- United States

- /

- Luxury

- /

- NYSE:KTB

Is Kontoor Brands Offering Value After Recent Global Expansion News and a 5.9% Price Decline?

Reviewed by Bailey Pemberton

- If you are wondering whether Kontoor Brands could be a hidden value opportunity or just another stock trading at a premium, you are in the right place.

- The stock has pulled back slightly in the short term with a 5.9% decline over the past week and a 1.7% dip over the last month, but it is still up an impressive 140.4% over three years.

- Recently, media coverage has highlighted Kontoor Brands’ strategic focus on expanding its Wrangler and Lee brands, including new product launches and international growth initiatives. These efforts help provide context for the recent price fluctuations. Such developments have put the company in the spotlight and may be influencing how investors perceive its risk and long-term prospects.

- KONTOOR’s valuation score stands at 4 out of 6, based on our checks of whether it is undervalued on key measures. Next, we will break down what that actually means using standard approaches. We will then reveal an even more insightful way to gauge the stock’s real intrinsic worth.

Approach 1: Kontoor Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future free cash flows and discounting them back to today, reflecting the time value of money. For Kontoor Brands, this involves looking ahead at the company's ability to generate cash and weighing those future earnings in today's dollars.

According to the analysis, Kontoor Brands generated $290.2 million in free cash flow over the last twelve months. Analysts provide direct forecasts up to 2027, when free cash flow is expected to reach $375.7 million. After that, projections are extrapolated, estimating free cash flow could grow to roughly $506.4 million in 2035. These projections represent a steady increase and reflect both analyst consensus and reasonable long-term assumptions.

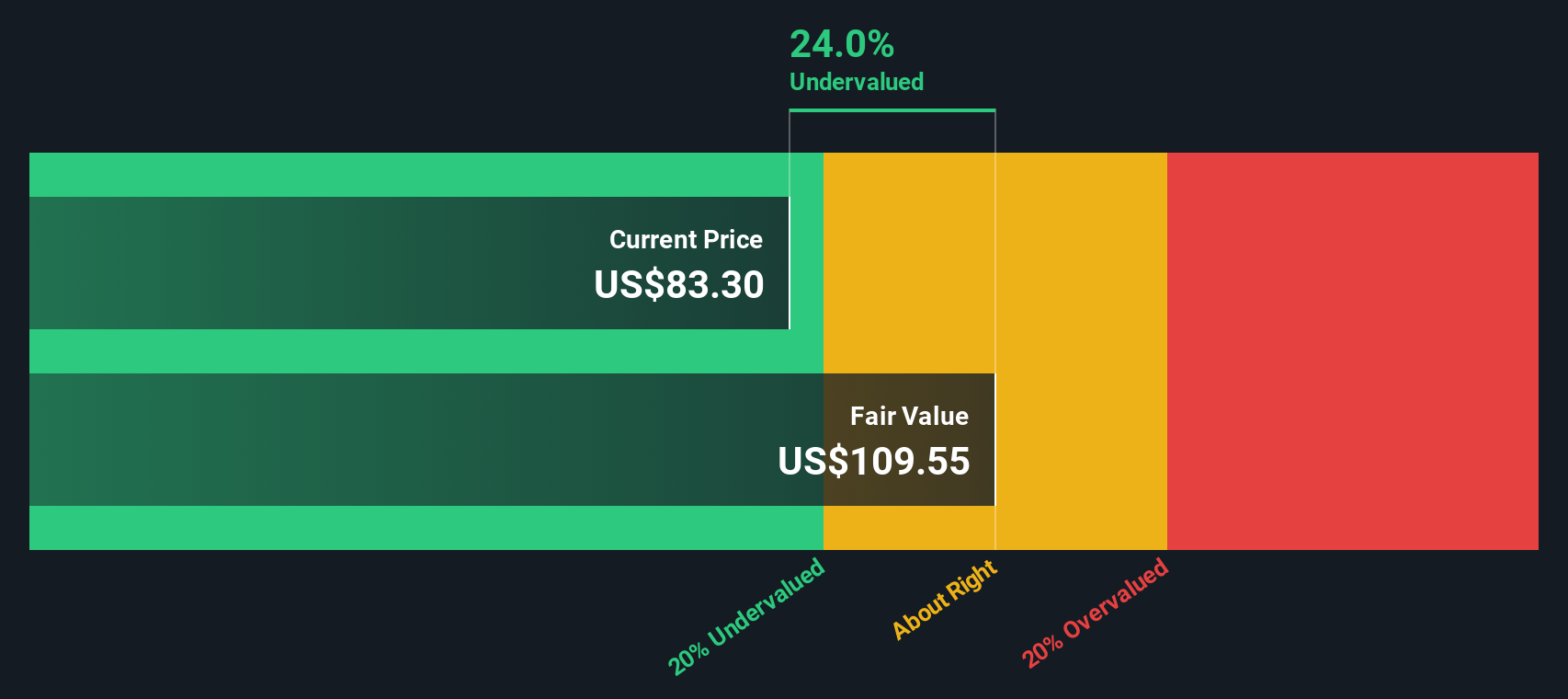

Using this two-stage DCF approach, the estimated intrinsic value of Kontoor Brands stock is $109.24 per share. This is approximately 25.9% higher than the current share price and suggests the market may be underappreciating the company’s future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kontoor Brands is undervalued by 25.9%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Kontoor Brands Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Kontoor Brands because it helps investors assess whether the stock price fairly reflects the company's earnings power. It is especially relevant for established firms generating consistent profit, offering a direct measure of how much the market is willing to pay for a dollar of earnings.

A "normal" or "fair" PE ratio is influenced by factors such as growth expectations and company-specific risks. Companies with stronger growth prospects or lower risk profiles often command higher PE multiples, while slower-growing or riskier businesses tend to trade at lower ones.

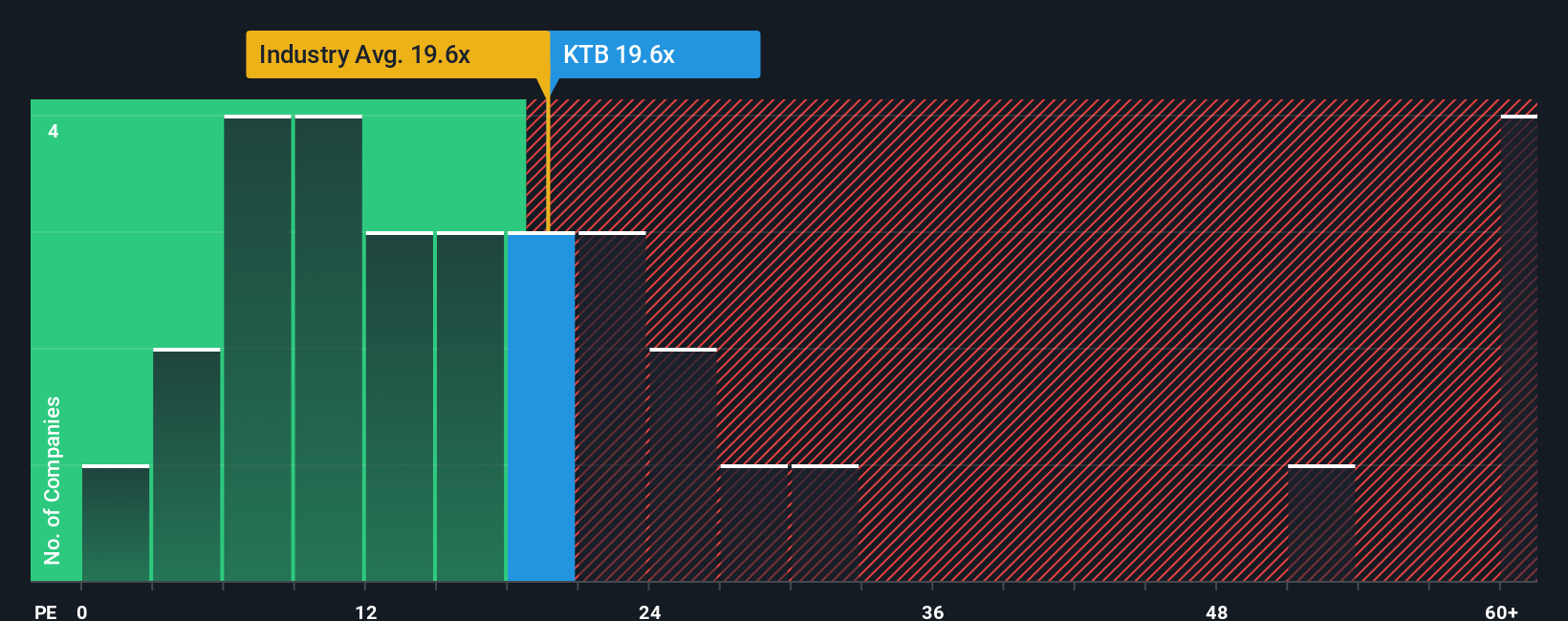

Currently, Kontoor Brands trades at a PE ratio of 17.9x. Compared to the luxury industry average of 19.5x and its peer group average of 24.3x, Kontoor’s multiple suggests a discount. However, these simple averages do not always account for important context, such as the company's unique growth outlook or risk profile.

That is where Simply Wall St’s "Fair Ratio" comes in. This proprietary metric determines what a reasonable PE multiple should be for Kontoor Brands, factoring in its earnings growth, profit margins, market capitalization, industry classification, and risk. Unlike broad industry or peer group benchmarks, the Fair Ratio offers a more nuanced assessment that adjusts for the specific realities facing Kontoor Brands right now.

With a Fair Ratio of 16.1x, Kontoor Brands is currently trading just above this analytical benchmark. The difference is not large, which means the stock’s valuation is right in line with expectations based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kontoor Brands Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a personal investment story—your viewpoint about Kontoor Brands, backed by your assumptions about its future revenue, earnings, and profit margins. Instead of just relying on numbers, a Narrative connects the company’s story (like new product launches or digital expansion) directly to your forecast and then translates that into a fair value per share.

Narratives are simple and accessible tools on the Simply Wall St Community page, trusted by millions of investors. They let you clearly articulate your investment thesis, factor in key trends and risks, and instantly see how your outlook translates into a fair value. This empowers you to make more informed buy or sell decisions based on how your Fair Value compares to the current market price.

Best of all, Narratives update dynamically as news, earnings releases, or industry shifts occur. This ensures your perspective and valuations always reflect the latest information. For Kontoor Brands, one Narrative projects a fair value as high as $99.0 per share, envisioning accelerated digital and international growth, while another sees just $49.0, focusing on legacy brand risks, digital disruption, and cost pressures.

Do you think there's more to the story for Kontoor Brands? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kontoor Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KTB

Kontoor Brands

A lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives