- United States

- /

- Luxury

- /

- NYSE:VFC

Is V.F. (VFC) Balancing Shareholder Returns and Transformation Amid a Softer Outlook?

Reviewed by Simply Wall St

- On July 30, 2025, V.F. Corporation declared a quarterly dividend of US$0.09 per share payable on September 18 to shareholders of record as of September 10, while also issuing earnings guidance for the second quarter of 2026 that anticipates a 2% to 4% revenue decline compared to last year.

- This combination of continued dividend payouts and a cautious revenue outlook signals management’s effort to balance shareholder returns with expectations of softer near-term business conditions.

- We’ll examine how V.F.'s recent revenue guidance update may shape its operational transformation and growth narrative for investors.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

V.F Investment Narrative Recap

To be a V.F. Corporation shareholder today, you must believe in the company’s long-term operational transformation and margin improvement initiatives despite near-term headwinds. The recent guidance of a 2% to 4% revenue decline for Q2 2026 reinforces that softer demand and slow turnaround at Vans remain the biggest risk, while cost-cutting progress and the scale of its brands continue to be the most important catalyst. This latest update does not appear to materially alter either the primary risk or growth driver for the stock at present.

Among the company’s recent developments, the reaffirmation of a US$0.09 quarterly dividend is especially relevant against a backdrop of cautious revenue projections and ongoing cost-saving efforts. Consistent dividend payments highlight management’s focus on maintaining shareholder returns even as short-term revenue visibility remains challenged, supporting the longer-term story of achieving sustainable profitability.

Yet, amid efforts to reward shareholders, investors should also be aware that sharp execution risk on the turnaround at Vans, particularly in Asia Pacific markets, could still impact…

Read the full narrative on V.F (it's free!)

V.F's outlook anticipates $10.1 billion in revenue and $655.9 million in earnings by 2028. This projection relies on 2.2% annual revenue growth and a rise in earnings of approximately $586.6 million from the current $69.3 million.

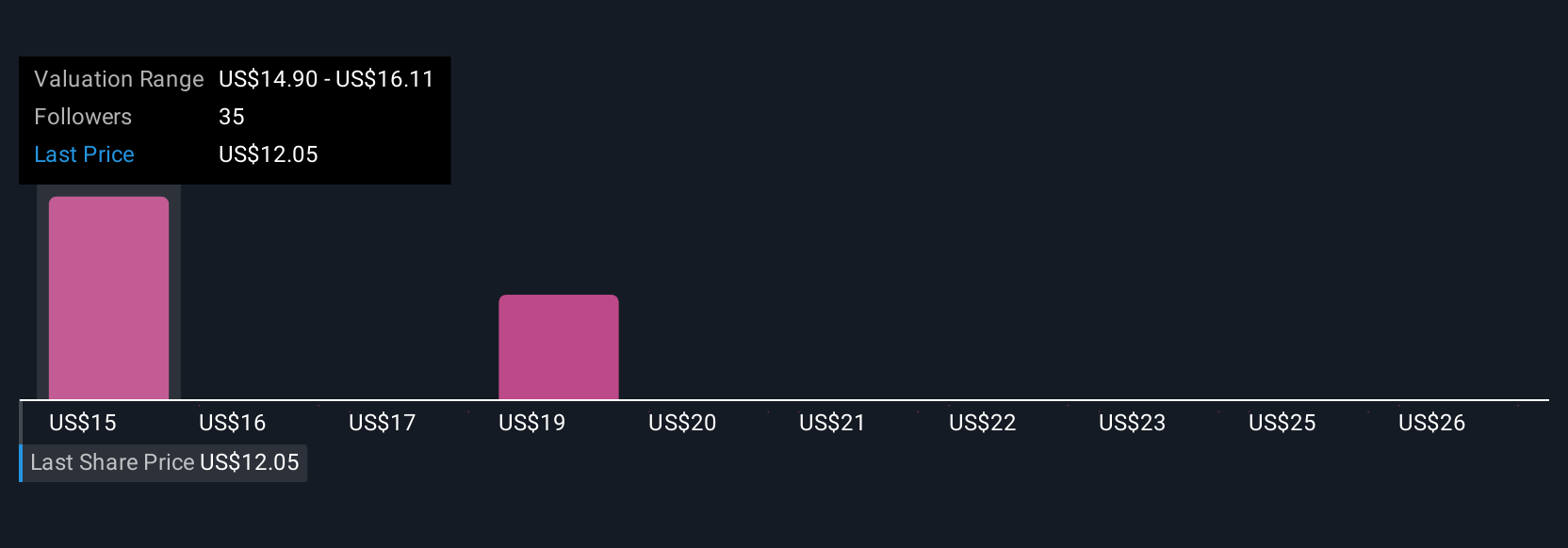

Uncover how V.F's forecasts yield a $14.90 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Six private investors from the Simply Wall St Community placed fair value for V.F. between US$14.33 and US$27.06 per share. Revenue headwinds and the complexity of brand turnarounds mean your outlook could look very different from others, explore the full picture here.

Explore 6 other fair value estimates on V.F - why the stock might be worth over 2x more than the current price!

Build Your Own V.F Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free V.F research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V.F's overall financial health at a glance.

No Opportunity In V.F?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives