- United States

- /

- Consumer Durables

- /

- NYSE:LZB

La-Z-Boy (LZB): Examining Valuation Disconnect After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for La-Z-Boy.

Looking at the bigger picture, La-Z-Boy's momentum has faded over recent months. A 1-year total shareholder return of -29.9% reflects both ongoing market pressure and shifting investor sentiment. Despite a strong three-year streak, more recent price performance suggests caution is taking hold.

If you’re on the lookout for new opportunities in the market, now’s the time to broaden your view and discover fast growing stocks with high insider ownership

With shares down and analysts assigning a price target far above current levels, the real question becomes whether La-Z-Boy is now trading at a discount or if the market has already priced in the company's future prospects.

Most Popular Narrative: 28.4% Undervalued

The most widely-followed narrative paints a striking disconnect: La-Z-Boy’s fair value is pegged at $41.00, well above the last close of $29.34. This sets the stage for deeper questions about what really drives the gap and where fundamental shifts could appear next.

Enhanced brand campaigns and modernization initiatives, including a refreshed brand identity and recognition as Newsweek's #1 furniture retailer, increase the company's appeal to both aging consumers seeking comfort/ergonomics and to younger homeowners, which could drive sustained top-line growth.

Want to know how La-Z-Boy could defy headwinds in a sluggish market? The narrative is built on ambitious growth targets and expanding profit margins. These numbers may surprise even seasoned investors. Unlock which bold projections underpin today’s valuation mystery.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in store traffic or prolonged promotional activity could limit revenue growth and compress margins, which would challenge the optimistic analyst outlook.

Find out about the key risks to this La-Z-Boy narrative.

Another View: What About Price Ratios?

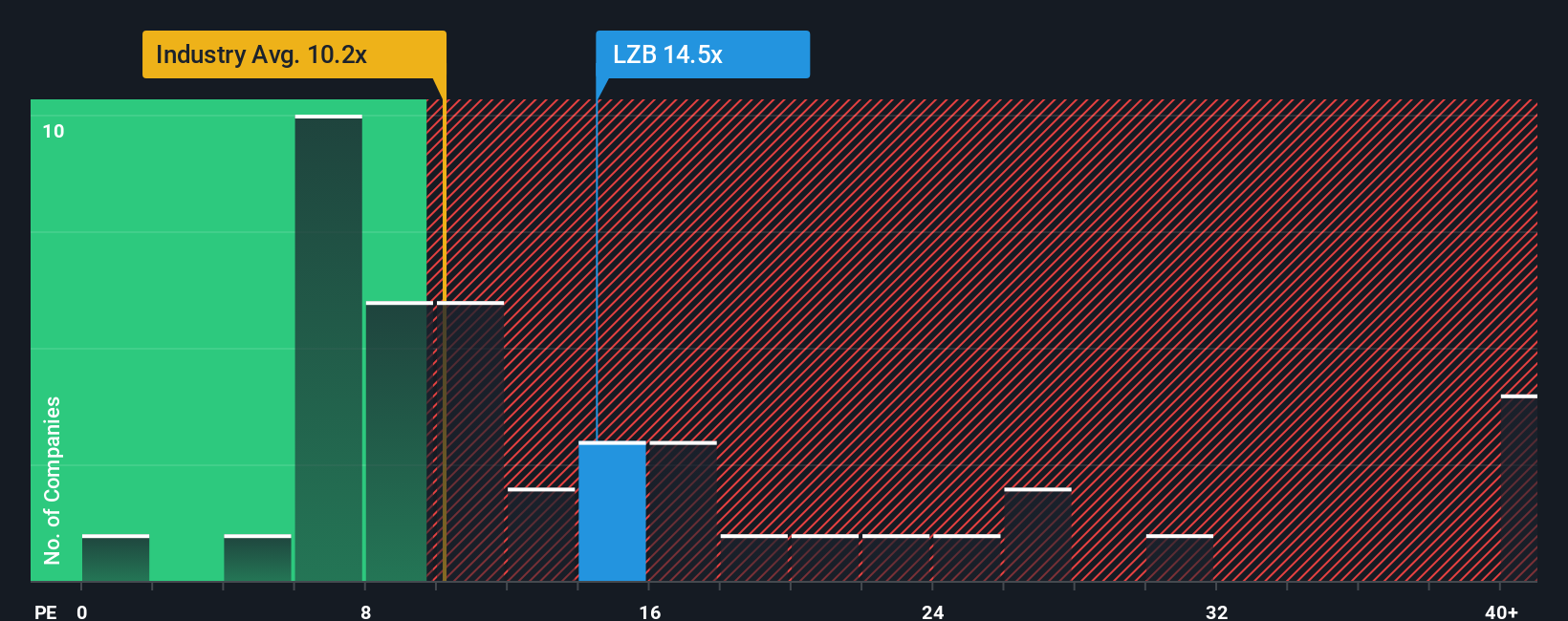

Looking through the lens of price-to-earnings, La-Z-Boy trades at 13.2x, higher than peer and industry averages near 10x and 11.6x. Although close to its fair ratio of 13.5x, this premium raises questions. Is the market overlooking risk, or is there hidden value yet to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own La-Z-Boy Narrative

If the consensus story does not fit your outlook or you prefer to dig into the numbers firsthand, you can assemble your own analysis in just a few minutes, so why not Do it your way

A great starting point for your La-Z-Boy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities do not wait for anyone. Maximize your investment potential by uncovering unique stocks and emerging trends that most investors overlook. Start exploring today before momentum shifts.

- Tap into rapid breakthroughs in artificial intelligence by reviewing these 27 AI penny stocks, which could shape the way industries innovate and automate.

- Accelerate your search for value with these 894 undervalued stocks based on cash flows, highlighting stocks that may trade below their true worth according to projected cash flows and fundamentals.

- Harness the income power of reliable companies by checking out these 18 dividend stocks with yields > 3% with yields above 3% and a track record of consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LZB

La-Z-Boy

Manufactures, markets, imports, exports, distributes, and retails upholstery furniture products in the United States, Canada, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives