- United States

- /

- Luxury

- /

- NYSE:HBI

Optimistic Investors Push Hanesbrands Inc. (NYSE:HBI) Shares Up 27% But Growth Is Lacking

Despite an already strong run, Hanesbrands Inc. (NYSE:HBI) shares have been powering on, with a gain of 27% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 9.2% isn't as impressive.

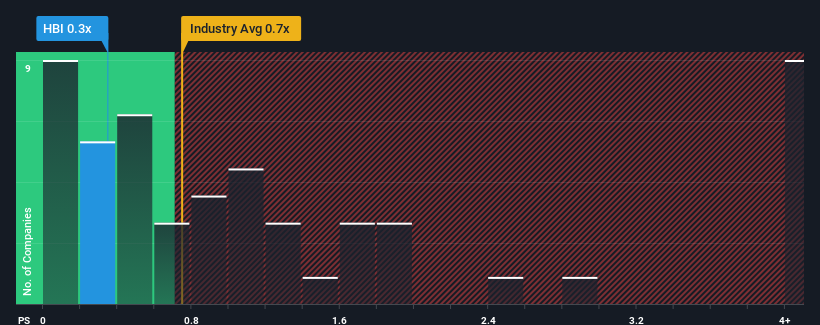

In spite of the firm bounce in price, there still wouldn't be many who think Hanesbrands' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Luxury industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hanesbrands

What Does Hanesbrands' P/S Mean For Shareholders?

Hanesbrands could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Hanesbrands will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Hanesbrands?

The only time you'd be comfortable seeing a P/S like Hanesbrands' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.6%. The last three years don't look nice either as the company has shrunk revenue by 8.0% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.8% each year as estimated by the seven analysts watching the company. With the industry predicted to deliver 7.9% growth per annum, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Hanesbrands' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Hanesbrands' P/S

Hanesbrands appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Hanesbrands' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You should always think about risks. Case in point, we've spotted 1 warning sign for Hanesbrands you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hanesbrands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HBI

Hanesbrands

Designs, manufactures, sources, and sells a range of range of innerwear apparel for men, women, and children in the Americas, Europe, the Asia pacific, and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives