- United States

- /

- Consumer Durables

- /

- NYSE:KBH

Can KB Home’s (KBH) Personalized Build-to-Order Model Strengthen Its Competitive Edge?

Reviewed by Sasha Jovanovic

- KB Home recently announced several new community grand openings across the United States, including Eagle Creek in Denton, Texas, The Traditions within Teravalis in Buckeye, Arizona, Ladera in Menifee, California, Greenleaf Grove in Bothell, Washington, and Canterbury and Cambridge in Roseville, California, each featuring personalized home designs, modern amenities, and energy-efficient construction.

- An interesting highlight is KB Home's differentiation through its Build-to-Order approach, where buyers can personalize their homes, supported by a high-ranking in customer satisfaction surveys and a focus on energy-efficient, healthy living environments.

- We’ll explore how KB Home’s expanding community portfolio and customer-centric model may influence its future growth outlook and valuation.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

KB Home Investment Narrative Recap

Owning KB Home stock often comes down to believing in a sustained housing demand from buyers seeking new homes with customization options, alongside a recovery in consumer confidence. Recent grand openings in multiple states showcase KB Home's ongoing expansion, but with earnings and revenue trending lower and a softer selling environment, these announcements have not materially changed the biggest near-term catalyst, improved builder efficiencies, nor reduced the key risk of declining consumer demand due to macroeconomic uncertainty.

Out of the recent announcements, the unveiling of Eagle Creek in Denton, Texas stands out, offering energy-efficient homes and extensive amenities. While this reflects the company’s continued push into active, desirable markets, consistency in monetizing these initiatives quickly enough to offset softer demand remains closely tied to the short-term outlook.

Yet, investors should also recognize that, despite these positive developments, ongoing pressures on home deliveries and demand, especially in select regions, mean…

Read the full narrative on KB Home (it's free!)

KB Home's outlook anticipates $6.8 billion in revenue and $496.4 million in earnings by 2028. This reflects a -0.2% annual revenue decline and a $125.1 million decrease in earnings from the current $621.5 million.

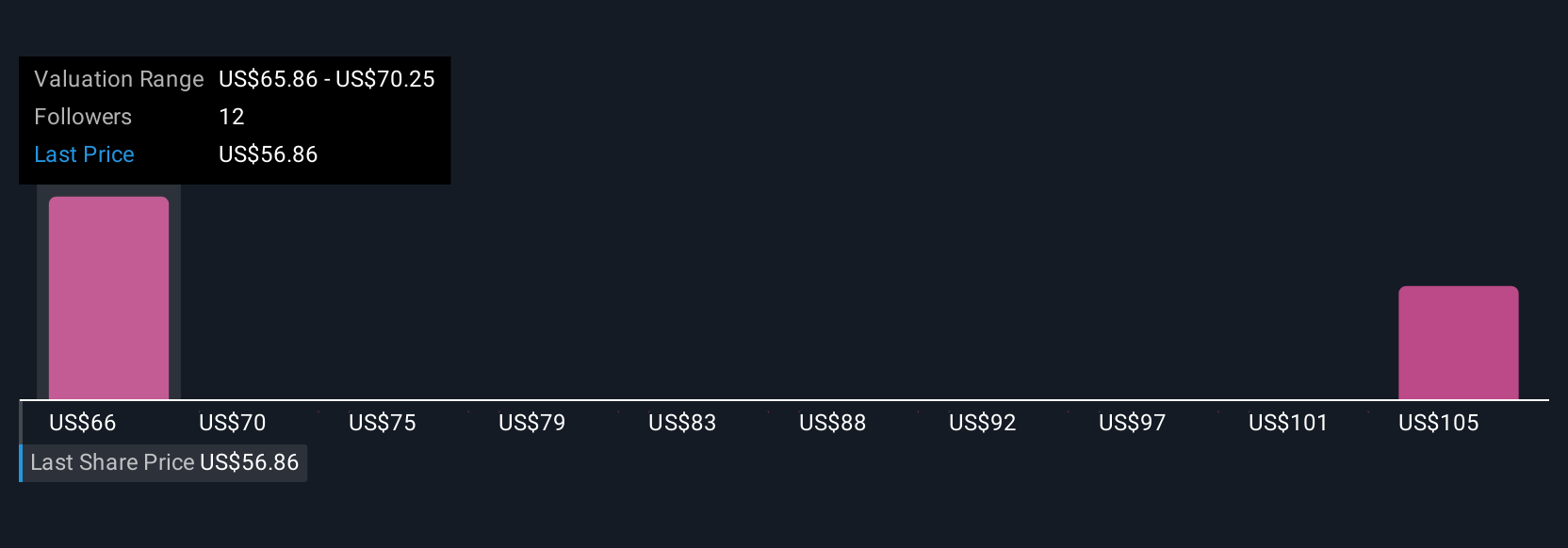

Uncover how KB Home's forecasts yield a $64.67 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$46.80 to a striking US$172,746.41 per share. As builder efficiency gains remain central to near-term prospects, the spread of market opinions highlights why exploring several viewpoints could be critical to your investment approach.

Explore 4 other fair value estimates on KB Home - why the stock might be worth 24% less than the current price!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives