- United States

- /

- Luxury

- /

- NYSE:TPR

It Might Be Better To Avoid Tapestry, Inc.'s (NYSE:TPR) Upcoming Dividend

It looks like Tapestry, Inc. (NYSE:TPR) is about to go ex-dividend in the next 4 days. Ex-dividend means that investors that purchase the stock on or after the 5th of March will not receive this dividend, which will be paid on the 30th of March.

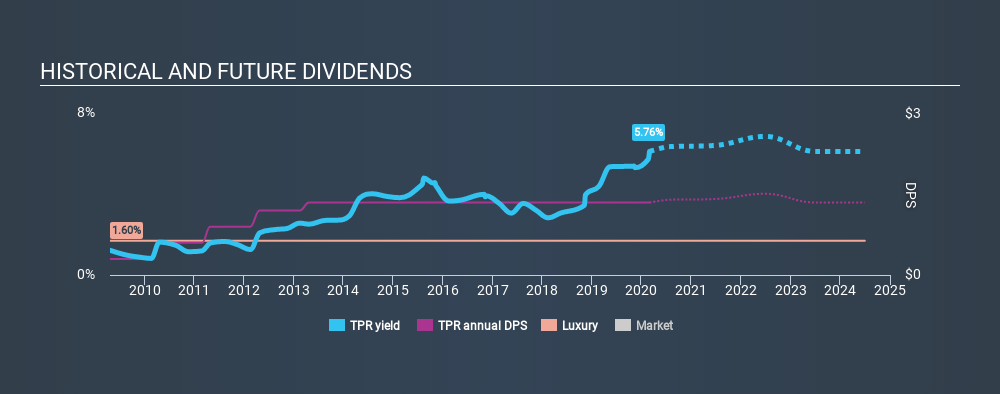

Tapestry's next dividend payment will be US$0.34 per share, and in the last 12 months, the company paid a total of US$1.35 per share. Calculating the last year's worth of payments shows that Tapestry has a trailing yield of 5.8% on the current share price of $23.45. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Tapestry has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Tapestry

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Tapestry is paying out an acceptable 66% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 82% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's positive to see that Tapestry's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by Tapestry's 6.1% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past ten years, Tapestry has increased its dividend at approximately 16% a year on average. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

To Sum It Up

Is Tapestry worth buying for its dividend? It's never good to see earnings per share shrinking, but at least the dividend payout ratios appear reasonable. We're aware though that if earnings continue to decline, the dividend could be at risk. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

Curious what other investors think of Tapestry? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion