- United States

- /

- Consumer Durables

- /

- NYSE:KBH

What KB Home (KBH)'s New $1.2 Billion Credit Agreement Means for Shareholders

Reviewed by Sasha Jovanovic

- On November 12, 2025, KB Home entered into a new revolving credit agreement with Bank of America providing up to US$1.2 billion in commitments, replacing its prior facility, and also extended the maturity of its US$360 million senior unsecured term loan to November 12, 2029.

- These debt financing activities enhance KB Home's liquidity and financial flexibility, positioning the company to fund operations or expansion as market conditions evolve.

- We’ll assess how this substantial increase in available credit could impact KB Home’s outlook for growth, resilience, and capital deployment.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

KB Home Investment Narrative Recap

For KB Home shareholders, the central belief rests on the company’s ability to regain homebuyer demand and manage costs in a market with uneven consumer confidence and softer guidance. The recent upsizing of its revolving credit facility and extension of loan maturities provide extra liquidity, though the impact on immediate catalysts like sales volume recovery and margin stabilization may be limited if demand headwinds persist. The most significant short-term risk remains weak consumer sentiment, which could pressure revenues and stall any turnaround in sales momentum.

Among recent announcements, KB Home’s opening of new communities in Modesto, California, stands out for its focus on energy-efficient design and flexible personalization. While impressive, such product launches are most effective as catalysts when broader market demand supports higher absorption rates and price stability, highlighting the importance of a healthy consumer backdrop.

On the other hand, investors should also be aware that regional shifts in demand and pricing, especially if prolonged, can still...

Read the full narrative on KB Home (it's free!)

KB Home's narrative projects $6.8 billion revenue and $496.4 million earnings by 2028. This requires a 0.2% yearly revenue decline and a $125.1 million decrease in earnings from $621.5 million.

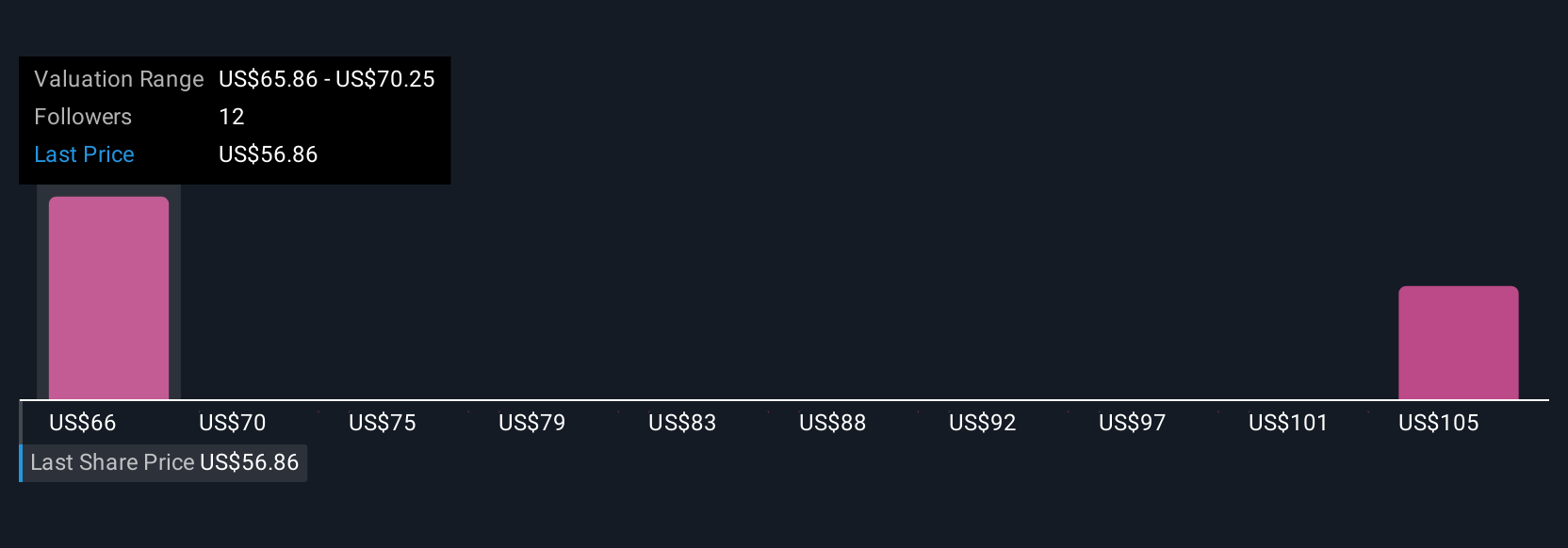

Uncover how KB Home's forecasts yield a $64.67 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for KB Home span from US$46.20 to over US$172,746 across 4 different viewpoints. As build-time improvements are seen as a catalyst, the potential for faster inventory turnover could influence future expectations and performance. Consider these diverse perspectives as you form your own view.

Explore 4 other fair value estimates on KB Home - why the stock might be a potential multi-bagger!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives