- United States

- /

- Consumer Durables

- /

- NYSE:MHK

CFO Succession Plan Might Change the Case for Investing in Mohawk Industries (MHK)

Reviewed by Sasha Jovanovic

- Mohawk Industries has announced that Chief Financial Officer James F. Brunk will retire effective April 1, 2026, with Nicholas P. Manthey, current Vice President of Corporate Finance and Investor Relations, named as his successor and Brunk remaining as a senior advisor to aid the transition.

- This planned leadership change marks a pivotal moment, as a CFO transition can signal both continuity and new direction in financial strategy for a global manufacturing leader.

- We'll examine how the upcoming CFO succession and planned advisory role could influence Mohawk Industries' investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Mohawk Industries Investment Narrative Recap

To be a Mohawk Industries shareholder, you need to believe the company can recover from recent industry headwinds and deliver on its promise of operational efficiency, innovation, and global growth despite ongoing margin pressures and demand uncertainty. The planned CFO transition, with an experienced internal successor and extended advisory support, is a non-material short-term event, likely ensuring continuity as Mohawk addresses its most pressing catalyst: a recovery in residential and commercial demand, while higher input costs and margin volatility remain the biggest risks.

Among recent company announcements, the October 2025 Q3 earnings results are most relevant; they reported steady revenue but declining net income and margins. This ties closely to the catalysts and risks at play, highlighting the pressures on profitability that the incoming CFO will need to manage during the transition.

However, beyond leadership changes, investors should be aware that persistent pricing pressure and margin compression could...

Read the full narrative on Mohawk Industries (it's free!)

Mohawk Industries' narrative projects $11.5 billion revenue and $827.2 million earnings by 2028. This requires 2.5% yearly revenue growth and a $352.9 million earnings increase from $474.3 million.

Uncover how Mohawk Industries' forecasts yield a $138.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

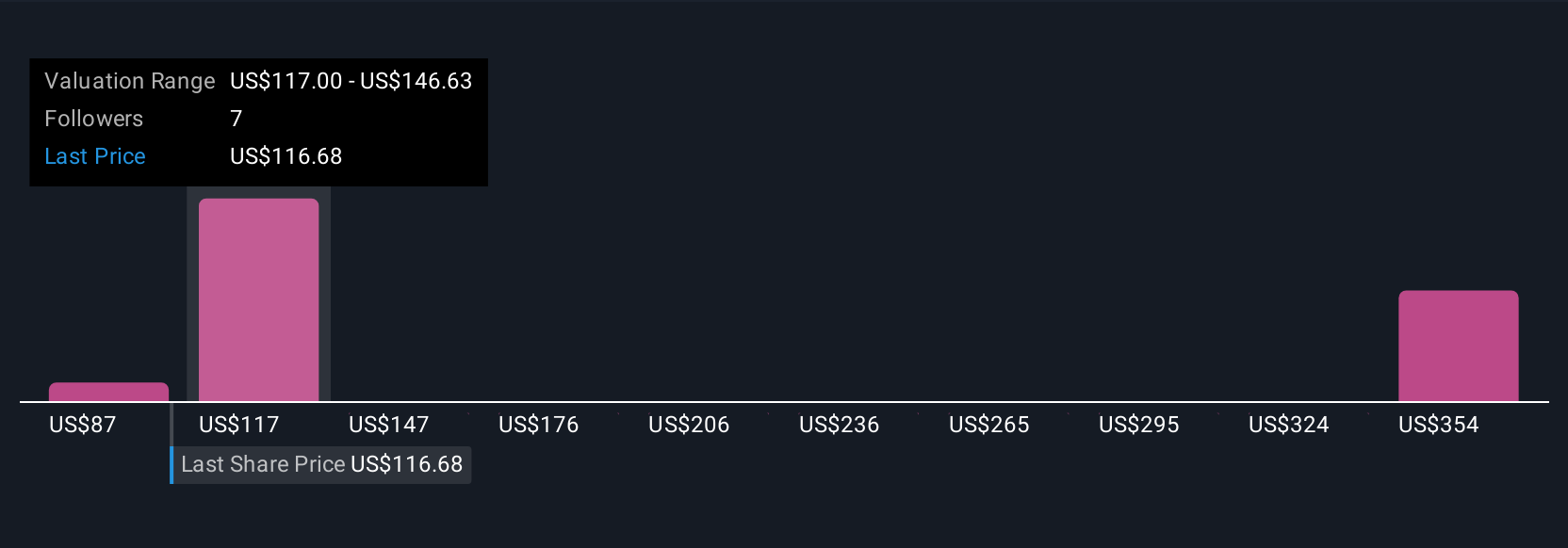

Simply Wall St Community estimates for Mohawk’s fair value span US$87.37 to US$164.21, reflecting three differing outlooks. While earnings growth is forecast to improve, many are still focused on whether margin recovery can outpace ongoing cost challenges.

Explore 3 other fair value estimates on Mohawk Industries - why the stock might be worth 20% less than the current price!

Build Your Own Mohawk Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mohawk Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mohawk Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mohawk Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHK

Mohawk Industries

Designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives