- United States

- /

- Consumer Durables

- /

- NYSE:SN

SharkNinja (SN): Evaluating Valuation as CFO Transition Draws Investor Interest

Reviewed by Simply Wall St

SharkNinja (NYSE:SN) has just announced a change at the top of its finance team. Patraic Reagan, the Chief Financial Officer, will step down in early September, and Adam Quigley, a company veteran, will step in as interim CFO. The company was quick to clarify that Reagan’s resignation was not due to any disagreement with management or the Board, aiming to reassure shareholders that this is not a red flag. Still, whenever there is a change in the finance chief’s chair, investors naturally start to weigh what this might mean for future strategy and execution.

This leadership update comes as SharkNinja’s stock has delivered a 23% return over the past year, with gains accelerating 21% since the start of the year and an especially strong move in the past three months. Recent headlines have been filled with the launch of the Ninja Fireside360 and a sizable follow-on equity offering, reinforcing the picture of a business both innovating and tapping the markets for capital. Overall, momentum seems to be building, though management changes add a layer of interest, especially for those eyeing company leadership stability.

So with shares up on solid growth, is SharkNinja now trading at a discount, or is the market pricing in all the company's forward momentum already?

Most Popular Narrative: 15% Undervalued

The current view among the most widely followed analysis is that SharkNinja shares are trading at a noteworthy discount to fair value, driven by robust growth assumptions and expanding profit margins over the next several years.

Rapid expansion of new product categories, such as beauty technology and outdoor appliances, positions SharkNinja to capture fresh demand fueled by consumer focus on health, wellness, and convenience. This supports above-market revenue growth and higher net margins through premium innovation.

Curious how future-focused innovation, category breakthroughs, and global expansion ambitions stack up to justify a price target beyond today’s levels? The narrative hints at a bold earnings trajectory and ambitious profitability roadmap, with numbers that could surprise you. Dive into the projections to see which financial leaps drive their assessment and where the real upside might lie.

Result: Fair Value of $137.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, higher manufacturing costs or slower global consumer demand could quickly challenge analysts’ bullish forecasts and affect SharkNinja’s growth outlook.

Find out about the key risks to this SharkNinja narrative.Another View: The Earnings Multiple Tells a Different Story

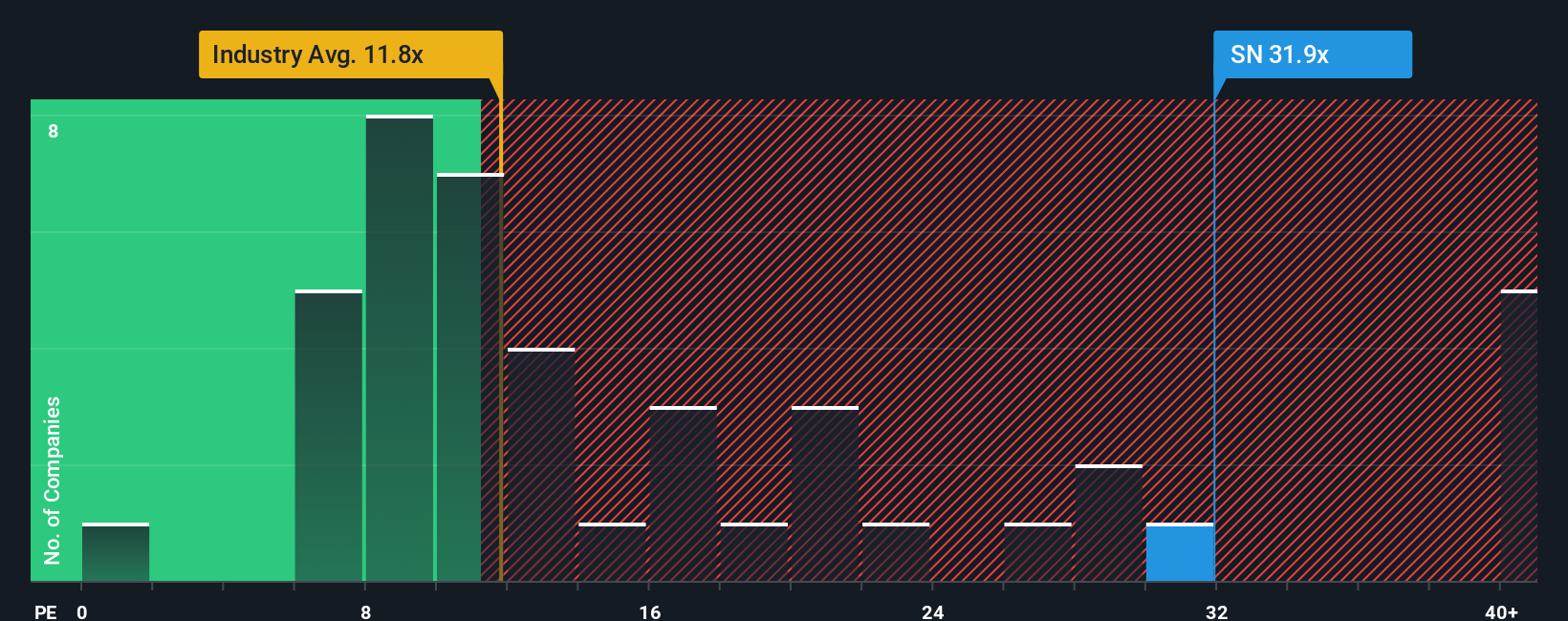

Looking at market valuation through the earnings lens presents a challenge to the bullish outlook. By this approach, SharkNinja appears pricier than industry averages, which suggests that optimism might already be included in the price. Does this highlight a risk that growth may not fully translate into value?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding SharkNinja to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own SharkNinja Narrative

If you look at the facts and feel your perspective differs, keep in mind it takes less than three minutes to build your own analysis: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SharkNinja.

Looking for More Investment Ideas?

Smart investors never stop seeking new opportunities. Stay ahead of the crowd by checking out handpicked stock ideas and unique markets using our tailored tools below.

- Supercharge your search for hidden gems with penny stocks that boast strong financials by using our penny stocks with strong financials.

- Capture emerging trends in healthcare and technology by scanning the top performers among medical pioneers driving breakthroughs with healthcare AI stocks.

- Boost your income potential with companies that offer reliable yields above 3% through our dedicated guide to dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026