- United States

- /

- Luxury

- /

- NYSE:RL

Renewed Analyst Optimism Could Be a Game Changer for Ralph Lauren (RL)

Reviewed by Sasha Jovanovic

- Over the past week, analyst sentiment toward Ralph Lauren strengthened as multiple brokerage firms maintained positive ratings and raised their forecasts ahead of the company's upcoming fiscal second-quarter earnings report. This wave of optimism reflects widespread expectations for continued robust international demand and the effectiveness of Ralph Lauren's premium market positioning and digital initiatives.

- The growing alignment among industry analysts suggests that Ralph Lauren's recent global expansion and consistent past earnings outperformance are key contributors to its emerging prominence within the luxury retail sector.

- We'll explore how renewed analyst optimism, focused on international demand and digital progress, shapes Ralph Lauren’s investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ralph Lauren Investment Narrative Recap

To be a Ralph Lauren shareholder today, one needs to believe that the company’s global brand strength, premium positioning, and digital momentum can drive sustainable growth even as higher price points may test consumer demand. This past week’s wave of bullish analyst sentiment highlights expectations for robust international sales, but does not materially change core risks, including potential consumer price sensitivity and macro pressures, which remain pivotal short-term factors to watch.

Among recent developments, the company’s reaffirmation of its fiscal 2026 guidance in September stands out. While international demand and digital initiatives are catalysts for investor optimism, management has cautioned that macroeconomic uncertainty and slowing growth in Europe could temper future performance, underscoring the importance of consistent execution in offsetting regional headwinds.

However, investors should also be aware that if consumers become more price sensitive, especially amid persistent inflation and tariff risk, the company’s ability to maintain its premium pricing could...

Read the full narrative on Ralph Lauren (it's free!)

Ralph Lauren's outlook anticipates $8.4 billion in revenue and $1.0 billion in earnings by 2028. This projection relies on a 5.0% annual revenue growth rate and a $205 million increase in earnings from the current $794.7 million.

Uncover how Ralph Lauren's forecasts yield a $351.94 fair value, a 4% upside to its current price.

Exploring Other Perspectives

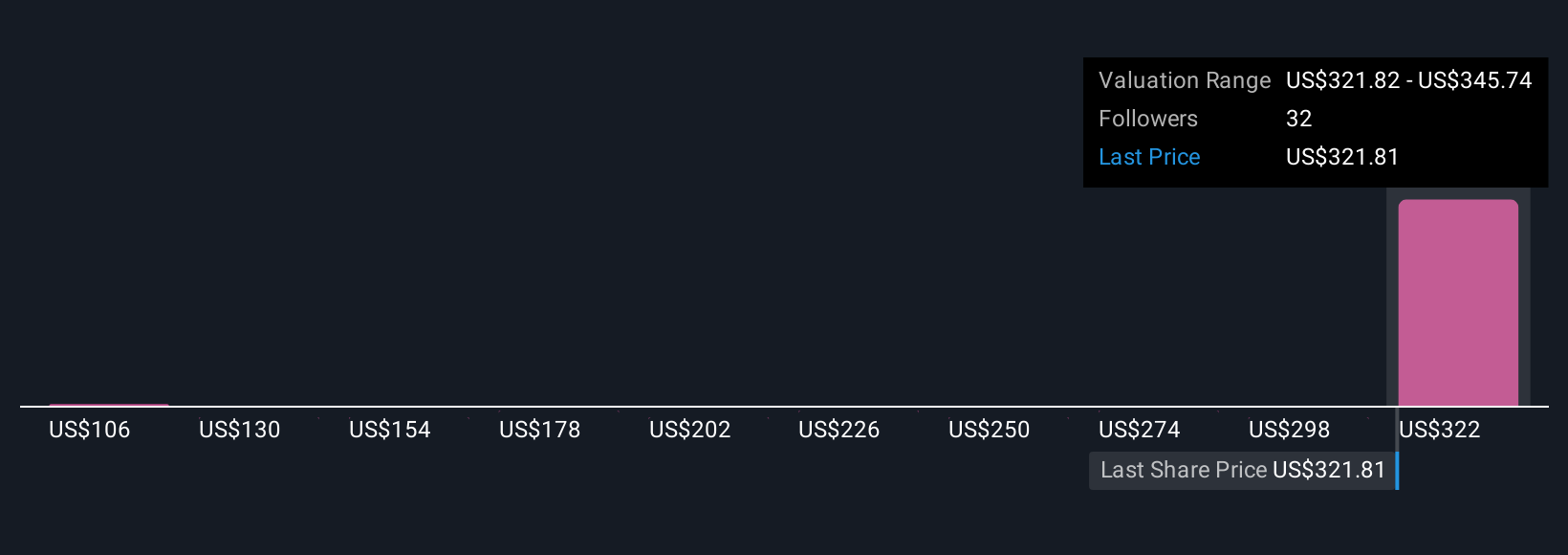

Seven members of the Simply Wall St Community have set Ralph Lauren’s fair value between US$106 and US$352 per share. With broad analyst optimism focused on digital and global expansion, you can see how perspectives diverge and why it’s important to explore several possible outcomes.

Explore 7 other fair value estimates on Ralph Lauren - why the stock might be worth as much as $351.94!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ralph Lauren research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ralph Lauren's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives