- United States

- /

- Luxury

- /

- NYSE:VFC

Why V.F (VFC) Is Up 8.3% After Strong Earnings and Renewed Fed Rate Cut Hopes

Reviewed by Sasha Jovanovic

- Earlier this week, VF Corporation released its second quarter fiscal 2026 earnings, reporting strong operational performance, while comments from Federal Reserve officials renewed hopes for an upcoming rate cut.

- This combination of solid company results and more accommodative monetary policy signals could have significant implications for consumer discretionary firms with global reach, such as VF.

- We'll explore how VF's robust quarterly earnings could reinforce its investment narrative around brand recovery and profit margin improvements.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

V.F Investment Narrative Recap

To be a shareholder in VF Corporation right now means believing in the company’s ability to execute a turnaround, drive brand recovery, and improve profit margins, particularly as monetary policy may soon become more supportive. The recent combination of strong Q2 results and renewed rate cut hopes could positively impact the short-term catalyst of stabilizing core brands, but persistent risks remain, especially if execution on premiumization and innovation falls short or debt levels stay elevated.

The Q2 earnings announcement is especially relevant, highlighting a meaningful increase in net income to US$189.77 million from US$52.18 million last year, despite ongoing revenue pressures. This improved profitability stands out as a key signal for investors focused on margin recovery, though headwinds tied to brand revitalization efforts, like those at Vans, continue to be a central concern.

However, potential margin improvements could be tested further if VF struggles to regain market share at its largest brand…

Read the full narrative on V.F (it's free!)

V.F's narrative projects $10.3 billion in revenue and $571.3 million in earnings by 2028. This requires 2.6% yearly revenue growth and a $466.4 million increase in earnings from the current $104.9 million level.

Uncover how V.F's forecasts yield a $16.00 fair value, in line with its current price.

Exploring Other Perspectives

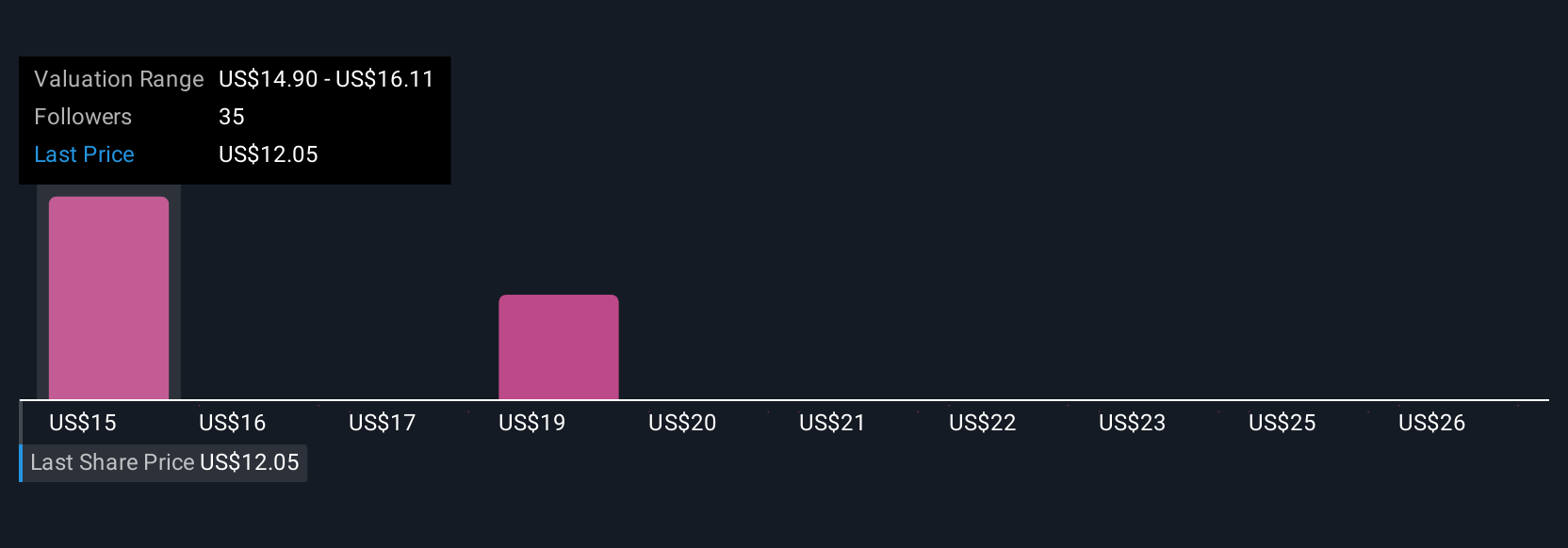

Fair value estimates from 8 Simply Wall St Community members range from US$10 to US$27.85 per share. While opinions differ, elevated debt levels continue to limit VF’s financial flexibility, shaping the outlook for future investment and growth.

Explore 8 other fair value estimates on V.F - why the stock might be worth 38% less than the current price!

Build Your Own V.F Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free V.F research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V.F's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives