- United States

- /

- Luxury

- /

- NYSE:VFC

Has V.F Turned a Corner After Recent 24.6% Share Price Rally?

Reviewed by Bailey Pemberton

- Ever wondered whether V.F’s shares might finally be a bargain, or if there’s more pain ahead? You’re in exactly the right place to get the real story on the company’s current value.

- After a rocky stretch this year, V.F stock jumped 8.0% over the last week and 24.6% in the past month, but is still down 18.8% year-to-date and 11.6% over the last year.

- Investors have been reacting to V.F’s recent strategic updates and restructuring moves, which have sparked both optimism and debate about the company’s turnaround potential. Headlines have highlighted management’s efforts to cut costs and refocus on core brands, a narrative that’s grabbed Wall Street’s attention.

- Despite the buzz, V.F scores just 1 out of 6 on our standard valuation checks. This suggests there is a lot more to investigate. Up next, let’s look at those traditional valuation methods, plus stick around for an even sharper way to spot value bargains that most investors miss.

V.F scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: V.F Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is really worth today by projecting its future cash flows and discounting those amounts back to the present. This approach focuses on what V.F could generate in actual cash for shareholders, making it one of the most widely used valuation methods for long-term investors.

Currently, V.F’s Free Cash Flow over the last twelve months stands at $208 million. Analyst estimates extend five years, with further projections continuing to 2035 using assumptions provided by Simply Wall St. According to these forecasts, V.F’s Free Cash Flow is projected to rise to approximately $679 million by 2030. This outlook reflects both analyst consensus and reasonable extrapolations, providing a view of improving underlying performance.

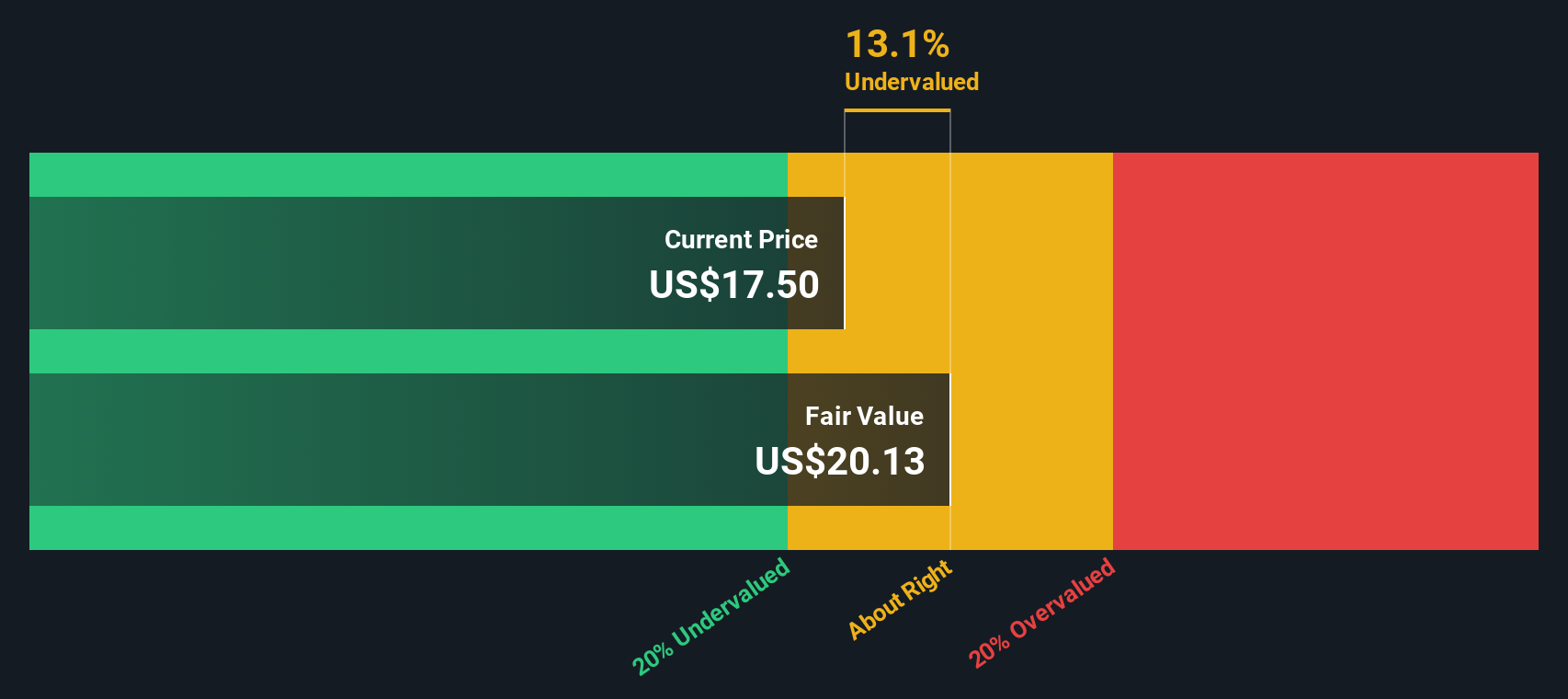

The result of this analysis is a DCF-based intrinsic value of $20.13 per share. With V.F’s share price trading about 13.1% below this estimate, the model indicates the stock is undervalued. In other words, investors buying today receive an implied discount based on conservative cash flow assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests V.F is undervalued by 13.1%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: V.F Price vs Earnings

The Price-to-Earnings (PE) ratio is often the primary valuation tool for analyzing profitable companies like V.F, as it directly relates the company's share price to its actual earnings. The PE ratio helps investors gauge how much they are paying for each dollar of earnings. Higher ratios often reflect higher growth expectations or lower risk profiles, while a lower PE can indicate either undervaluation or higher perceived risk.

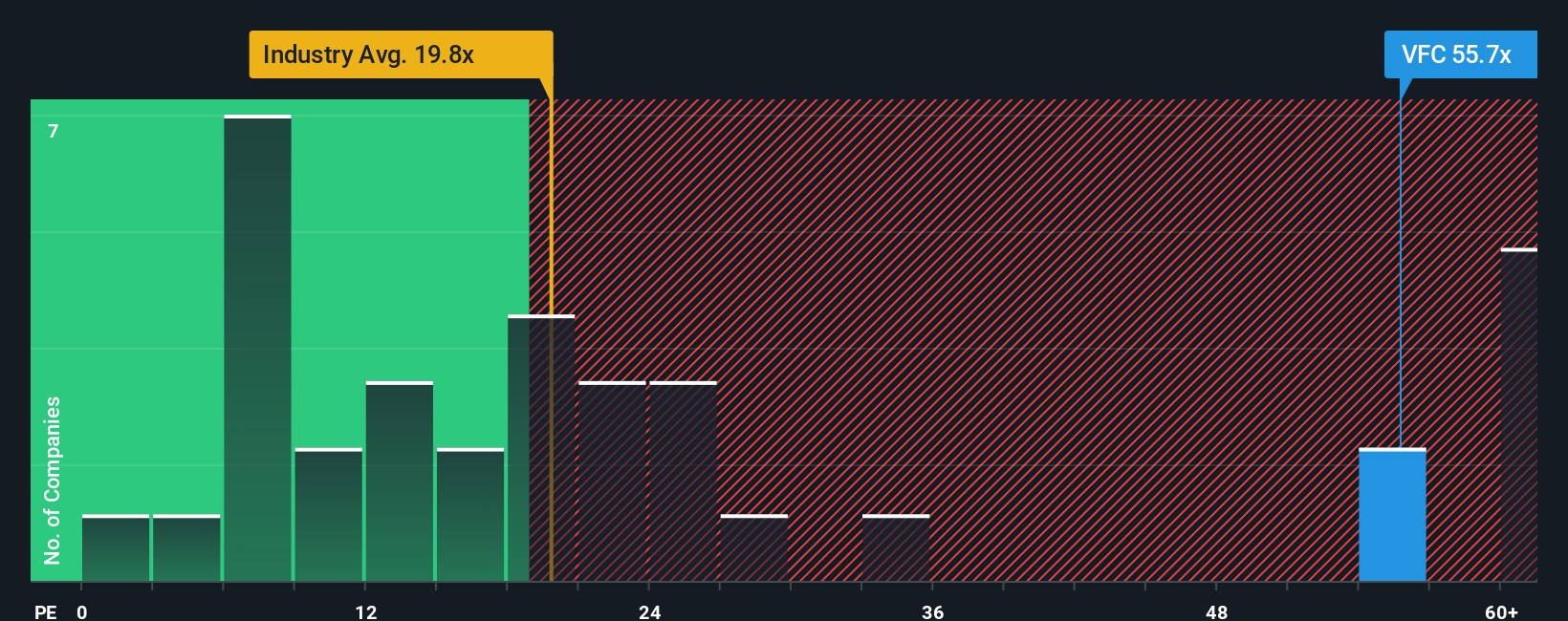

Currently, V.F trades at a PE ratio of 74.2x. This figure is well above the luxury industry average of 20.0x and also surpasses the average for its closest peers at 14.9x. At first glance, this may suggest that V.F is either priced for outsized growth or facing unique profitability challenges that distort the current ratio.

To account for differences in growth potential, risk, profit margins, and other company-specific factors, Simply Wall St calculates a proprietary “Fair Ratio,” which for V.F is 26.5x. Unlike simple peer or industry comparisons, the Fair Ratio provides a more tailored benchmark, reflecting what would be expected for a company with V.F’s specific characteristics, performance, and market position.

Comparing V.F’s current PE of 74.2x to its Fair Ratio of 26.5x indicates the stock is significantly overvalued based on its actual earnings potential and risk profile. While benchmarks are useful, this more nuanced view highlights that the current price reflects a premium that is difficult to justify on fundamentals alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your V.F Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce Narratives. A Narrative is your opportunity to connect the story you see in a company, such as V.F’s strategy, turnaround potential, and brand performance, with the numbers that matter, like fair value, future revenue, earnings, and margins. With Narratives, you simply state your outlook and see how your assumptions impact V.F’s estimated value, giving your investment decisions a personal context that goes beyond traditional ratios or analyst forecasts.

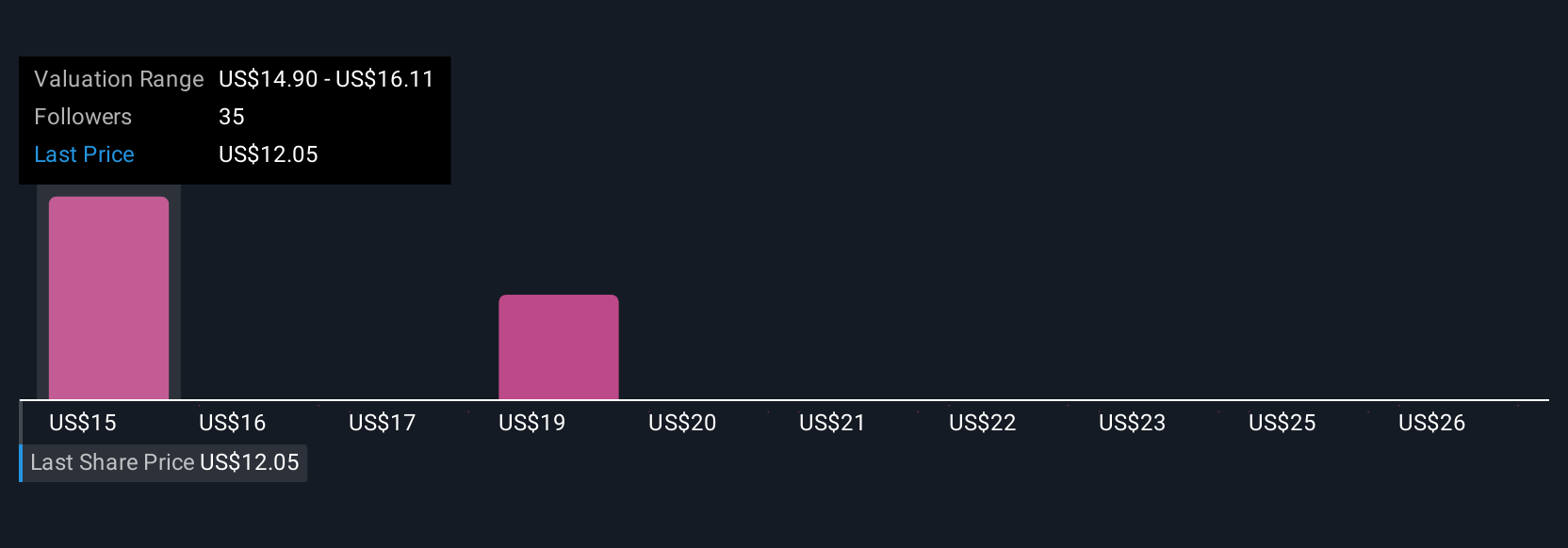

Narratives are easy to use, dynamic, and available right within the Community page on Simply Wall St, where millions of investors share firsthand perspectives. They help you assess fair value by comparing your view to today’s price, and they automatically update as new company news or earnings emerge, keeping your investment story relevant and informed. For example, some investors envision strong growth and assign V.F a future price as high as $40.00, seeing premiumization and cost-cutting as significant catalysts, while others predict just $10.00 for the stock, focusing on brand challenges, execution risks, and pressured demand. Narratives empower you to choose the story and the numbers that fit your convictions best.

Do you think there's more to the story for V.F? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026