- United States

- /

- Luxury

- /

- NasdaqCM:VNCE

Health Check: How Prudently Does Vince Holding (NYSE:VNCE) Use Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Vince Holding Corp. (NYSE:VNCE) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Vince Holding

What Is Vince Holding's Net Debt?

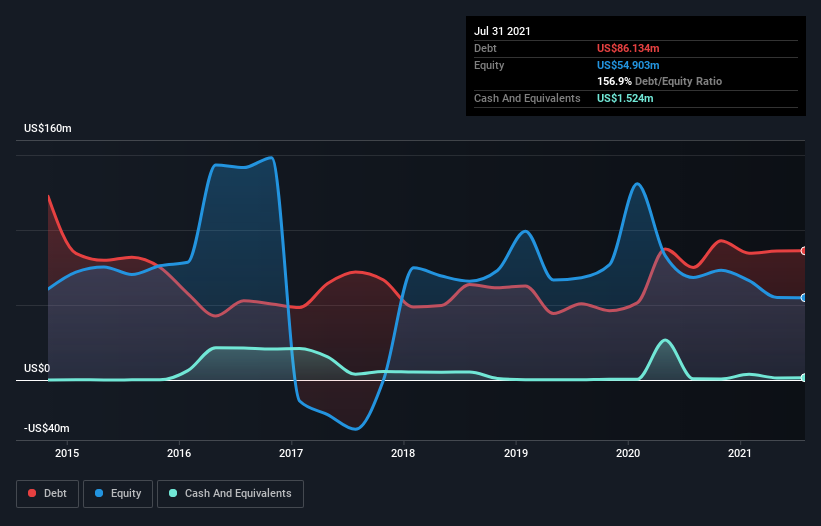

As you can see below, at the end of July 2021, Vince Holding had US$86.1m of debt, up from US$75.0m a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

A Look At Vince Holding's Liabilities

Zooming in on the latest balance sheet data, we can see that Vince Holding had liabilities of US$94.1m due within 12 months and liabilities of US$182.2m due beyond that. Offsetting these obligations, it had cash of US$1.52m as well as receivables valued at US$31.2m due within 12 months. So it has liabilities totalling US$243.6m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$92.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Vince Holding would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Vince Holding can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Vince Holding's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Vince Holding had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at US$2.1m. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it vaporized US$7.9m in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is risky, like walking through a dirty dog park with a mask on. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Vince Holding (including 1 which is a bit concerning) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Vince Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:VNCE

Vince Holding

Provides luxury apparel and accessories in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives