- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Champion Homes (SKY): Evaluating Valuation After Strong Q2 Earnings and Expanded Share Buyback Program

Reviewed by Simply Wall St

Champion Homes (SKY) just posted second-quarter results that showed both sales and net income ticking higher from the previous year. At the same time, the company expanded its share buyback program, which signals ongoing confidence from management.

See our latest analysis for Champion Homes.

After a string of rapid gains, Champion Homes is firmly back in the spotlight. The share price surged more than 24% over the past week and is up over 22% for the month, recapturing some lost ground despite a year-to-date price return of -5.8%. While recent buyback activity and better-than-expected earnings have revived momentum, longer-term total shareholder returns remain impressive. A five-year gain of nearly 189% reflects strong growth over time.

If you're interested in companies where growth is matched by high insider ownership, this is the perfect moment to discover fast growing stocks with high insider ownership

Yet with the shares rebounding and new buybacks announced, investors may be wondering whether the current price understates Champion Homes’ true value or if the recent run-up simply reflects the market accounting for all of its future growth.

Most Popular Narrative: 4.4% Undervalued

With the narrative's fair value pegged at $84.67, just above Champion Homes’ last close of $80.97, the stage is set for a close look at what could drive further upside. Analyst expectations have shifted, setting a higher benchmark for what justifies the current rally.

Strategic expansion into high-margin multifamily and commercial modular segments, alongside the recent Iseman Homes acquisition and continued integration synergies, positions Champion to structurally improve net margins and drive earnings growth over time. Broader adoption of off-site construction solutions among builders and developers, along with growing builder/developer pipelines, increases Champion's share of a diversifying addressable market, supporting revenue and market share gains.

Earnings growth, margin resilience, and big bets on expansion are the narrative’s secret ingredients. What future profit assumptions and multiple are behind that higher fair value? Uncover the full story and decide if this ambitious outlook justifies the premium price.

Result: Fair Value of $84.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing order momentum and rising input costs could challenge revenue growth and margin stability. Investors may want to stay alert for further developments.

Find out about the key risks to this Champion Homes narrative.

Another View: Market Multiples Raise Questions

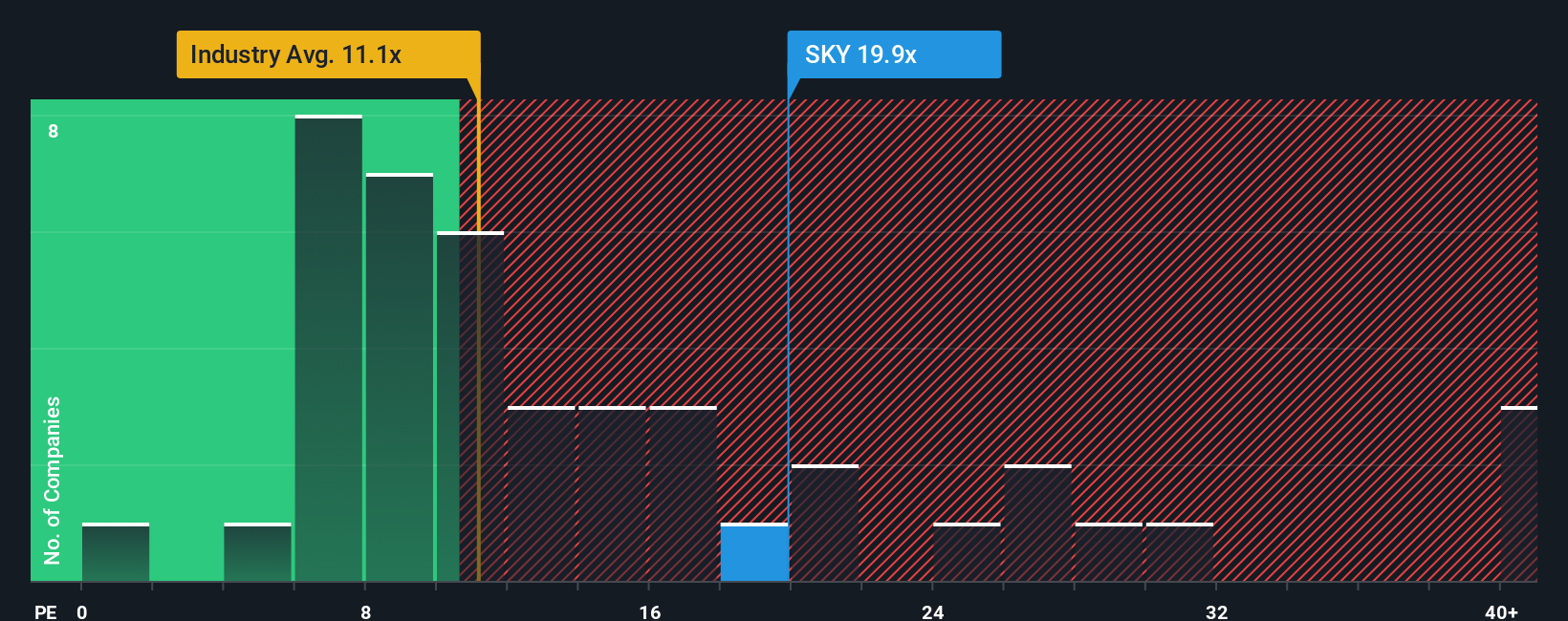

Looking at how Champion Homes is valued compared to other consumer durables companies, its price-to-earnings ratio stands at 20.7x. This is nearly double both the industry average (10.9x) and the average of its closest peers (11.5x). The fair ratio suggests a multiple closer to 13.3x might be more reasonable, so the current premium could mean investors are paying up for future growth that is not guaranteed. Is this premium the start of a new trend, or does it limit the room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Champion Homes Narrative

If you see things differently or prefer examining the numbers firsthand, you can easily build your own view of Champion Homes in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Champion Homes.

Looking for more investment ideas?

Don't wait for the market to come to you. See what smart investors are watching next with these hand-picked opportunities from the Simply Wall Street screener:

- Capture steady income by targeting companies with reliable yields using these 17 dividend stocks with yields > 3% and spot those paying over 3% returns right now.

- Unlock high-conviction, undervalued stocks that experts believe have strong cash flow potential through these 861 undervalued stocks based on cash flows before others catch on.

- Stay ahead of the curve by tracking cutting-edge breakthroughs with these 28 quantum computing stocks. You can also discover which businesses are powering the quantum computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives