- United States

- /

- Consumer Durables

- /

- NYSE:PHM

How PulteGroup’s (PHM) 18 Percent Dividend Hike Reflects Confidence in Cash Flow and Financial Flexibility

Reviewed by Sasha Jovanovic

- On November 19, 2025, PulteGroup announced its Board of Directors voted to increase its quarterly dividend by 18% to US$0.26 per share, effective with the payment scheduled for January 6, 2026, to shareholders of record on December 16, 2025.

- This meaningful dividend increase signals PulteGroup’s continued commitment to returning value to shareholders and maintaining a strong financial position in the homebuilding sector.

- We’ll look at how the significant dividend increase highlights PulteGroup’s confidence in its cash flow and future financial flexibility.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PulteGroup Investment Narrative Recap

To be a PulteGroup shareholder, you need to believe in the company's ability to capitalize on long-term U.S. housing demand, particularly as it targets strong demographics like active adults and adapts to consumer migration trends. The recent 18% dividend hike is a show of confidence in its cash flow but, given near-term pressure on earnings and orders, doesn’t alter the fact that volatile homebuyer demand remains the key short-term catalyst and risk for the business.

The news of PulteGroup’s expansion into Cincinnati, announced just prior to the dividend increase, stands out as especially relevant. Broadening its geographic reach helps offset softness in markets like Texas and California, supporting revenue stability even when regional risks are elevated. Investors are watching closely as the company rolls out new communities for diverse buyer segments in this Midwestern market.

However, amid upbeat headlines, it’s important to stay alert to how ongoing affordability pressures and weakening net new orders could affect near-term results…

Read the full narrative on PulteGroup (it's free!)

PulteGroup's narrative projects $17.7 billion revenue and $2.2 billion earnings by 2028. This requires a 0.0% annual revenue growth rate and a $0.5 billion decrease in earnings from $2.7 billion today.

Uncover how PulteGroup's forecasts yield a $137.38 fair value, a 14% upside to its current price.

Exploring Other Perspectives

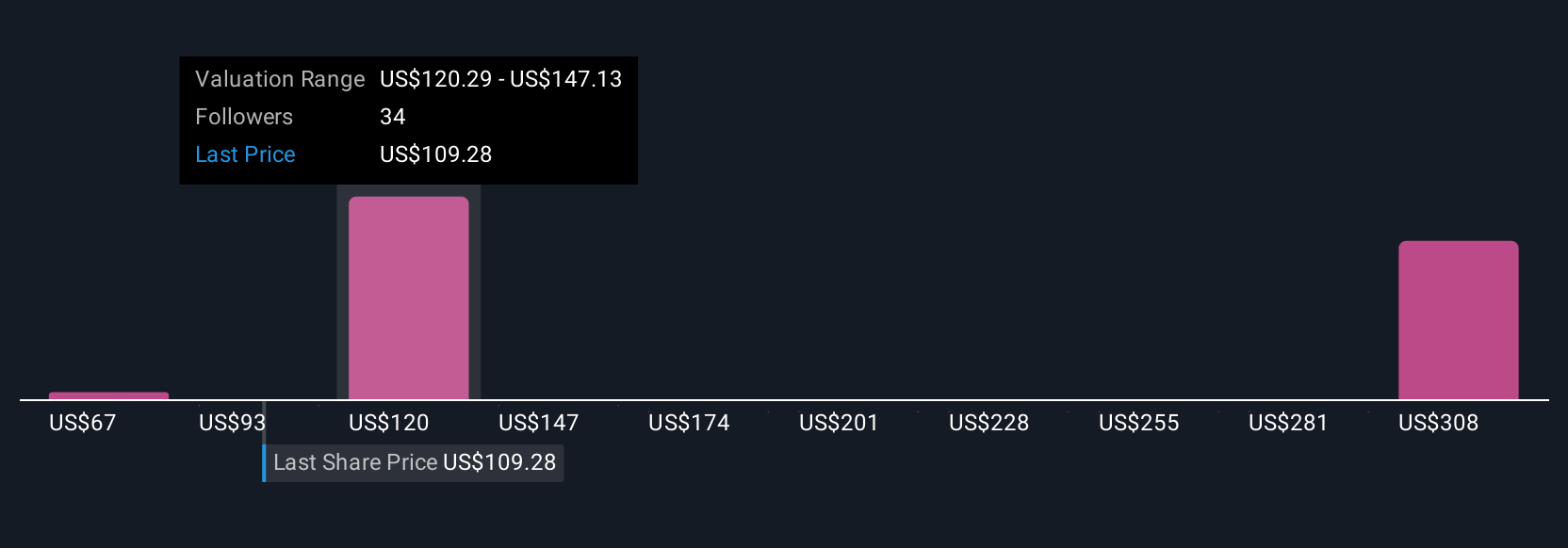

Simply Wall St Community members provide nine fair value estimates for PulteGroup, ranging from US$88 to US$153.38 per share, reflecting broad opinion. As many weigh the company’s expansion efforts, the persistent risk of unpredictable homebuyer demand could influence future results in ways that merit closer inspection by readers seeking different viewpoints.

Explore 9 other fair value estimates on PulteGroup - why the stock might be worth 27% less than the current price!

Build Your Own PulteGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PulteGroup research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PulteGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PulteGroup's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives