- United States

- /

- Consumer Durables

- /

- NYSE:TMHC

Should You Revisit Taylor Morrison After Recent 16.6% Drop and Sector Volatility?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Taylor Morrison Home could be a hidden value play or a stock to avoid, you are not alone and you are in exactly the right place.

- Despite a 2.3% dip this week and a 13.9% pullback over the past month, the stock is still up an eye-catching 123.8% over the last three years and 158.0% over five years. However, the past year has brought a 16.6% slide.

- Fresh developments around the real estate and homebuilding sectors, ranging from mortgage rate fluctuations to sector-wide analyst upgrades, have grabbed investor attention. In particular, rising interest rates and shifting buyer sentiment have added both volatility and opportunity to Taylor Morrison’s recent price action.

- The big question now is valuation, and Taylor Morrison stands out here with a strong 6/6 score on our valuation checks, signaling that it is undervalued by every metric we track. Of course, you probably want more than just checking boxes, so here is how different valuation approaches stack up for Taylor Morrison Home, along with a fresh way to think about value at the end of the article.

Find out why Taylor Morrison Home's -16.6% return over the last year is lagging behind its peers.

Approach 1: Taylor Morrison Home Discounted Cash Flow (DCF) Analysis

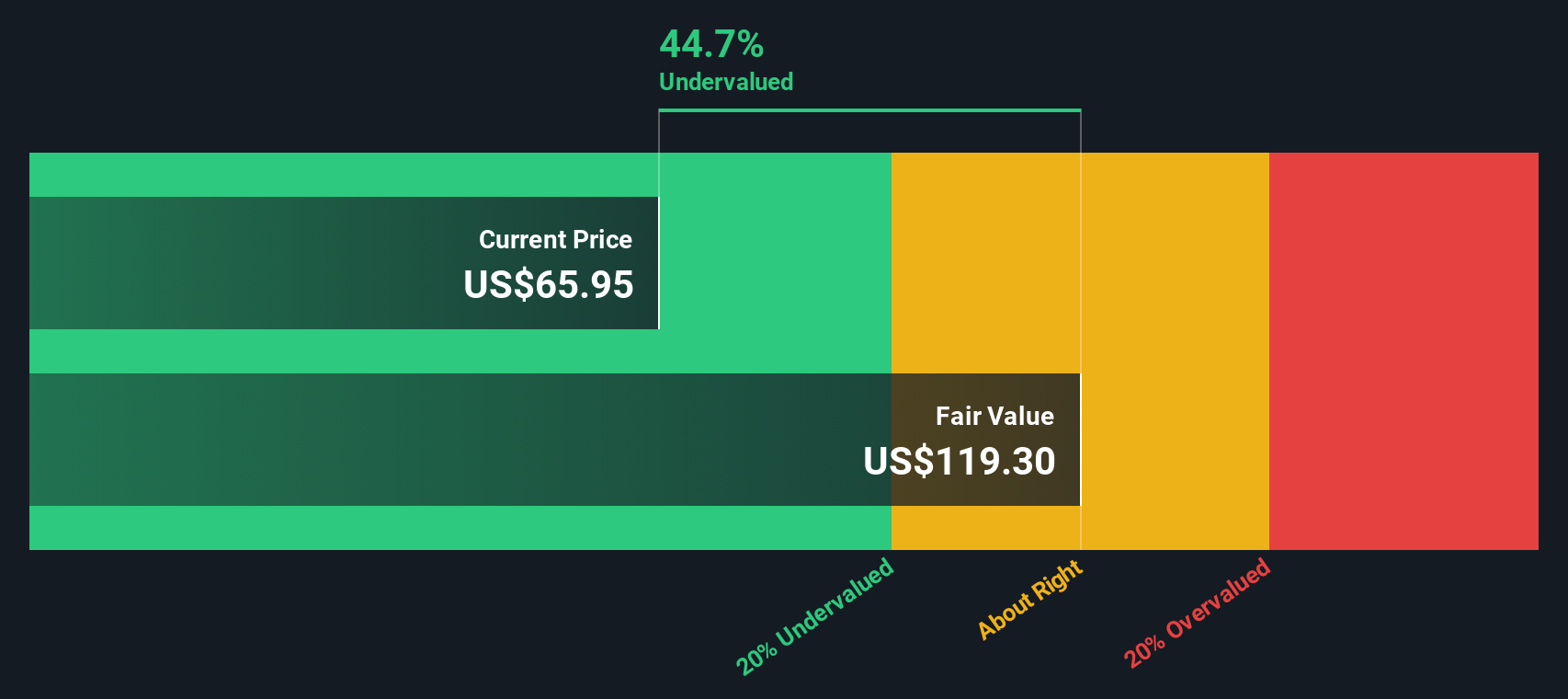

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge what the business is worth right now, based on projected performance rather than current market sentiment.

For Taylor Morrison Home, the latest reported Free Cash Flow is $571.9 million. Analysts have provided estimates through 2027, with cash flows expected to decrease to around $521.5 million by then. Beyond analyst estimates, projections extrapolate out to 2035, with annual free cash flows expected to stay in the $500 to $580 million range according to the model’s assumptions.

The two-stage Free Cash Flow to Equity model calculates an intrinsic value per share of $76.02. Comparatively, the stock currently trades about 23.1% below this estimate, indicating it is meaningfully undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taylor Morrison Home is undervalued by 23.1%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

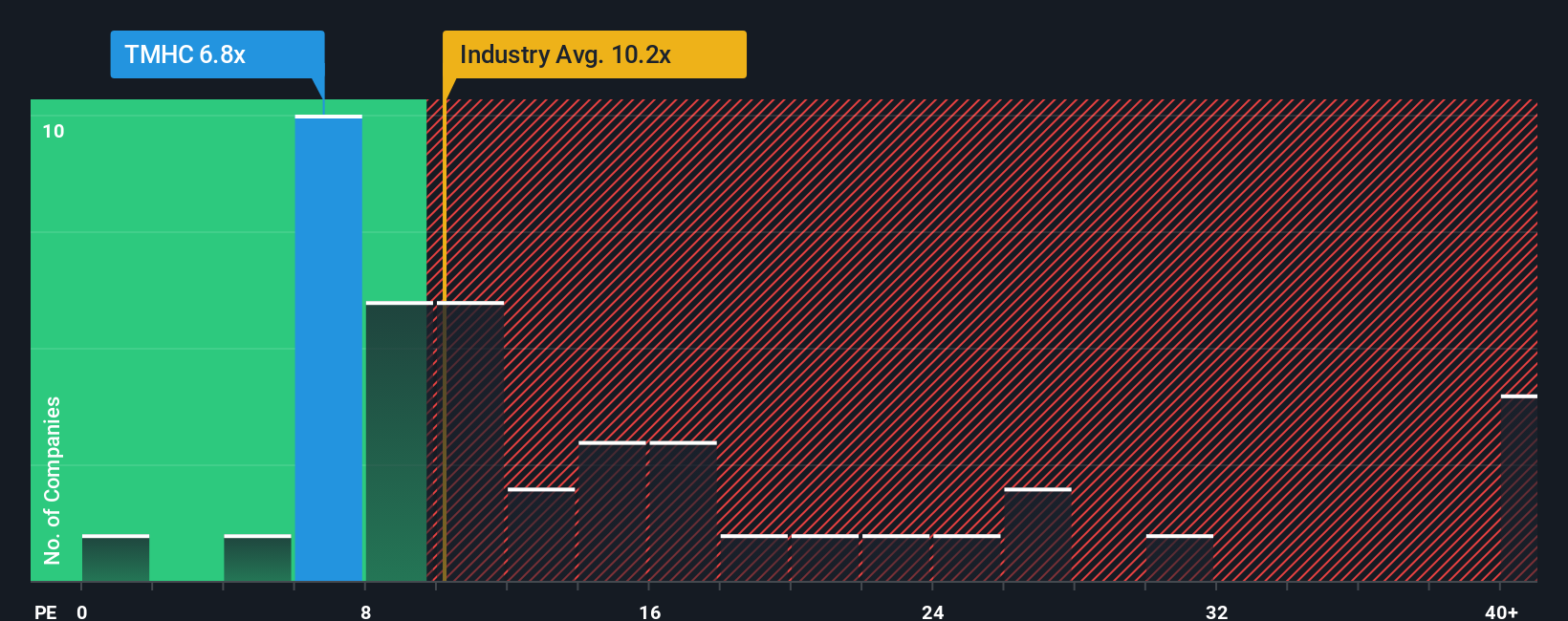

Approach 2: Taylor Morrison Home Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Taylor Morrison Home. It gives investors a quick sense of how much they're paying for each dollar of earnings, making it especially useful when a company is generating healthy profits.

Generally, a company's "normal" or "fair" PE ratio should reflect both growth expectations and the level of risk. Investors tend to pay a higher multiple for companies with faster growth prospects or lower perceived risk. In contrast, slower growers or riskier businesses typically trade at a discount.

Taylor Morrison Home currently trades at a PE ratio of 6.7x. This stands out as low compared to the Consumer Durables industry average of 10.4x and an even higher peer group average of 15.9x. On the surface, this may look like a bargain.

However, Simply Wall St’s proprietary Fair Ratio provides a more tailored benchmark. The Fair Ratio (11.45x) estimates what a justifiable multiple should be, factoring in not just growth or industry averages but also Taylor Morrison's earnings outlook, profit margins, market cap, and unique risk profile. This holistic view makes the Fair Ratio a more meaningful yardstick than a simple peer or sector comparison.

Since Taylor Morrison’s current PE ratio of 6.7x is notably below the Fair Ratio of 11.45x, the stock appears undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taylor Morrison Home Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story you create about a company, where you set your own assumptions for fair value, future revenue, earnings, and profit margins. It represents your perspective behind the numbers.

Narratives connect Taylor Morrison’s underlying business story to your own financial forecast, providing a clear path from big-picture trends all the way to a calculated fair value. With Narratives on Simply Wall St’s Community page, millions of investors can easily build, compare, and discuss these scenarios without advanced financial know-how.

This tool makes it simple to track how your fair value compares to the current share price, helping you decide if and when to buy or sell. In addition, every Narrative dynamically updates as new company announcements, news, or financial results are released. For example, some investors believe margin pressures and cautious expansion mean Taylor Morrison’s fair value is just $65. Others point to stable demand, pricing power, and robust financials for a target closer to $85. With Narratives, you can make your own judgment and invest with confidence as the story unfolds.

Do you think there's more to the story for Taylor Morrison Home? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Morrison Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMHC

Taylor Morrison Home

Operates as a land developer and homebuilder in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives