- United States

- /

- Luxury

- /

- NYSE:TPR

Tapestry (TPR): Evaluating Valuation Following Strong Q1 Results and Continued Dividend Commitment

Reviewed by Simply Wall St

Tapestry (TPR) kicked off its fiscal year on a strong note, reporting first quarter results with higher sales and net income compared to last year. Investors also took note because the company maintained its quarterly dividend.

See our latest analysis for Tapestry.

After a blockbuster first quarter and continued shareholder-friendly moves like share buybacks and a steady dividend, Tapestry’s 2025 story is all about momentum. The share price has soared 54.5% year-to-date, while delivering a remarkable 80.4% total shareholder return over the last year and an astonishing 302% total return for those who held on for five years. Optimism appears steady as recent gains reflect growing confidence in the company’s growth and capital return strategies.

If Tapestry’s surge has you weighing your next move, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Still, with Tapestry’s shares riding high after these impressive results, investors have to wonder if there is further upside left or if the market has already factored in all of the company’s expected growth.

Most Popular Narrative: 17.2% Undervalued

The most widely followed valuation narrative for Tapestry places its fair value at $122.47, well above its last close of $101.41. With the share price trailing this estimate, bullish arguments center on the company's long-term catalysts and operational tailwinds.

Ongoing investments in digital infrastructure, omnichannel capabilities, and data-driven customer engagement are expected to enable margin expansion and direct-to-consumer growth. These efforts may enhance both revenue and net margins over the long term.

Wondering what’s fueling this optimistic valuation? There is one bold profit prediction behind the current fair value, and it challenges expectations for both Tapestry’s margins and future market performance. Ready to uncover the full set of assumptions and see what supports this high target? Dive in for details that could change your outlook.

Result: Fair Value of $122.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as ongoing tariff pressures and the slower turnaround of underperforming brands may challenge Tapestry’s ability to sustain its current growth trajectory.

Find out about the key risks to this Tapestry narrative.

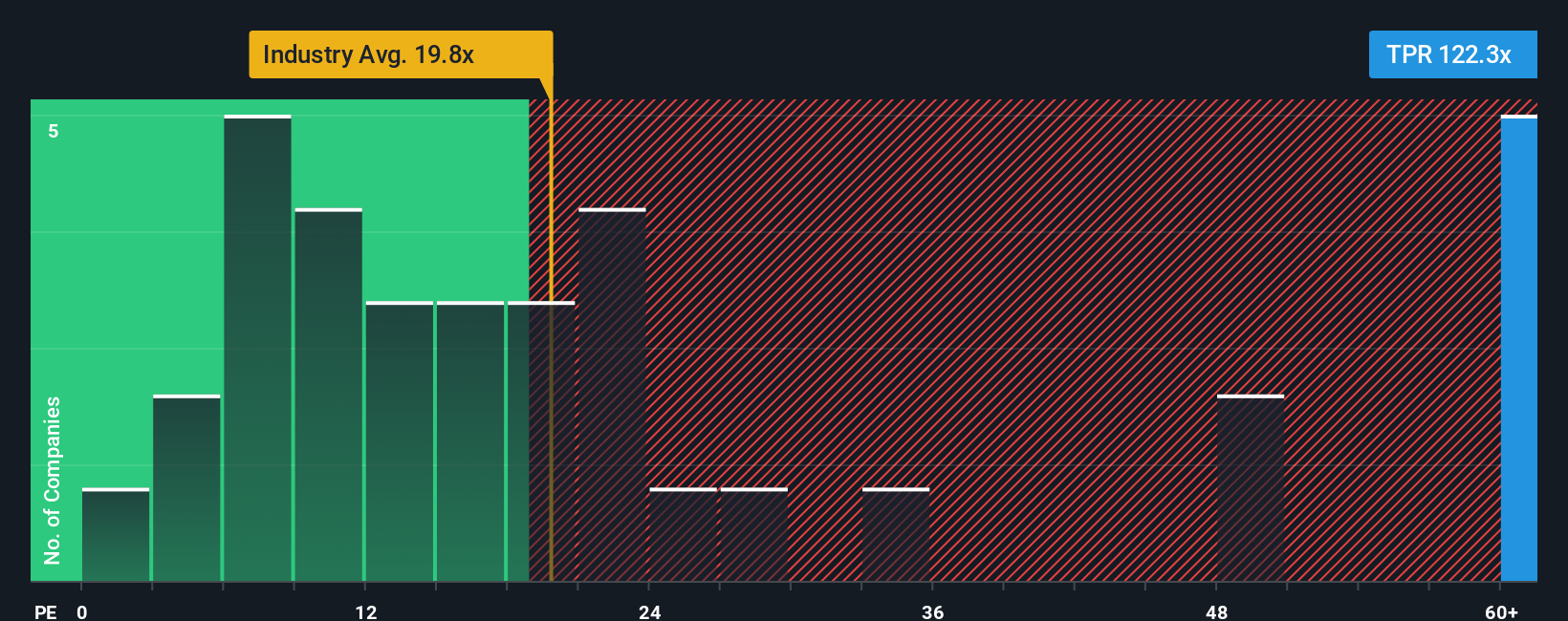

Another View: What Multiples Are Saying

Looking at the company’s price-to-earnings ratio, a different story emerges. Tapestry trades at 76.5 times earnings, much higher than both the US Luxury industry average of 18.9x and the peer average of 31.5x. Even compared to its fair ratio of 24.6x, Tapestry looks expensive, which signals valuation risk instead of clear opportunity. Might the market be running ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tapestry Narrative

If you see things differently or prefer hands-on analysis, you can pull the numbers and craft your personal narrative in just a few minutes: Do it your way

A great starting point for your Tapestry research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart opportunities don’t wait around. Get ahead with a new perspective and tap into stocks that could transform your strategy. You’ll wish you found these sooner.

- Unlock generous passive income potential by reviewing these 16 dividend stocks with yields > 3% offering yields above 3%. This can be ideal for those seeking reliable returns in all market conditions.

- Stay on the edge of innovation by evaluating these 25 AI penny stocks that are positioned to lead the artificial intelligence movement and reshape entire industries with breakthrough technology.

- Secure tomorrow’s big winners by targeting these 879 undervalued stocks based on cash flows with strong fundamentals, giving you a head start before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives