- United States

- /

- Luxury

- /

- NYSE:VFC

V.F Corp (VFC): Evaluating Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for V.F.

Despite a strong rebound earlier this quarter, V.F's momentum has cooled off as the initial optimism seems to have faded. The stock's 90-day share price return of 24.2% stands in sharp contrast to its 32.5% year-to-date slide and a one-year total shareholder return of -33.2%. Recent news has only reinforced the narrative that investors remain divided on the company's long-term prospects amid shifting consumer trends and broader economic headwinds.

If you want to keep your investing radar sharp, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at over a 22% discount to their estimated intrinsic value, but recent gains already reflecting some optimism, the real question is whether V.F is a bargain or if the market has fully accounted for its recovery potential.

Most Popular Narrative: 7.6% Undervalued

V.F’s most closely watched narrative assigns a fair value of $15.74, reflecting a 7.6% premium to the last close of $14.55. The market’s recent turn hints at more upside potential according to this widely referenced outlook.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement. This approach is expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

There’s more to this price target than meets the eye. The ambitions in this narrative are built on bold assumptions for future profits, margin expansion, and revenue growth. Want to see which projections could propel V.F back into the spotlight? Uncover the full story behind these numbers in the complete narrative.

Result: Fair Value of $15.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent struggles at Vans and uncertainty around execution of turnaround plans could quickly challenge the current optimism analysts hold for V.F's comeback story.

Find out about the key risks to this V.F narrative.

Another View: What Do the Multiples Say?

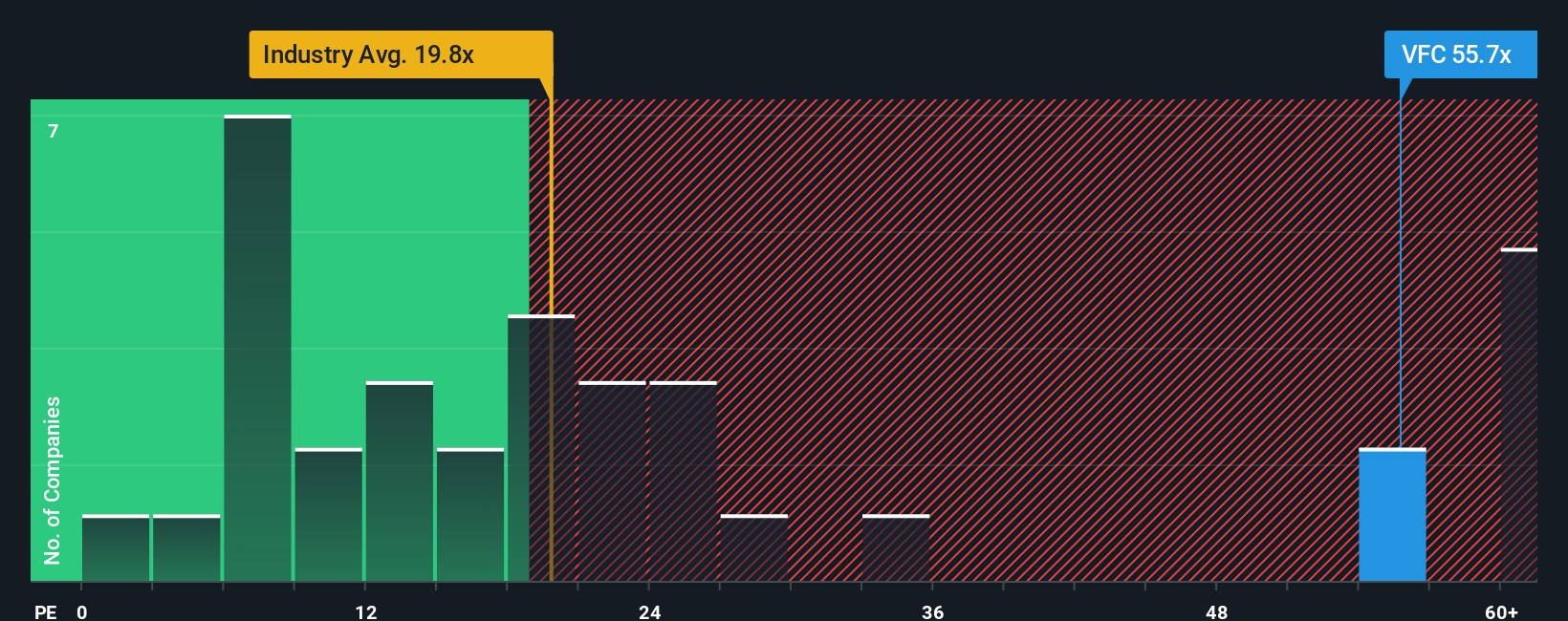

Now, let’s look at how V.F stacks up using its price-to-earnings ratio. At 61.7x, this is much steeper than both the US Luxury industry average of 19.9x and the peer average of 13.5x, and it even tops its own fair ratio estimate of 30.7x. This big gap suggests the market has baked a lot of recovery hopes into the price, which leaves little room for disappointment. Could the shares be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own V.F Narrative

If you'd rather chart your own course or dig into the numbers firsthand, you can craft a custom narrative in just a few minutes, so why not Do it your way

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Every smart investor keeps their horizons wide. Right now, you can seize an edge by targeting unique opportunities the market may be overlooking. Let Simply Wall Street help you make your next big move.

- Capture the potential of emerging tech by tracking these 26 AI penny stocks, which are shaking up artificial intelligence and automation trends.

- Unlock value with these 848 undervalued stocks based on cash flows that show strong fundamentals yet fly under Wall Street’s radar.

- Boost your income strategy by targeting stability and high yields among these 21 dividend stocks with yields > 3% that pay more than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives