- United States

- /

- Consumer Durables

- /

- NYSE:MTH

Meritage Homes (MTH) Margin Drop Challenges Bullish Narratives on Operational Efficiency

Reviewed by Simply Wall St

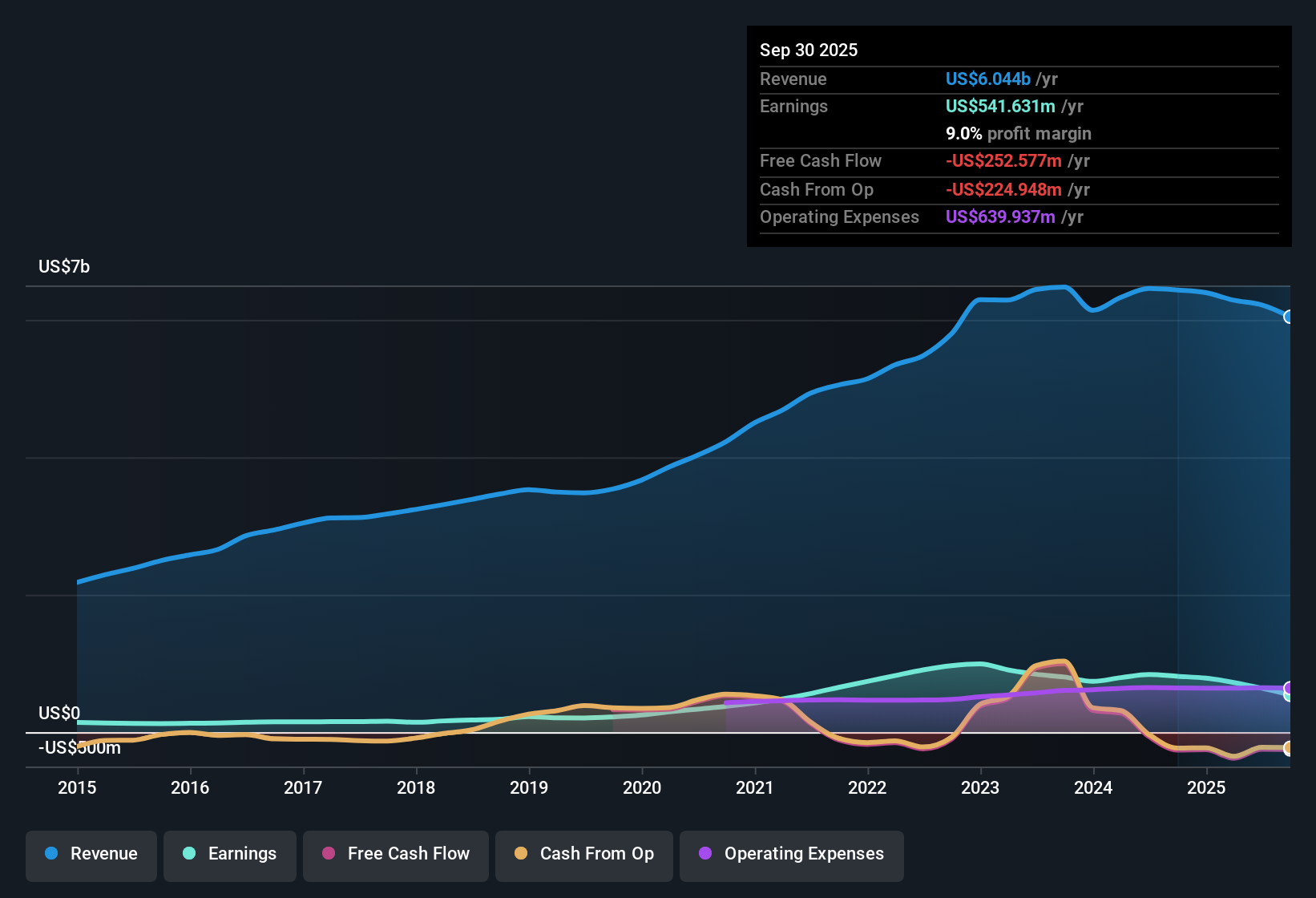

Meritage Homes (MTH) has reported average revenue growth forecasts of 6.3% per year and earnings growth of 2.3% annually, both trailing the broader US market expectations of 10.2% and 15.6% respectively. Over the past five years, the company’s earnings grew at a 5.3% yearly pace. Most recently, Meritage experienced a decline in earnings, with net profit margins now at 9%, down from 12.6% a year ago. The cooling in growth rates and margin compression highlight a company known for historical strength but now facing a tougher earnings environment.

See our full analysis for Meritage Homes.Next up, we’ll see how these numbers stack up against the core market story and community narratives. Expectation meets reality, and surprises may be in store.

See what the community is saying about Meritage Homes

Share Price Lags Analyst Target

- With Meritage Homes trading at $67.08, the stock sits 20% below the current analyst price target of $83.88. This creates a significant valuation gap despite recent profitability weakness.

- Analysts' consensus view highlights that:

- Their price target is grounded in projections for 4.8% annual revenue growth and margins narrowing to 7.7% over the next three years, even as the current profit margin has already slipped below 10%.

- Despite consensus estimates indicating a decline in earnings and profit margins through 2028, analysts are still expecting the share price to rise. This suggests they see present challenges as temporary rather than structural setbacks.

Consensus expects the current gap to the target price could close quickly if results stabilize as forecast. Get the full consensus breakdown before making your next move. 📊 Read the full Meritage Homes Consensus Narrative.

Margin Compression Defies Efficiency Gains

- Net profit margins have compressed to 9% from 12.6% a year earlier, even as the company touts construction cycle improvements and process efficiencies dropping build times to roughly 110 days per home.

- The analysts' consensus narrative points out:

- Ongoing investment in geographic diversification and improved operational efficiency should theoretically help stabilize or expand margins. However, recent persistent affordability challenges and rising land costs have instead led to a sizable 480 basis point drop in gross margin and a 35% decrease in net earnings, directly rebutting the bullish hope that operational gains alone can offset tough market conditions.

- While the efficiency improvements are meaningful, their upside is currently absorbed by macro pressures such as buyer hesitation and increased competition, limiting the positive readthrough investors might expect from operational wins.

Peer and Sector Discounts Are Widening

- Meritage trades at a price-to-earnings (PE) ratio of 8.8x, notably below both its peer group average of 13.3x and the broader US Consumer Durables industry average of 10.7x. This is a rare discount for a builder with historically strong execution.

- According to the consensus narrative:

- The stock’s lower valuation is at odds with Meritage’s double-digit community count expansion and focus on entry-level homes, which are designed to capture stable long-term demand and support revenue resilience even in a challenging landscape.

- Despite this attractive relative value, the market remains hesitant, likely due to visibility and margin worries, making it important for investors to weigh discounted valuation metrics against continued execution risks in the months ahead.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Meritage Homes on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Use just a few minutes to turn your insights into a personal narrative and make your view heard. Do it your way

A great starting point for your Meritage Homes research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Meritage’s declining profit margins, below-market earnings growth, and widening valuation discount indicate unstable performance and weak resilience compared to steadier peers.

If you want more confidence in your portfolio, use stable growth stocks screener (2122 results) to zero in on companies with reliable growth and stronger fundamentals through ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTH

Meritage Homes

Designs and builds single-family attached and detached homes in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives