- United States

- /

- Luxury

- /

- NYSE:LEVI

Should Levi Strauss's (LEVI) New 2030 Water Goals Prompt Investors to Reassess Environmental Strategy?

Reviewed by Sasha Jovanovic

- Levi Strauss & Co. recently announced new 2030 sustainability goals, aiming to cut absolute freshwater use by 15% in its supply chain from 2022 levels and ensuring 40% of water in manufacturing is recycled or reused, along with new supplier standards and transparent reporting.

- This move highlights the company’s increased focus on operational resilience and environmental impact, reflecting broader apparel industry pressures regarding climate change and resource management.

- We'll explore how Levi Strauss's ambitious water reduction and recycling targets may influence its investment outlook and future growth prospects.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Levi Strauss Investment Narrative Recap

To be a shareholder in Levi Strauss today, you need to believe in the company’s global brand strength, long-term relevance of denim, and ability to adapt to evolving consumer trends. While Levi’s new 2030 sustainability targets for water reduction and recycling show leadership on environmental issues, this update is not expected to materially affect the most critical near-term catalyst, its shift to a Direct-to-Consumer business model, or the main risk linked to denim’s fashion cycles and concentration of revenue in its core brand. Among recent announcements, the appointment of Chris Callieri as Senior VP and Chief Supply Chain Officer directly relates to Levi’s 2030 water stewardship goals. Supply chain leadership is crucial as stricter supplier standards and increased transparency may impact costs, execution, and how fast Levi achieves these targets, all factors that investors watch closely given ongoing pressures on gross margin and operational resilience. But before assuming these changes offer lasting protection, investors should also be mindful of how quickly...

Read the full narrative on Levi Strauss (it's free!)

Levi Strauss' outlook anticipates $6.8 billion in revenue and $769.0 million in earnings by 2028. This forecast is based on a 1.4% annual revenue growth rate and a $345.9 million increase in earnings from the current $423.1 million.

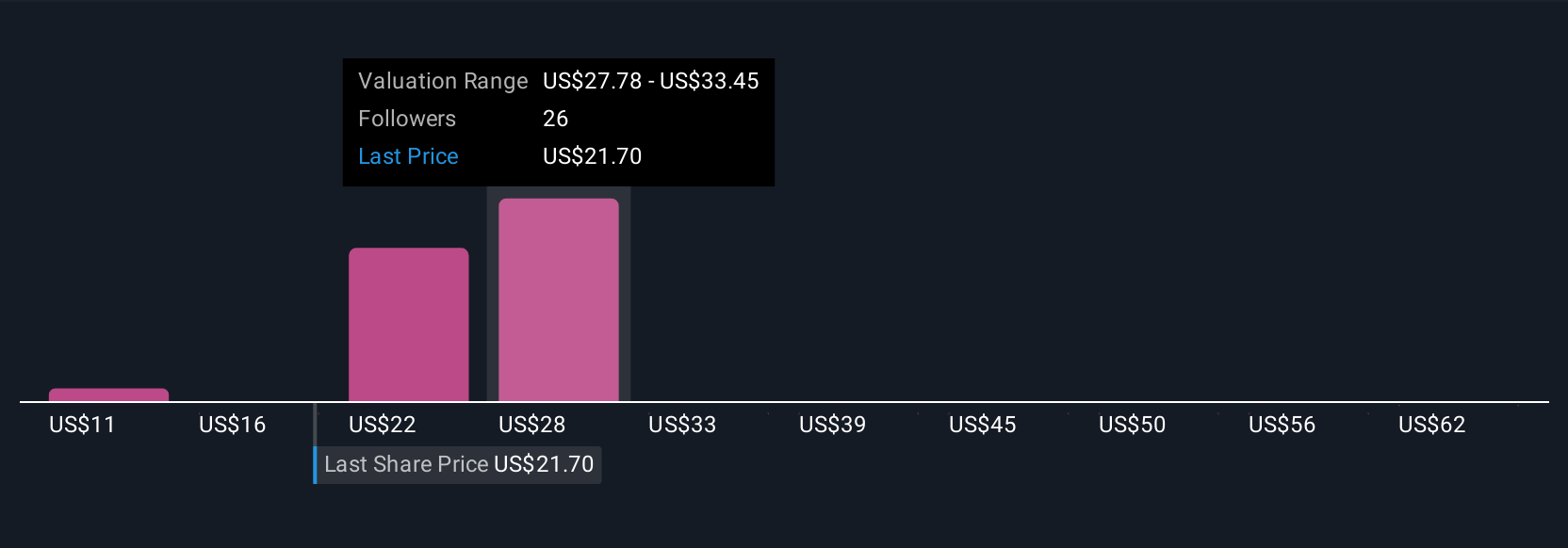

Uncover how Levi Strauss' forecasts yield a $26.79 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community estimate Levi Strauss’s fair value from as low as US$10.77 to as high as US$1,010.96. Even with such a wide span, the company’s reliance on its core denim brand remains a common challenge flagged by analysts as a critical factor for future results.

Explore 8 other fair value estimates on Levi Strauss - why the stock might be a potential multi-bagger!

Build Your Own Levi Strauss Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Levi Strauss research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Levi Strauss research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Levi Strauss' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEVI

Levi Strauss

Designs, markets, and sells apparels and related accessories for men, women, and children in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives