- United States

- /

- Luxury

- /

- NYSE:TPR

Tapestry (TPR): Evaluating Valuation After Strong Sales Growth, New Customers and Raised 2026 Guidance

Reviewed by Simply Wall St

Tapestry (TPR) just backed up its hot share price with equally strong fundamentals, delivering 13% year over year net sales growth and 2.2 million new customers while raising its 2026 revenue and EPS guidance.

See our latest analysis for Tapestry.

That guidance upgrade helps explain why the 1 month share price return sits at a strong 20.1 percent, feeding into a 91.1 percent year to date share price gain and a powerful 5 year total shareholder return of about 360 percent. This suggests momentum is still firmly building rather than fading.

If Tapestry’s run has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with the share price already near analyst targets and long term returns soaring, is Tapestry still trading below its intrinsic value, or are investors now paying up for all that future growth?

Most Popular Narrative Narrative: 3.3% Overvalued

With Tapestry last closing at $125.42 against a narrative fair value near $121, the story leans toward a modestly stretched valuation built on ambitious profit gains.

Analysts expect earnings to reach $1.4 billion (and earnings per share of $6.83) by about September 2028, up from $183.2 million today. The analysts are largely in agreement about this estimate.

Curious how a relatively steady sales outlook can still justify a step change in profitability and valuation multiples? The secret is in the margin rebuild and buyback math. Read on to see which earnings and share count assumptions really drive this price view.

Result: Fair Value of $121.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks at Kate Spade and lingering tariff headwinds could pressure margins and challenge the bullish profit ramp that underpins today’s stretched valuation.

Find out about the key risks to this Tapestry narrative.

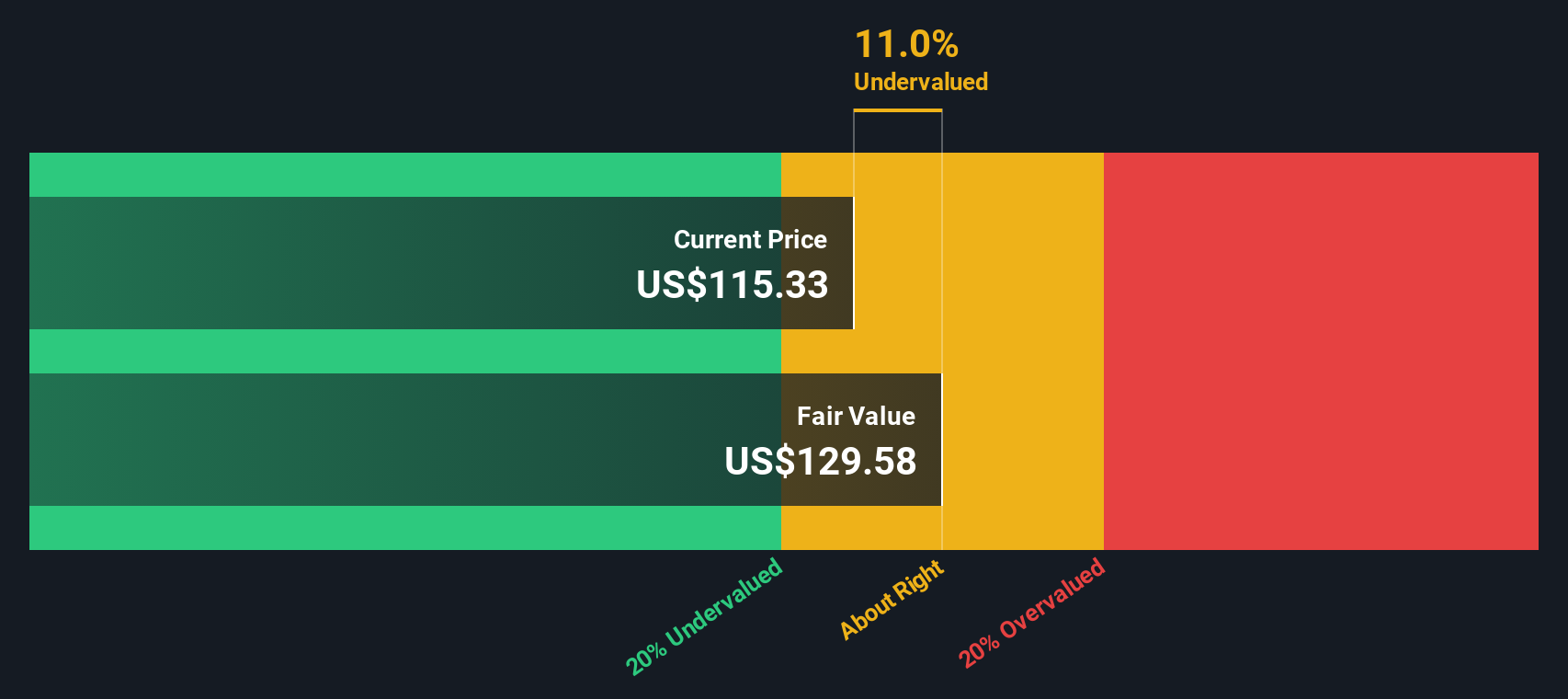

Another View, Our DCF Says Undervalued

While the narrative fair value pegs Tapestry at about 3 percent overvalued, our DCF model points the other way and suggests fair value near $138 versus the $125.42 share price. If cash flows win out over multiples, could today’s rally still leave upside on the table?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tapestry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tapestry Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a custom take in just a few minutes: Do it your way.

A great starting point for your Tapestry research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using our powerful screener tools to identify quality stocks that other investors may only notice later.

- Target reliable income streams with these 13 dividend stocks with yields > 3% that combine attractive yields with the potential for long term stability.

- Tap into breakthrough innovation by scanning these 28 quantum computing stocks in areas such as computing, security, and advanced problem solving.

- Explore potentially mispriced opportunities across the market using these 914 undervalued stocks based on cash flows to find companies where cash flows may indicate additional upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion