- United States

- /

- Luxury

- /

- NYSE:UAA

The Bull Case for Under Armour (UAA) Could Change Following Curry Brand Separation and Restructuring Actions

Reviewed by Sasha Jovanovic

- Under Armour announced in November 2025 that it will separate the Curry Brand from its business and expand restructuring efforts, updating fiscal 2026 guidance to reflect an operating loss of US$56 million to US$71 million with related charges increasing to US$255 million.

- This move marks the end of a 13-year partnership with NBA star Stephen Curry and signals a major brand realignment as Under Armour shifts focus to its core brand and operational changes.

- We'll look at how the separation of Curry Brand and expanded restructuring reshape Under Armour's investment outlook and future profitability profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Under Armour Investment Narrative Recap

As an Under Armour shareholder today, you must believe in the company’s ability to reset and refocus on its core brand, despite deepening short-term losses and restructuring. The recent split from Curry Brand and lowered guidance sharpen the focus on whether Under Armour’s operational resets can counter pressure from declining revenue and margin risks driven by ongoing promotional activity and supply chain costs. The biggest catalyst, improving core brand profitability, remains tied to successful restructuring, while persistent sales declines across channels are the most important risk.

One particularly relevant announcement is the planned transition of Reza Taleghani to Chief Financial Officer in early 2026. Bringing in leadership with global transformation experience intersects with the current realignment effort and may influence how quickly Under Armour can address its near-term profitability and operational priorities. The interplay between this leadership change and the company’s urgent need for efficiency will be important in upcoming quarters.

Yet with margin pressures from tariffs and ongoing cost headwinds still unresolved, investors should be aware that...

Read the full narrative on Under Armour (it's free!)

Under Armour's narrative projects $5.4 billion revenue and $191.0 million earnings by 2028. This requires 1.5% yearly revenue growth and an $89.5 million earnings increase from $101.5 million today.

Uncover how Under Armour's forecasts yield a $5.83 fair value, a 37% upside to its current price.

Exploring Other Perspectives

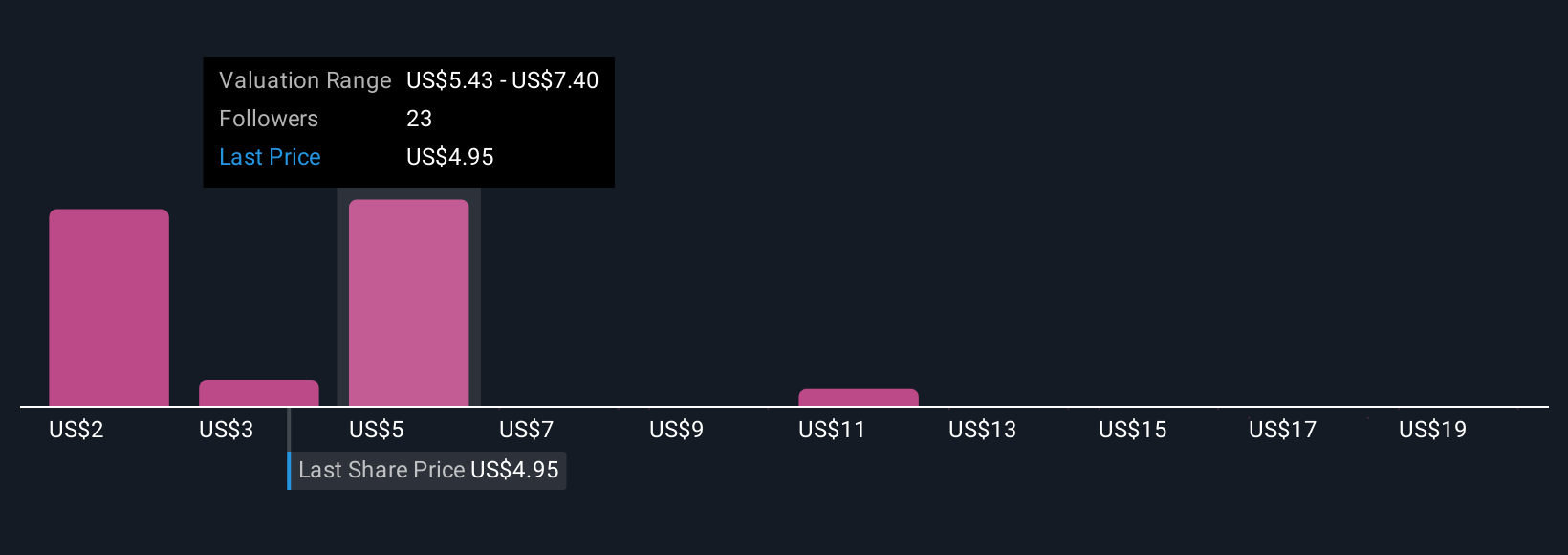

Fifteen Simply Wall St Community fair value estimates for Under Armour swing from US$4.04 to US$21.14 per share, reflecting a wide spectrum of expectations. With cost and margin risks looming, investor viewpoints diverge sharply, consider comparing these perspectives for deeper insight.

Explore 15 other fair value estimates on Under Armour - why the stock might be worth over 4x more than the current price!

Build Your Own Under Armour Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Under Armour research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Under Armour research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Under Armour's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAA

Under Armour

Engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives