- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (PII): Exploring Valuation After Recent Share Price Uptick in 2024

Reviewed by Simply Wall St

Polaris (PII) shares have edged up slightly, closing at $63.61 after recent trading. Year to date, the stock has returned about 13%, even as longer-term performance remains more mixed.

See our latest analysis for Polaris.

Polaris has enjoyed a strong run so far in 2024, with a 12.82% year-to-date share price return suggesting renewed investor confidence. However, its one-year total shareholder return remains marginally negative. Recent market momentum points to a rebound, but the longer-term track record shows there is still ground to recover.

If you're interested in seeing which other names are gathering steam in the auto world, now’s a perfect moment to explore See the full list for free.

With a modest gain since January and shares trading just below analyst targets, the key question is whether Polaris is currently undervalued, or if the market has already priced in any potential upside for the year ahead.

Most Popular Narrative: 3% Undervalued

Polaris’s fair value narrative sits at $65.83 per share, just above the last close of $63.61. This slight gap raises the stakes for whether current optimism is justified or fleeting.

Polaris is executing on new product launches and innovations, such as the digital helm in their boating lineup, which are expected to enhance their portfolio and drive future sales growth, potentially increasing revenue. Dealer feedback indicates a strong partnership and alignment with Polaris' strategic initiatives, which suggests effective inventory management and could stabilize and eventually increase market share, supporting long-term revenue growth.

Want the inside story behind these numbers? The latest narrative rests on Polaris pulling off ambitious new launches plus a big profit margin turnaround. Curious what ambitious assumptions propel that fair value above today’s price? There is a game-changing growth expectation you will want to see for yourself.

Result: Fair Value of $65.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff costs and continued market competition could quickly reverse optimism if they affect Polaris’s margins or slow its ongoing sales recovery.

Find out about the key risks to this Polaris narrative.

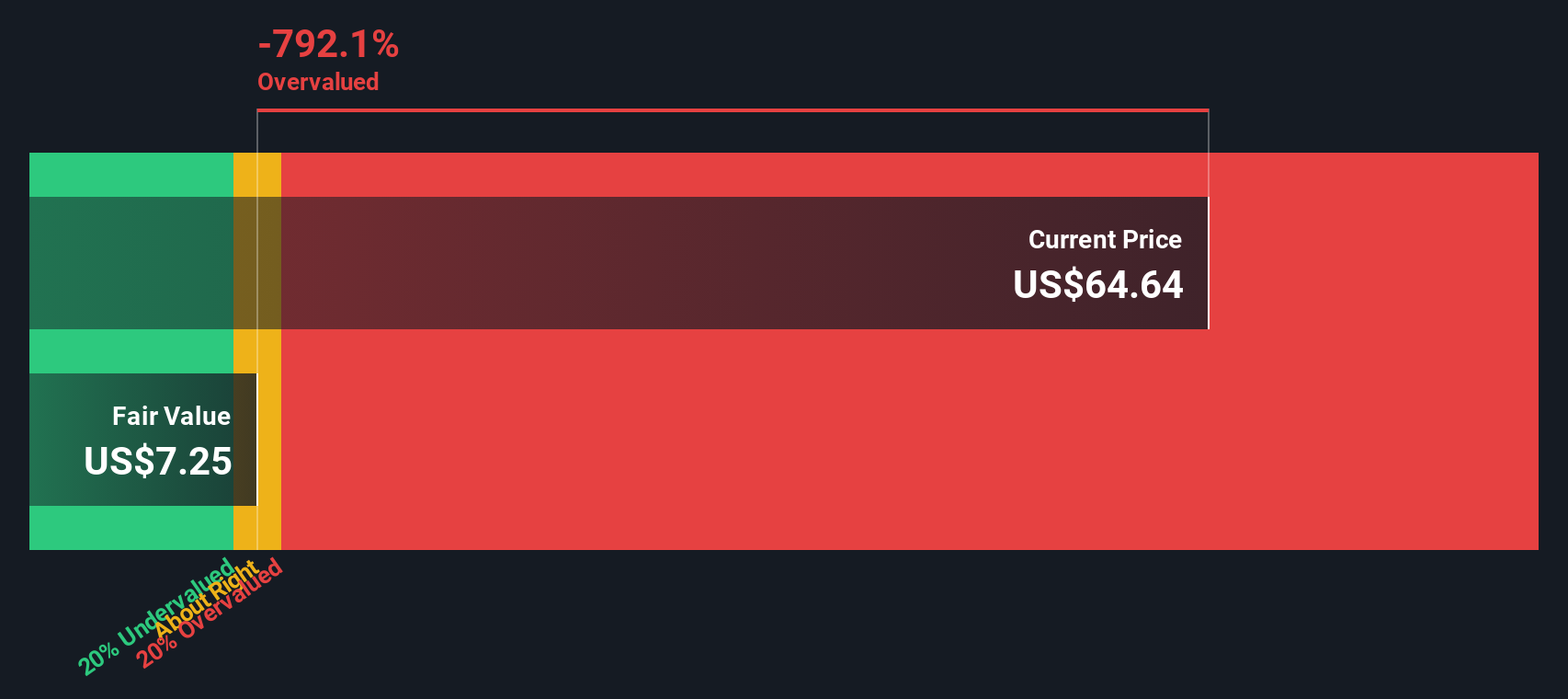

Another View: Our DCF Model Challenges the Narrative

While the most popular narrative sees Polaris as slightly undervalued, our SWS DCF model offers a starkly different view. By estimating future cash flows, the DCF pegs fair value at just $7.23, which is far below the current share price. Which perspective captures reality, hope or caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Polaris for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Polaris Narrative

If you want a different take or prefer diving deep into your own research, now’s the time to craft your own Polaris narrative in just minutes. Do it your way.

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always scan new frontiers before the crowd. Use our screeners and position yourself to capitalize on tomorrow's biggest market moves before others catch on.

- Spot small-cap surprises with strong financials by checking out these 3598 penny stocks with strong financials that could punch above their weight in the market.

- Cash in on reliable income streams by seeing these 16 dividend stocks with yields > 3% offering yields above 3% for steady returns even in uncertain times.

- Get ahead in the AI race and review these 26 AI penny stocks fueling breakthroughs at the frontier of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives