- United States

- /

- Luxury

- /

- NYSE:PVH

Will Renewed Value Stock Interest Shift the Long-Term Narrative for PVH (PVH) Investors?

Reviewed by Sasha Jovanovic

- PVH Corp. recently participated in the 18th Annual New York Global Innovation Summit at The Yale Club in New York, featuring insights from Senior Vice President and CISO JP Calderon Del Vecchio.

- An interesting takeaway is that renewed investor interest in value-oriented stocks coincided with favorable US government actions and new analyst coverage, highlighting broader market influences on PVH’s outlook.

- We'll evaluate how the shift in investor preference toward value stocks may influence PVH's investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

PVH Investment Narrative Recap

To be a PVH shareholder, you need to believe that the company’s strong brand portfolio and ongoing operational improvements will drive steady returns, despite external pressures and evolving consumer preferences. The recent surge in PVH’s stock price, coinciding with market rotation into value-oriented names and relief from US government funding risks, may boost short-term sentiment but does not materially alter the biggest near-term catalyst: growth in direct-to-consumer and digital sales. Persisting global tariff uncertainties remain the largest risk, with potential for ongoing margin strain. Among recent announcements, PVH’s new licensing agreement for Calvin Klein and Tommy Hilfiger outerwear in the US and Canada stands out. This move supports the company’s efforts to expand in North America, reinforcing branded revenue streams that could help counteract volatility from global markets and provide resilience should tariff-related pressures persist. In contrast, investors should be aware that continued tariff headwinds may still weigh on profitability if mitigation efforts fall short...

Read the full narrative on PVH (it's free!)

PVH's outlook anticipates $9.4 billion in revenue and $707.7 million in earnings by 2028. Achieving this outcome assumes annual revenue growth of 2.3%, representing an increase in earnings of about $239 million from the current level of $468.5 million.

Uncover how PVH's forecasts yield a $96.79 fair value, a 24% upside to its current price.

Exploring Other Perspectives

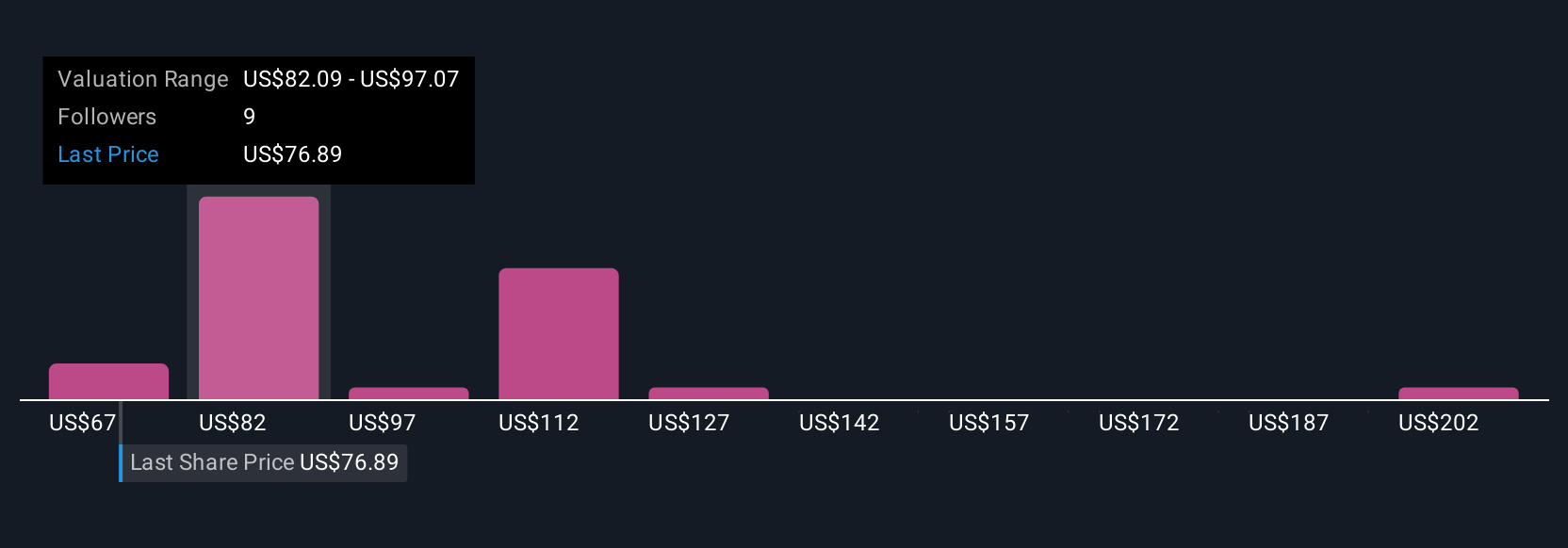

Seven Simply Wall St Community members set fair value estimates for PVH between US$67.10 and US$216.96. While perspectives differ widely, recent analyst concerns about tariff impacts could signal further earnings pressure ahead.

Explore 7 other fair value estimates on PVH - why the stock might be worth 14% less than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PVH

PVH

Operates as an apparel company in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives