narratives let you decide.

Do you think there's more to the story for Whirlpool? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHR

Whirlpool

Manufactures and markets home appliances and related products and services in the North America, Latin America, Asia, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives