- United States

- /

- Leisure

- /

- NYSE:PII

A Fresh Look at Polaris (PII) Valuation Following Recent Analyst Upgrades and Strategy Shifts

Reviewed by Simply Wall St

Polaris (PII) shares have shown some interesting movement lately, especially over the past month. The company’s stock price has edged slightly lower, which has sparked conversations about what may be driving investor sentiment right now.

See our latest analysis for Polaris.

Polaris has seen momentum ebb and flow this year, with its recent 21.5% 90-day share price gain standing out despite a more modest 13.5% year-to-date move and a 1-year total shareholder return of -5.3%. While short-term optimism around growth and profitability seems to be building, long-term returns show investors remain cautiously selective. This reflects ongoing reassessments of risks and value.

If recent shifts in sentiment have you rethinking your strategy, this might be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

Given these results, investors may be wondering whether Polaris is trading at a bargain compared to its future potential. Alternatively, the recent gains might indicate that the market is already factoring in all expected growth.

Most Popular Narrative: 2.5% Undervalued

With Polaris’s fair value recently raised to $65.64, now slightly above the last close at $64.01, analysts see near-term upside potential if expectations are met. Investors are closely watching whether margin improvements and divestitures create the financial momentum the market anticipates.

The divestiture of Indian Motorcycles is seen as accretive to earnings, with expectations for a meaningful lift to adjusted EPS due to margin improvements in the remaining business segments. Resumption of market share gains as competitors’ previously high inventory levels have normalized indicates stronger brand positioning.

Think those price upgrades are just routine? There is one hidden assumption quietly steering the narrative: future profitability is set to surge alongside healthier margins. Wonder how bullish projections and new product momentum intersect to power this fair value? Uncover the precise forecasts and surprising calculations driving analysts’ confidence and see what is fueling the next chapter for Polaris.

Result: Fair Value of $65.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant tariff costs or a prolonged industry downturn could quickly erode expected margin improvements. This could also put recent analyst optimism to the test.

Find out about the key risks to this Polaris narrative.

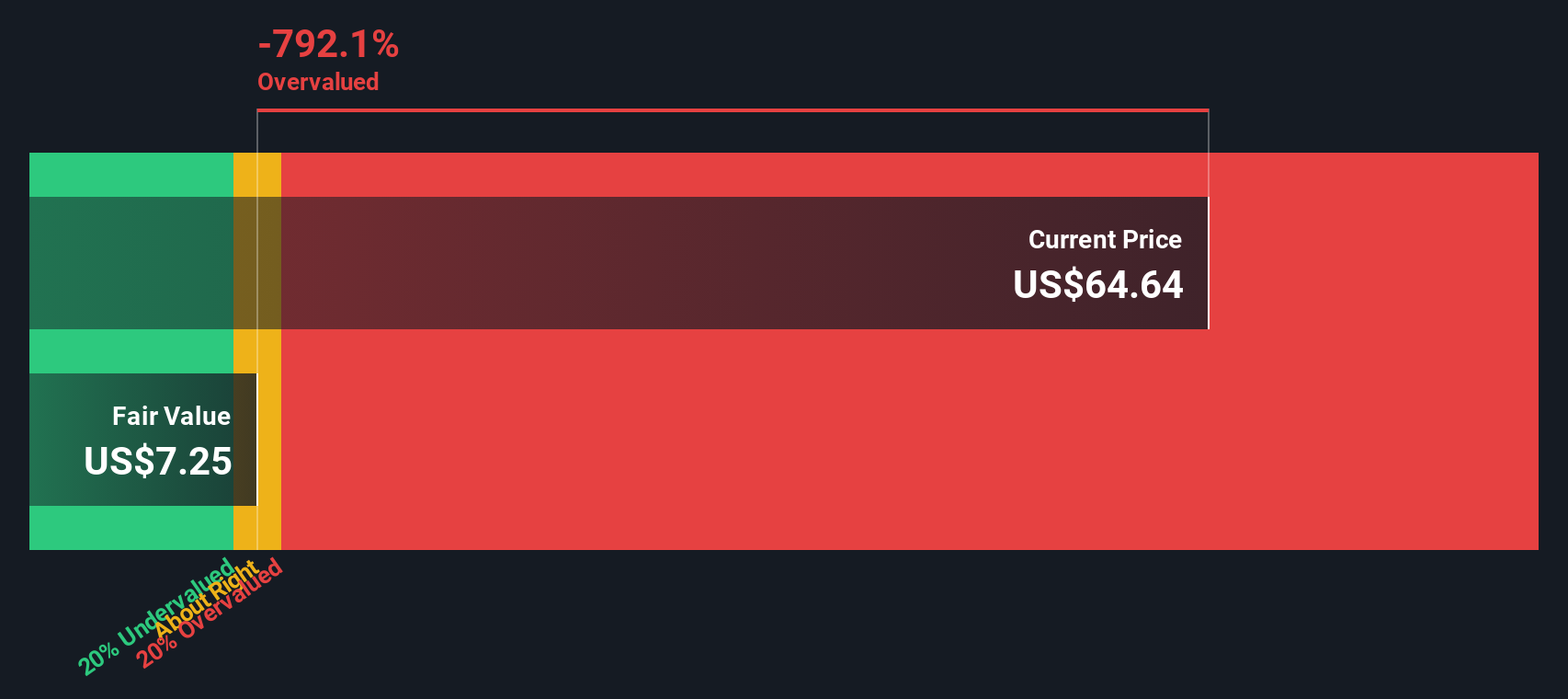

Another View: Discounted Cash Flow Perspective

Our SWS DCF model presents a much different picture, with Polaris shares currently trading well above this model's estimate of fair value. While the first method found a hint of undervaluation based on analyst targets and improved earnings, DCF numbers suggest considerable downside risk instead. Could this gulf in outlook simply reflect conservative cash flow assumptions, or is the market overlooking potential headwinds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Polaris for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Polaris Narrative

If you see the story unfolding differently or want to dig deeper into the numbers yourself, you can shape your own perspective, and do it all in just a few minutes. Do it your way

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to get ahead of the market by finding smart alternatives that could add real momentum to your portfolio. Stay proactive and uncover top stocks before others catch on.

- Target fast-growing businesses by checking out these 839 undervalued stocks based on cash flows, where disciplined value strategies are combined with impressive fundamentals.

- Capture the latest surge in artificial intelligence with these 26 AI penny stocks and see which companies are transforming technology right now.

- Boost your income stream by seeing these 20 dividend stocks with yields > 3%, featuring stocks yielding more than 3% for consistent payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives