- United States

- /

- Consumer Durables

- /

- NYSE:MTH

Meritage Homes (MTH): Exploring Valuation as Investors Brace for Quarterly Results and Potential Surprises

Reviewed by Simply Wall St

Meritage Homes (MTH) is in the spotlight this week as it gears up to announce its latest quarterly financial results. Investors are watching closely, given the company’s history of outperforming Wall Street expectations even as industry revenue growth slows.

See our latest analysis for Meritage Homes.

Meritage Homes shares recently traded at $71.41, and while the year-to-date share price return stands at -6.05%, the longer-term total shareholder return tells a different story, with gains of nearly 96% over three years. The recent mild uptick suggests that investors are considering both cyclical risks and the company’s track record of beating expectations as the next results approach.

If you’re eyeing new opportunities in housing or adjacent sectors, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

While Meritage’s recent performance has lagged, its history of earnings beats and a share price below analyst targets raises a pressing question. Is there hidden value here, or is the market already factoring in every ounce of future growth?

Most Popular Narrative: 14.9% Undervalued

With Meritage Homes' widely followed narrative assigning a fair value of $83.88 versus the last close at $71.41, the market appears to be discounting the company's resilient outlook. This gap suggests analysts see more potential ahead than the current trading price reflects.

Meritage's significant and accelerating growth in community count, including double-digit expansion for both 2025 and 2026, directly addresses the persistent undersupply of housing in the U.S. This positions the company to capture increased new-home demand and drive future revenue and earnings growth as macro headwinds abate.

Want to know the hidden assumptions fueling this upbeat view? The narrative’s bold forecast relies on a mix of volume growth and higher multiples rarely seen in today's cautious housing sector. Which critical financial levers truly justify this price target? Dive in to uncover what the consensus suspects lies beneath the headline numbers.

Result: Fair Value of $83.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability challenges and potential demand shocks from high mortgage rates remain key risks that could undermine Meritage’s bullish narrative.

Find out about the key risks to this Meritage Homes narrative.

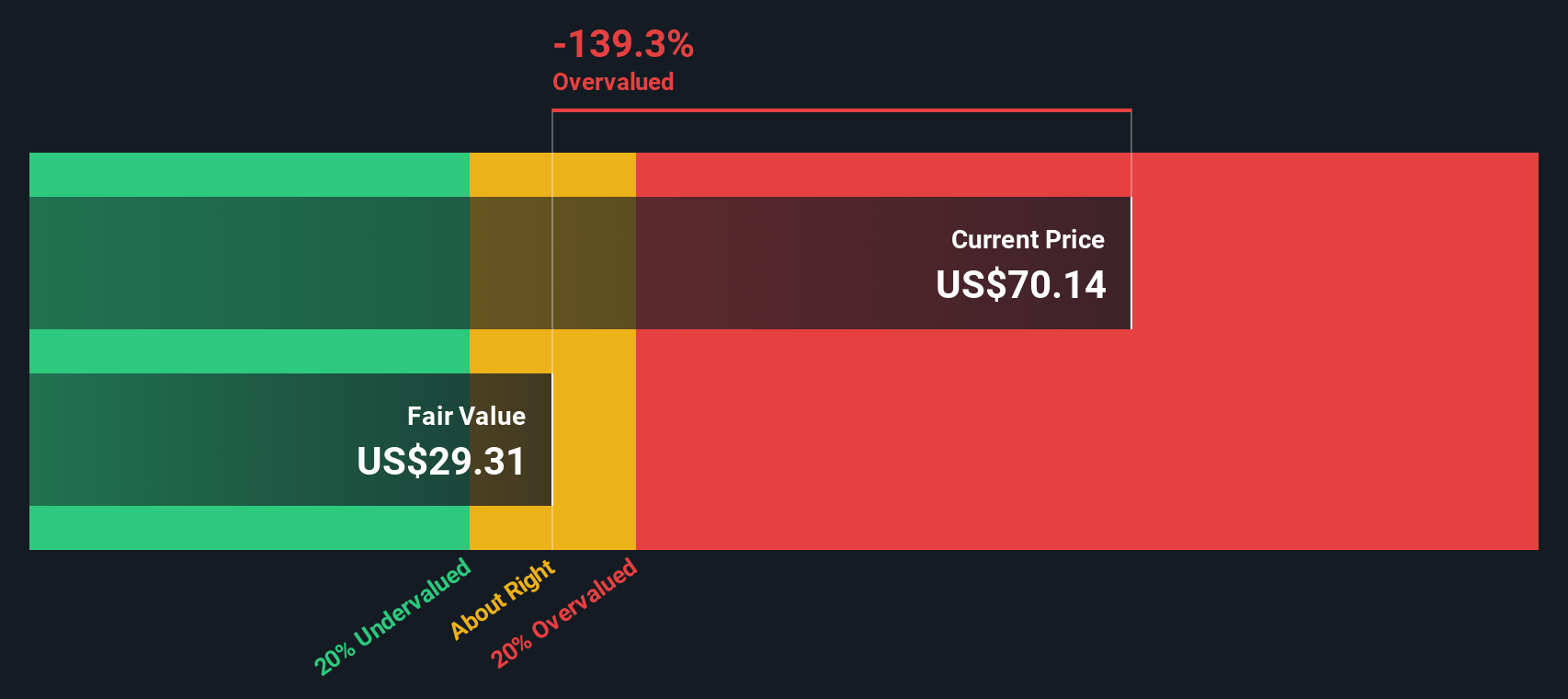

Another View: What Does the SWS DCF Model Say?

Taking a different approach, the SWS DCF model presents a contrasting perspective. By estimating the present value of all future cash flows, the model actually suggests Meritage Homes is trading above its estimated fair value. Could this signal hidden downside, or does it overlook the resilience of the housing cycle?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meritage Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meritage Homes Narrative

If you think the story looks different through your own lens or want to test the data for yourself, you can build a personal narrative in under three minutes. Do it your way

A great starting point for your Meritage Homes research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to uncover stock picks primed for tomorrow’s market leadership. Don’t miss your chance to spot game-changing potential before the crowd catches on.

- Capture high-yield opportunities while markets shift by reviewing these 19 dividend stocks with yields > 3% targeting companies with robust income streams and sustainable payouts.

- Stay one step ahead of the next disruption by exploring these 27 AI penny stocks featuring innovative businesses pushing the boundaries of artificial intelligence.

- Profit from market mispricing today by checking out these 869 undervalued stocks based on cash flows and find undervalued stocks the smart money is eyeing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTH

Meritage Homes

Designs and builds single-family attached and detached homes in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives