- United States

- /

- Consumer Durables

- /

- NYSE:TPH

Did Tri Pointe Homes' (TPH) 55+ Community Launch Just Shift Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Tri Pointe Homes has broken ground on its first 55+ lifestyle community, Altis at Serenity, in Fuquay-Varina, North Carolina, with amenities including an 8,000 square foot clubhouse and 425 homes planned as part of the award-winning Serenity master development.

- This marks the company’s entry into the active adult housing segment, tapping into growing demand for lifestyle-focused, age-targeted communities in high-growth regions.

- We'll now examine how Tri Pointe’s move into the 55+ market may influence its investment narrative, especially regarding growth opportunities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tri Pointe Homes Investment Narrative Recap

To own shares of Tri Pointe Homes, you need to believe the company can reignite growth, either by capturing more demand or improving profitability despite high-interest rates and ongoing affordability challenges. The recent move into 55+ active adult housing signals an attempt to tap new demographics, yet, by itself, is unlikely to materially offset the current short-term catalyst: reversing recent home order declines and regaining lost market share. The biggest risk remains softer demand and sustained underperformance in absorption rates, which could further pressure margins if incentives must rise to spur sales.

The October 2025 launch of sales for Altis at Serenity, the same active adult community now breaking ground, underscores Tri Pointe’s push in the Southeast. This initiative aligns with the company's ongoing expansion into high-growth regions, a catalyst that could help offset geographic concentration risk and broaden demand, though investors should weigh how quickly incremental volumes might translate into improved financial performance.

On the other hand, investors should be aware that increased exposure to new buyer segments does not fully insulate Tri Pointe from pressure on absorption rates and the risk that...

Read the full narrative on Tri Pointe Homes (it's free!)

Tri Pointe Homes' outlook anticipates $3.2 billion in revenue and $193.6 million in earnings by 2028. This reflects a 7.5% annual revenue decline and a $172.2 million decrease in earnings from the current $365.8 million.

Uncover how Tri Pointe Homes' forecasts yield a $38.60 fair value, a 20% upside to its current price.

Exploring Other Perspectives

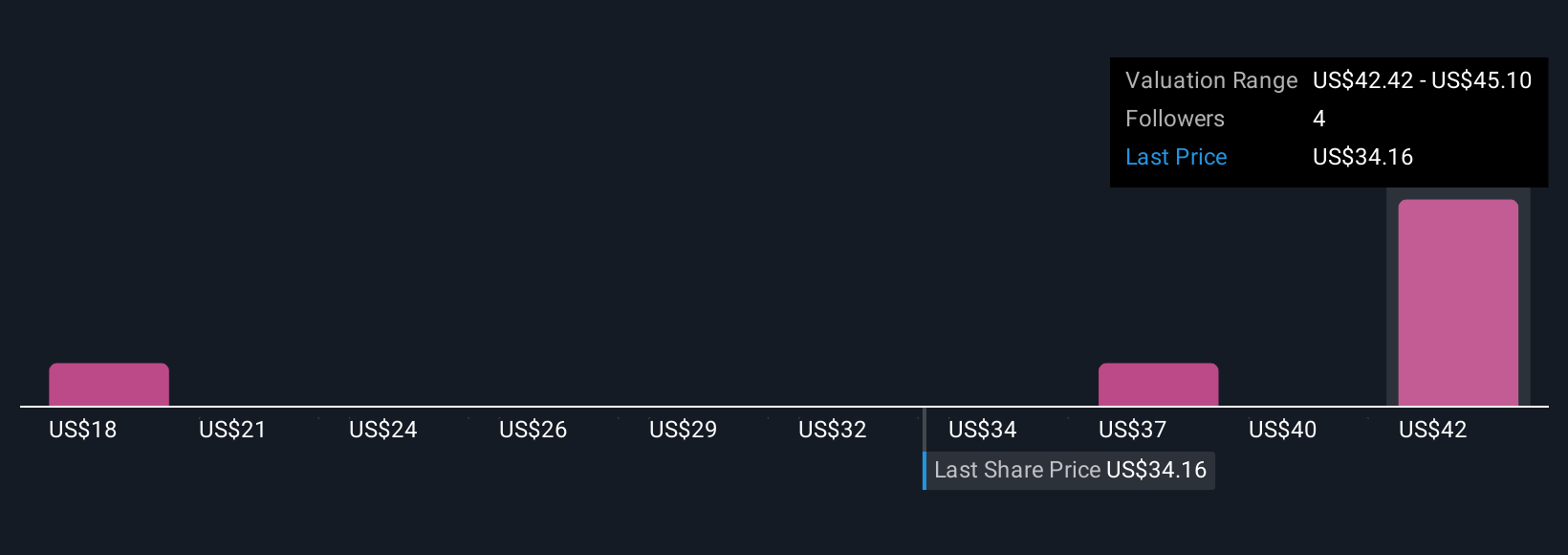

Simply Wall St Community members provided three distinct fair value estimates for Tri Pointe Homes, ranging from US$18.35 to US$41.34 per share. While views vary, many are closely watching whether new customer segments like active adults can help reverse the recent decline in home orders, explore these different viewpoints to inform your own outlook.

Explore 3 other fair value estimates on Tri Pointe Homes - why the stock might be worth as much as 28% more than the current price!

Build Your Own Tri Pointe Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tri Pointe Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tri Pointe Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tri Pointe Homes' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tri Pointe Homes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPH

Tri Pointe Homes

Engages in the design, construction, and sale of single-family attached and detached homes in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives