- United States

- /

- Luxury

- /

- NYSE:LEVI

Is Levi’s Pullback a Buying Opportunity After a 16.9% Drop This Month?

Reviewed by Bailey Pemberton

- Wondering whether Levi Strauss stock is a smart buy or overpriced right now? Let’s dig in and see what’s really driving its value.

- The shares are up 16.4% year-to-date and an impressive 21.5% over the past year, though the last month has seen a pullback of 16.9% as some investors rethink the outlook.

- Recent headlines about global retail industry shifts and changing consumer behavior have been swirling around Levi’s, giving both bulls and bears something to talk about. These factors have added momentum and a dash of uncertainty to the recent moves in the stock price.

- Levi Strauss scores a strong 6 out of 6 on our undervaluation checks, but how do these methods stack up against each other? Is there a smarter way to judge the stock’s true value? Let’s dive into different valuation approaches next, and stick around for a perspective that goes beyond just the numbers.

Approach 1: Levi Strauss Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today, reflecting what those future dollars are worth in present terms. This approach focuses on the company’s ability to generate free cash in the years ahead.

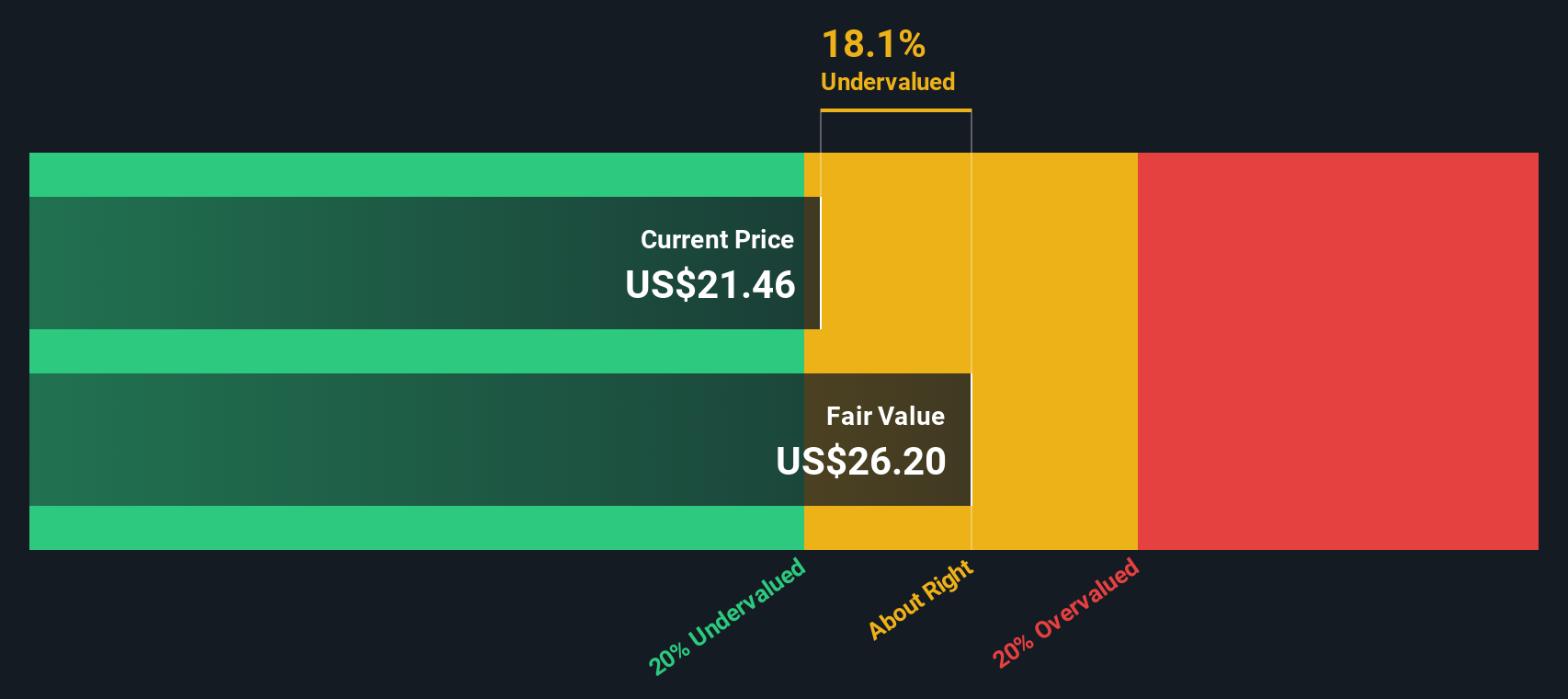

For Levi Strauss, recent data shows a Last Twelve Months Free Cash Flow of $283.8 million. Analyst projections put this figure at $468.3 million in 2026 and $539.5 million in 2027. Moving even further out, Simply Wall St extrapolates these numbers and estimates Free Cash Flow will rise to around $846.1 million by 2035. All projections are in US dollars, and after discounting those future flows, the calculated fair value for Levi Strauss stock is $25.77 per share.

Given the current market price, the DCF suggests the stock is trading at a 21.3% discount to its intrinsic value. This implies the stock is meaningfully undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Levi Strauss is undervalued by 21.3%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Levi Strauss Price vs Earnings (PE Ratio)

For a profitable company like Levi Strauss, the Price-to-Earnings (PE) ratio is one of the best-known ways to gauge valuation. This metric tells us how much investors are willing to pay for each dollar of the company’s earnings, making it a go-to tool for comparing similar businesses in the same sector. Generally, companies with stronger growth prospects or lower risk profiles tend to command higher PE multiples, while those with slower growth or more risk are assigned lower PE ratios.

Levi Strauss currently trades at a PE ratio of 15.2x. That is notably below the Luxury industry average of 19.5x and also well under the average PE of its listed peers, which sits at 40.7x. However, context is key. Using just industry or peer averages can miss the individual nuances that actually move the needle for Levi’s valuation.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. Unlike a simple peer or industry comparison, the Fair Ratio adjusts for Levi’s specific growth outlook, profit margins, risk factors, its spot in the industry, and even its market cap. The Fair Ratio calculated for Levi’s is 18.7x, which is a tailored benchmark that reflects not just where Levi's stands now but also where it could be headed.

Comparing Levi’s current PE of 15.2x to the Fair Ratio of 18.7x suggests the stock is undervalued on this basis. The market may not be fully appreciating the company’s earnings power and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Levi Strauss Narrative

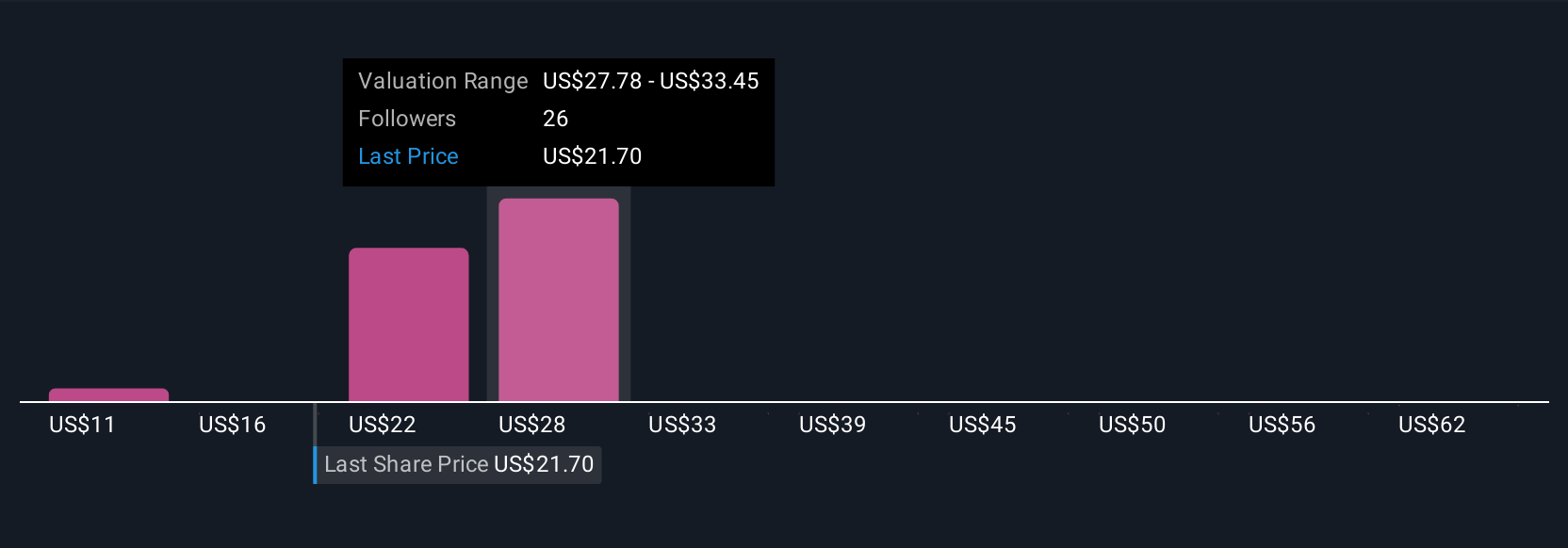

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, dynamic story that reflects your personal perspective on a company, going beyond just financial ratios by linking your real-world outlook to forecasts for future revenue, profit margins, and ultimately, a fair value estimate.

Narratives turn static numbers into meaningful insights by connecting what you believe about a company’s business model, market position, and risks to specific financial assumptions, resulting in a fair value calculation you control. On Simply Wall St’s Community page, used by millions of investors, you can create and follow Narratives in just a few clicks. This makes it easy to adapt your investment thesis as the news, earnings, or forecasts change.

This approach helps you decide when to buy or sell by comparing your Narrative’s fair value to the current price, and since Narratives update dynamically with new information, you always have the freshest view. For example, looking at Levi Strauss, one investor might be highly optimistic, forecasting strong rebound sales and set a Narrative fair value up at $28.00, while another might focus on risks from tariffs and shifting consumer tastes, landing at just $19.00. This demonstrates how different stories lead to different, actionable valuations.

Do you think there's more to the story for Levi Strauss? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEVI

Levi Strauss

Designs, markets, and sells apparels and related accessories for men, women, and children in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives