- United States

- /

- Luxury

- /

- NYSE:RL

Exploring Ralph Lauren’s Valuation Following New Collaboration With Indigenous-Led Brand TOPA

Reviewed by Simply Wall St

Ralph Lauren (NYSE:RL) just launched a fresh collaboration with Indigenous-led brand TOPA through its Artist in Residence program. The new collection pairs rich cultural craftsmanship with Polo Ralph Lauren’s classic aesthetic, making heritage a centerpiece.

See our latest analysis for Ralph Lauren.

Ralph Lauren’s newest collaboration rides a wave of positive shareholder momentum, with the 1-year total shareholder return standing at an impressive 60.02% and the share price up 41.2% year-to-date. While the stock eased slightly in the past month, overall performance has shown sturdy, long-term gains and continues to suggest investor confidence in the brand’s creative evolution.

If Ralph Lauren’s blend of tradition and innovation has you thinking bigger, consider what else could be on the rise by discovering fast growing stocks with high insider ownership.

With shares trading 12% below analyst price targets and recent gains driven by solid fundamentals, the real question is whether Ralph Lauren remains undervalued or if the market has already fully priced in its future growth potential.

Most Popular Narrative: 10.6% Undervalued

Ralph Lauren’s most widely followed narrative places its fair value at $365.87 per share, a notable step above the last close of $326.96. This calls attention to a valuation gap that is underpinned by forward-looking growth and improving profitability dynamics.

“Premium brand positioning and reduced reliance on discounting continue to increase average unit retail (AUR) by 14% in the quarter, illustrating strengthened pricing power and value perception among consumers who desire quality and authenticity. These factors underpin future gross margin expansion. Significant investments in technology, AI-driven inventory management, and automated supply chain operations are driving greater operating efficiencies and setting the stage for improved operating margins and inventory turns as scale increases.”

Want to know what profit and revenue growth assumptions are fueling this bullish outlook? The projected future margin leap and valuation multiple could surprise even growth optimists. The earnings runway and cost-efficiency narrative are at the heart of this fair value. Curious which numbers the analysts are betting on? Find out what’s really driving this premium price target.

Result: Fair Value of $365.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty or slowing European growth could easily challenge even the most bullish outlook for Ralph Lauren’s long-term momentum.

Find out about the key risks to this Ralph Lauren narrative.

Another View: Multiples Tell a Different Story

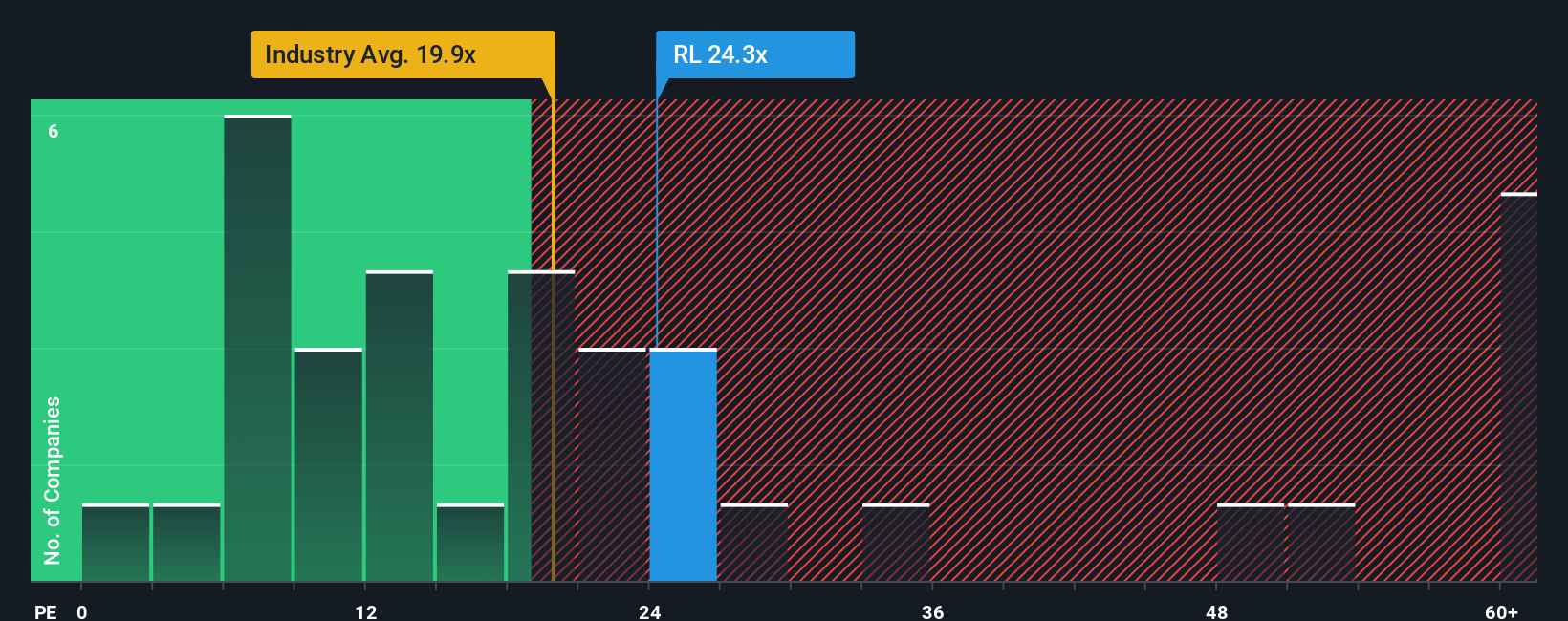

Looking through the lens of price-to-earnings, Ralph Lauren trades at 23.2 times earnings, above both the US Luxury industry average of 19.3x and its fair ratio of 17.8x. This premium could signal that the market expects sustained outperformance, but it also raises the stakes if future growth slows. Is the higher price truly justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If you want a different take or value hands-on research, why not dive into the data and build your own story in just minutes? Do it your way.

A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Turn your research into action and make your next move count. Don’t settle for the ordinary when fresh opportunities are waiting. See where your strategy can take you.

- Unlock steady income potential by checking out these 16 dividend stocks with yields > 3% offering attractive yields and reliable track records.

- Spot undervalued gems poised for growth when you use these 919 undervalued stocks based on cash flows and seize opportunities others might overlook.

- Tap into market-defining innovation with these 25 AI penny stocks featuring bold companies harnessing artificial intelligence to lead the next wave of disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives